Visa Wants to Help Banks Jump into the Stablecoin Bandwagon 🇺🇸

We're also covering Australia's new credit score duopoly 🇦🇺, the $23 billion in unused gift cards opportunity 🇨🇦, TymeBank reaching 10M clients 🇿🇦, KOHO's bank charter ambition 🇨🇦 & more!

🇺🇸 Visa Wants to Help Banks Jump into the Stablecoin Bandwagon

Visa is launching a new platform, the Visa Tokenized Asset Platform (VTAP), to assist banks in issuing their own stablecoins, which are cryptocurrencies pegged to fiat currencies such as the US dollar or the euro. This initiative comes as more financial institutions and fintechs, including BBVA, Revolut, PayPal, and Robinhood, announce their intention to jump on the stablecoin bandwagon. Currently in the testing phase, VTAP aims to allow banks to mint, burn, and transfer stablecoins, with plans for a public launch next year. Spanish bank BBVA is among the first to pilot this technology, intending to use it for transactions on the Ethereum blockchain.

Sources: American Banker & Fortune

🇦🇺 Experian’s illion Buyout Leaves Equifax Facing Just One Rival in Australia

Experian has successfully completed its 820 million AUD (557 USD) acquisition of illion, reducing Australia's credit reporting landscape to just two major players: Experian and Equifax. The Australian Competition and Consumer Commission approved the acquisition in August, highlighting that the merger would not disrupt the competitive dynamics, as Equifax continues to dominate the market. With this acquisition, Experian aims to unlock the combined potential of their teams, technology, and customer bases, with the 500 illion employes joining Experian. Current illion CEO John Banfield will step down as the integration progresses, and Experian anticipates a rebranding effort within the next year, likely retaining some illion product names that resonate with the credit market.

Source: The Adviser

🇪🇺 European Banks Launch Wero Payment Network to Challenge Visa and Mastercard's Market Dominance

The European Union's major banks have launched Wero Payments, a new digital payment platform aimed at challenging the dominance of Visa and Mastercard for payments both online and in-store. Backed by 16 banks, including BNP Paribas and Deutsche Bank, Wero starts with a €500 million (553 million USD) war chest and a network of banks that dominates the european banking market. This initiative seems to follow the playbook of Interac in Canada, a nonprofit payment network launched by Canadian banks back in in the 1980s and that now processes over 30% of transactions in the country. Wero comes as Europe seeks greater financial sovereignty, particularly in light of geopolitical tensions highlighted by the withdrawal of Visa and Mastercard from Russia after its invasion of Ukraine.

Source: Bloomberg

🇸🇪 Mastercard to Acquire Swedish Startup Minna Technologies To Help Consumers Cancel Their Recurring Subscriptions

Mastercard has agreed to acquire Minna Technologies, a Swedish startup that allows consumers to manage their subscriptions within banking apps and websites, regardless of the payment method used. This acquisition aims to help consumers cancel subscription plans like Netflix or Amazon Prime more easily, addressing the common pain point of subscription fatigue. According to Juniper Research, global subscriptions are projected to rise from 6.8 billion to 9.3 billion by 2028.

Source: CNBC

🇨🇦 Givex and Bridge Partner Up to Ensure No Gift Card Goes Unused

Toronto-based Givex, a global leader in gift card processing solutions, has partnered with US-based Bridge, a pioneer in add-to-wallet technology, to digitize physical gift cards, enabling consumers to store and redeem them through digital wallets like Apple Wallet and Google Pay. This integration seeks to modernize merchants' gift card programs and unlock the billions of dollars in unredeemed gift card funds, with a Bankrate survey revealing that Americans hold nearly $23 billion in unused gift cards, averaging $187 per person. The partnership aims to entice users to spend their gift cards in full by allowing merchants to send targeted push notifications and promotional offers directly to cardholders. The integration is available for Givex's clients in the US, UK, Canada, and Australia.

Source: Global Fintech Insider

🇿🇦 TymeBank Soars Past 10 Million Customers Thanks to Financial Inclusion

TymeBank has achieved a significant milestone by surpassing 10 million customers in under six years, establishing itself as South Africa's fastest-growing bank in 2024. This growth is attributed to its financial inclusion strategy, which includes physical kiosks in major retail stores like Pick n Pay and Boxer. Furthermore, the bank's SendMoney service also allows fund transfers to anyone in South Africa, even those without bank accounts. TymeBank has also reached profitability and holds nearly R7 billion (402.5 million USD) in customer deposits. Additionally, it has provided over 600 million USD in funding to over 80,000 small businesses, aided by its acquisition of Retail Capital. Looking ahead, TymeBank plans to expand into Indonesia.

