Top Fintech Books, Podcasts & Documentaries To Enjoy During the Holidays

I can't promise these picks will make you better fintech leaders, but you'll learn something and be entertained along the way!

Saturday was the first day of my holiday vacation, I visited my favorite bookstore and got myself the latest Malcolm Gladwell, Revenge of the Tipping Point. It didn’t make it into my recommendations since it’s not a fintech book, and I haven’t read it yet. The reason I’m telling you this is that I always catch up on reading during my holidays, and I assume many of you do the same.

If you’re wondering what fintech content to catch up on during this holiday, this special issue of the Global Fintech Insider newsletter should help! My criteria for picking the books, podcast, and documentaries recommend below were that these pieces of content needed to be both entertaining and insightful about something fintech-related! Yep, it’s the holidays, and I wouldn’t want to recommend something insightful... but boring. So, without further ado, here’s the fintech stuff I think you’ll enjoy watching, listening to, and reading during the holidays!

My Fintech Books Recommendations

Going Infinite by Michael Lewis (288 pages)

I’ve read almost all of Michael Lewis’s books since Liar’s Poker, and Going Infinite, which tells the story of FTX founder and CEO Sam Bankman-Fried (SBF), didn’t disappoint. Published before SBF’s trial, the book doesn’t capture how absurdly simple the scam was… Customer funds were simply funneled into Alameda Research, SBF’s crypto hedge fund, and recklessly invested in highly illiquid, volatile assets, or loaned to SBF and his business partners. Still, the book is worth reading.

Lewis tell the story of how a socially awkward figure who believed in effective altruism (the idea that people should make as much money as possible in order to use it to make the world a better place) managed to build such a massive crypto empire. Lewis reveal that SBF’s awkwardness and disregard for others often worked to his advantage. Not showing up to his meetings or playing video games during calls somehow made him more appealing to investors, enabling him to raise billions with little scrutiny.

Amazon.com | Amazon.ca | Amazon.co.uk | Amazon.in

Elon Musk by Walter Isaacson (688 pages)

While the book extensively covers Musk’s role in building business giants like SpaceX and Tesla, the fintech-related highlights are his internship at Scotiabank, his work at X.com (later renamed PayPal), and his ambitions for Twitter (also later rebranded as X.com). The book reveals that while interning at Scotiabank in Toronto, Musk pitched a trade idea he believed was genius and was appalled when the bank didn’t act on it. His conclusion? Banks were stupid, and he could do better. This idea led to X.com, which offered bank accounts and credit cards before merging with Peter Thiel’s PayPal.

PayPal gained traction, while X.com didn’t, and Musk wanted to rebrand PayPal under the X name. However, Musk was fired despite being the company’s largest shareholder, and Peter Thiel took over, eventually selling PayPal to eBay for $1.5 billion. Musk later bought the X.com domain from eBay and appears to have acquired Twitter to transform it into a fintech super app.

Isaacson’s biography is overall an excellent read and a must for anyone wanting to understand the logic behind the madness of an entrepreneur who is arguably the second most, if not the most, powerful person in the U.S. since Trump’s re-election.

Amazon.com | Amazon.ca | Amazon.co.uk | Amazon.in

Bloomberg by Bloomberg by Micheal Bloomberg (256 pages)

Mike Bloomberg is the granddaddy of fintech entrepreneurs, having started Bloomberg LP in 1981. Not only is he worth over $100 billion, but he managed to retain a massive 88% stake in Bloomberg LP and never went public! His autobiography is a classic that I read a long time ago, explaining how he methodically built Bloomberg into the all-encompassing window to the world of financial information it is today.

Much like Amazon started with books, Bloomberg didn’t begin by offering every type of financial information imaginable. It started by providing real-time quotes and a messaging system. Over time, it expanded to include fundamental data, news, and data on different asset classes. Mike Bloomberg managed to disrupt the market by being first to market in many areas, including entering the recurring subscription business three full decades before SaaS became the norm. In his biography, he credits his success to his work ethic (12 hours for work, 12 hours for rest daily) and the $10 million buyout he received after being fired as a partner at Salomon Brothers.

Amazon.com | Amazon.ca | Amazon.co.uk | Amazon.in

The Money Trap by Alok Sama (304 pages)

Alok Sama was never a fintech investor, but as former president and CFO of Softbank, he had unfettered access to Softbank founder and CEO Masayoshi Son, one of the greatest tech investors of all time. While Son was the largest investor in the ill-fated WeWork (probably not his smartest bet), he was an early investor in Alibaba Group, which spun off Ant Group, one of China’s largest fintech companies operating both a payment network (Alipay+) and China’s social credit bureau (Sesame Credit). He also invested in US-based SMB lender Kabbage (acquired by Amex), the Indian payment unicorn Paytm, the US-based banking software provider Zeta, and the Indian insurance comparison site Policybazaar.