Sources: Fintech Singapore & Tech Africa News

🇨🇦 KOHO Raises $140M in Bid to Become Canada’s First Fintech Bank

KOHO, a Canadian neobank offering a savings app linked to a prepaid Mastercard card, has secured $190 million CAD (140 million USD) in equity and debt to support its efforts in obtaining a Schedule 1 banking license. The funding will also help the Canadian fintech expand its lending products and accelerate growth. However, acquiring a banking license in Canada is an extremely complex process in Canada, and KOHO would be the first fintech to successfully obtain one if robo-advisor Wealthsimple or online brokerage Questrade (both of which have expressed interest in acquiring banking licenses in past years) don’t beat it to the punch.

Sources: BetaKit & Global Fintech Insider

🇫🇷 French Neobank For SMBs Qonto Launches in Austria, Belgium, Portugal, and the Netherlands

French neobank Qonto has announced its European expansion, planning to establish new offices in Austria, Belgium, Portugal, and the Netherlands. Founded in 2016, Qonto focuses on providing online banking accounts and financing services, such as invoicing and bookkeeping, primarily targeting small and medium-sized businesses (SMBs) and freelancers, who account for 99% of businesses in Europe.

Source: Finextra

🇬🇧 HSBC Considers UK Mobile Banking App Monese To Be Worthless

British bank HSBC has written off its $35 million investment in Monese, a UK mobile banking app launched in 2015. This means HSBC now considers its Monese stake worthless, just two years after investing. Monese is restructuring its business, splitting its banking-as-a-service platform into a separate company called XYB, while its consumer banking service got sold to Pockit for an undisclosed amount. Once valued at nearly £1 billion, Monese has disappointed other major investors too, including PayPal. The news coincides with HSBC making major changes under new CEO Georges Elhedery.

Source: BNN Bloomberg

🇹🇹 India's UPI Payment System Expands to Trinidad and Tobago

Trinidad and Tobago is set to adopt India's Unified Payments Interface (UPI) to develop a real-time payments system for person-to-person and person-to-merchant transactions. This initiative aims to expand digital payments and promote financial inclusion in the island nation that is home to about 1.5 million people. Since its launch in 2016, UPI has revolutionized digital payments in India, processing over 100 billion transactions, and is now expanding its footprint internationally, with recent agreements in countries like Peru, Namibia, and Nepal.

Source: Finextra

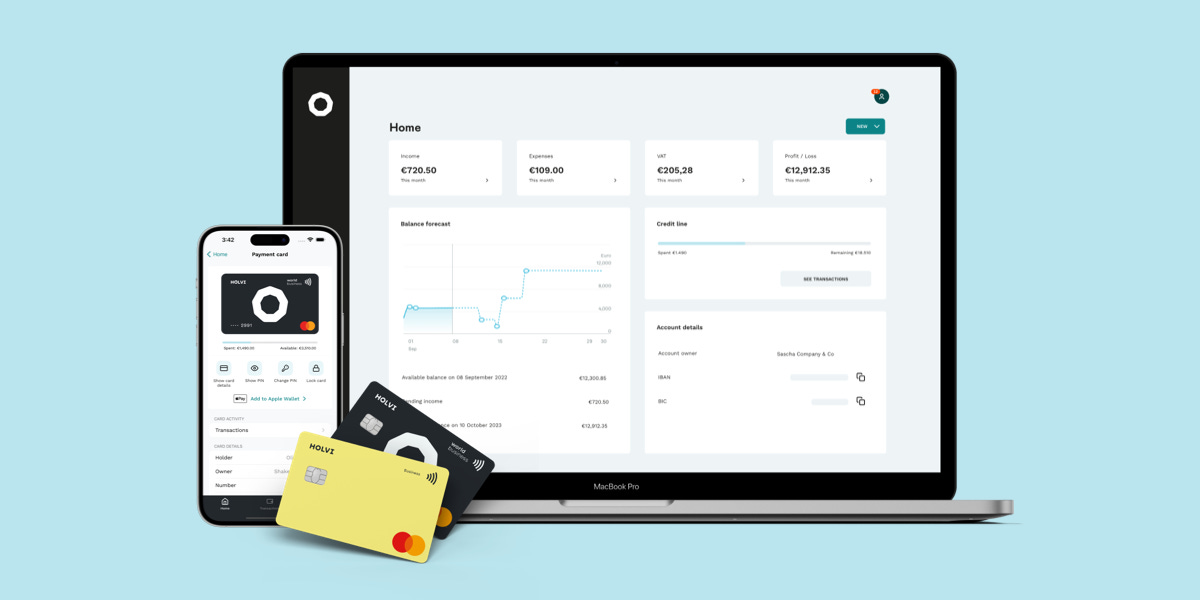

🇩🇪 Finnish neobank for SMBs Holvi Enters Germany

Finnish neobank for SMBs Holvi has partnered with Germany-based lemon.markets to launch business accounts tailored for SMBs in Germany, leveraging lemon.markets' brokerage and custody infrastructure. This collaboration allows Holvi, which serves self-employed individuals and small businesses, to integrate a liquidity management solution through lemon.markets’ investment API, offering low-risk investment options to its clients.

Source: The Fintech Times

🇺🇾 Latin American E-commerce Titan MercadoLibre Embraces Fintech to Grow Faster

MercadoLibre, the Montevideo-based e-commerce giant serving more than 200 millions customers across Latin America, is expanding its fintech strategy by integrating financial services directly into its e-commerce ecosystem. The company leverages its extensive data from transactions on its platform to assess creditworthiness using artificial intelligence, allowing for quick loan approvals. This approach not only facilitates instant credit for purchases but also encourages consumer spending, as seen with users taking out loans to buy products directly from the platform. The company's fintech revenues grew by about 30% last year, while its credit unit grew at a faster rate of 50%. Despite facing competition from dedicated latin-american fintech firms like Nubank and Uala, MercadoLibre's integrated approach, utilizing artificial intelligence to assess credit risk, positions it well in a region where many lack access to traditional banking.

Source: Reuters

Upcoming Fintech Events

🇺🇸 G2E will be held in Last Vegas Oct. 7th to 10th ($309 to $1999), with speakers such as Greg Kirstein, GM, iGaming North America at Paysafe and Sarah Stapp, Head of Strategic Initiatives at Aeropay.

🇬🇧 The Globalization of Open Banking conference will be held in London on Oct. 14th, with speakers such as Don Cardinal, CEO of Financial Data Exchange and Henk Van Hulle, CEO of UK’s Open Banking Ltd.

🇺🇸 Boston Fintech Week will be held in Boston Oct. 14th to 18th ($395), with speakers such as Chris Behling, Head of Risk Product Sales & Underwriting at Northwestern Mutual and Matt Harris, partner at Bain Capital Ventures.

🇺🇸 Money 20/20 will be held in Las Vegas Oct. 27th to 30th ($3999), with speakers such as Chris Britt, CEO of Chime and Daniela Amodei, president of Anthropic.

🇸🇬 The Singapore Fintech Festival will take place Nov. 6th to 8th, with speakers such as Kfir Godrich, Chief Innovation Officer at BlackRock and Richard Teng, CEO of Binance.

🇿🇦 The Africa Tech Festival will be held in Cape Town November 12-14 ($1,749), with speakers such as Kagiso Mothibi, CEO of MTN Fintech and Christian Kajeneri, director, payment systems at the National Bank of Rwanda.

Fintech’s Musical Chair

🇺🇸 Coastal Financial has appointed Brian Hamilton as President of CCBX, the fintech arm of the community bank.

🇺🇸 Katherine Snow, former Head of Global Policy at Messari, has been named General Counsel at crypto venture studio Thesis.

🇮🇳 Deependra Rathore, former Senior Vice-President at Paytm, a fintech POS app, has been appointed CTO of the company. The outgoing CTO, Manmeet Dhody, transitions to AI Fellow at the company.

🇮🇳 Siddharth Mahanot, co-founder of Indifi Technologies, has stepped down as Executive Director after nine years. Newly appointed CEO Sangram Singh will take over his responsibilities.

🇪🇺 Tine Simonsen, former leader at AIG’s Nordic Financial Lines team, joins cybersecurity InsurTech Coalition as Head of Insurance for Continental Europe to spearhead the company’s expansion in the region.

🇬🇧 Chris Higham, Secure Trust Bank’s Head of Payments and Cards, is set to step down by year’s end, after leading the payments function since 2021.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@protonmail.com