Alok Sama’s book, while it provides a window into the psyche of Masa (yep, apparently, that’s how people close to him refer to him), focuses on the Vision Fund era of Softbank that starts in 2016. I was always fascinated by how such a fund could exist (it’s obviously too much capital to be deployed in start-ups), and Alok Sama did not disappoint on that front. In his book, he explains how this weird venture capital beast was born.

This odd story starts with the newly minted crown prince of Saudi Arabia, Mohammed bin Salman (MBS), trying to buy his way into Silicon Valley’s elite circles. He flew to California in the hopes of deploying his country’s seemingly unlimited oil money into Silicon Valley’s top funds like Sequoia Capital, Andreessen Horowitz, and co. The idea was that he could invest in those funds, allowing Saudi’s sovereign fund, the Public Investment Fund (PIF), to gain some insight into technology investing or even convince some of those funds to set up shop in Saudi Arabia.

Turns out Silicon Valley’s top brass didn’t want anything to do with his oil money. Given the limited size of their funds, they constantly refuse investors, so they didn’t need MBS’s capital and could avoid the reputational risk of taking on his money with no downside. On the other hand, Masa had the opposite problem. He already envisioned that AI would disrupt the world economy and was looking for a very large amount of capital to invest, which was getting difficult given the amount of debt that Softbank was carrying. When Masa met MBS, both quickly realized they could solve each other’s problems by working together: MBS would get access to Silicon Valley and top tech deals around the world, and Masa would get the crazy amount of capital nobody was willing to give him at this point. That’s how the $100 billion Vision Fund came to be.

Alok Sama reveals a bunch of other interesting stuff about how Masa thinks, which makes this book worthwhile. The only negative about this book is that the author spends too many words proving that he’s really smart, too. And I guess he is, but if I were his editor, I would have cut some of his pompous prose.

Amazon.com | Amazon.ca | Amazon.co.uk | Amazon.in

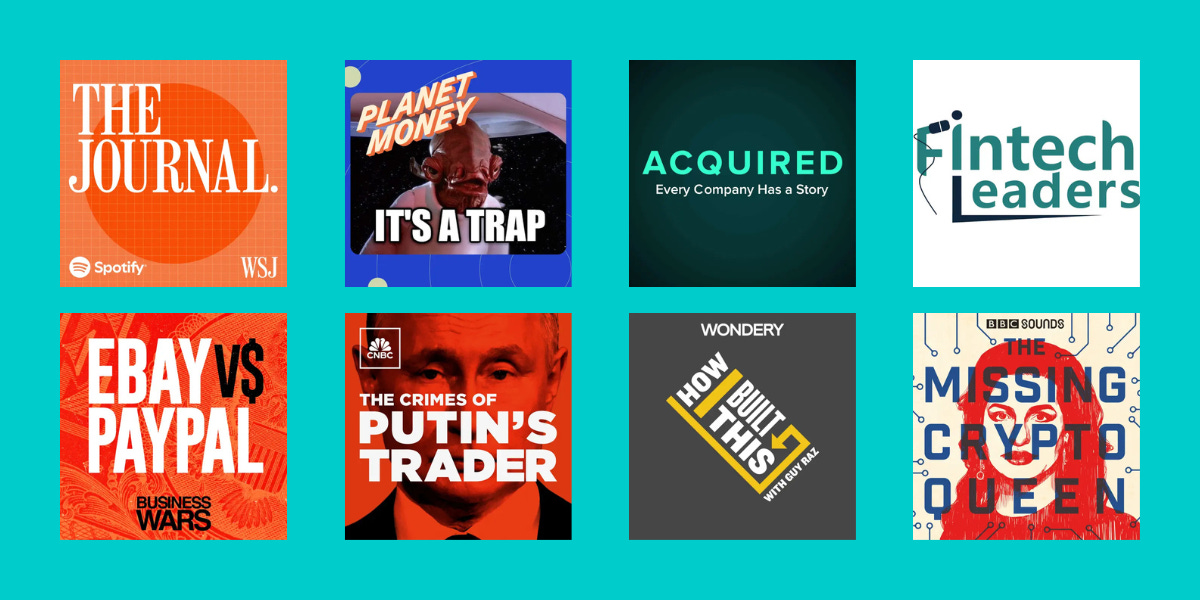

My Fintech Podcasts Recommendations

Podcast Episode: The $6 Million Banana’s Appeal, The Journal (21m)

A crypto mogul paid $6.2 million for a banana and then ate it, but the story doesn’t end there. Justin Sun, the founder of TRON cryptocurrency and the USDD stablecoin, purchased Maurizio Cattelan’s “Comedian,” a conceptual art piece featuring a banana duct-taped to a wall. What Sun actually bought wasn’t the banana but a certificate of authenticity. The podcast highlights how this wasn’t just a quirky splurge. By tying the viral notoriety of the banana to his personal brand and TRON, Sun gained global attention that likely exceeded the cost of the purchase. And even though he ate the actual banana, he could still make his money back… if someone is crazy enough to pay $6.2 million for the certificate of authenticity.

Podcast Series: eBay VS PayPal, Business Wars (7 episodes)

The eBay vs PayPal series chronicles the rise of PayPal, detailing its battle to become the leading online payment system during the dotcom boom. The series highlights PayPal’s early struggles and breakthrough strategies, like convincing eBay powersellers to use PayPal for transactions. As the company gained traction, PayPal’s founders faced internal challenges and fierce competition. At the same time, the company’s rapid success set it on a collision course with eBay, which saw PayPal as both a vital partner and a growing threat. As eBay moved toward creating its own payment system, PayPal fought to retain its dominance.

Podcast Episode: The Subscription Trap, Planet Money (31m)

This episode of Planet Money explores the rise of subscription-based services, which have transformed everything from razors to meal kits into recurring payments. While this model offers convenience, it also traps consumers in subscriptions they often don’t realize they have, with companies making it easy to sign up and hard to cancel. The episode features fintech entrepreneur Haroon Mokhtarzada, founder of Truebill, which helps users track and manage these recurring charges. By using Plaid to connect to users' bank accounts and credit cards, Truebill’s algorithm identifies subscriptions in their transactions. Haroon later sold Truebill to Rocket Mortgage for $1.3 billion in 2022.

Podcast Series: The Crimes of Putin’s Trader (7 episodes)

In CNBC Investigations' podcast series The Crimes of Putin’s Trader, journalist Eamon Javers explores Vladislav Klyushin’s $93 million hack-to-trade operation. His firm, M-13, stole corporate earnings reports from U.S. companies, allowing Russian hackers to trade on insider information. Authorities cracked the case by analyzing the filing agents used by companies targeted in the scheme. They found that 97% of earnings events traded by Klyushin’s group were filed with the same SEC agents, proving the link between insider trading and the hacks. The podcast also highlights how Danish online broker SaxoTraderGO’s compliance officers flagged the suspicious trades, which Klyushin tried to justify as technical analysis—a claim that didn’t hold up.

Podcast Episode: Visa, Acquired (3h42m)

In the Acquired podcast episode on Visa, the hosts Ben Gilbert and David Rosenthal explore the origins of the financial giant, beginning with Bank of America's bold experiment in Fresno, California, in 1958. BankAmericard, the precursor to Visa, was initially launched in the city with a mass mailing of 65,000 unsolicited credit cards. The small-scale test aimed to provide a unified credit solution at a time where bank employees would have to manually review small loans applications from clients wanting to buy something as small as a fridge. Despite early success, the project quickly faced challenges, including high delinquency rates and fraud. However, after reshuffling its approach and gaining control over these issues, Bank of America expanded the program, eventually making it profitable and inspiring other American banks to launch what would become Mastercard.

Podcast Series: PayPal & Affirm: Max Levchin, How I Built This (2h26m)

In this two-part series, Max Levchin shares with podcast host Guy Raz his incredible journey from co-founding PayPal to turning Affirm, the leading US BNPL provider, into a 23 billion USD giant. In part one, Max recounts how he and other members of the "PayPal Mafia," including Peter Thiel, Elon Musk, and Reid Hoffman, built PayPal into a dominant force in online payments. From early startup struggles to the emotional departure of Elon Musk as CEO, Max reflects on the highs and lows of creating a company that would eventually sell to eBay for $1.5 billion. In part two, Max opens up about life after PayPal and the emotional struggles he faced before rediscovering his passion for fintech. He talks about founding Affirm, a "buy now, pay later" provider competing with the likes of Visa and Mastercard, and how his experiences at PayPal shaped his approach to building a billion-dollar fintech company.

Part 1 (PayPal): Apple Podcasts | Spotify

Part 2 (Affirm): Apple Podcasts | Spotify

Podcast Episode: Mikhail Lomtadze, Kaspi.kz CEO - Building a $24Bn Tech Titan, From Kazakhstan to the World, Fintech Leaders (51m)

I feel a little bit ashamed to admit it, but before listening to this episode, I had never heard of Mikhail Lomtadze nor of Kaspi.kz. Based in Kazakhstan, the company is one of the most impressive examples of a fintech super app. It goes far beyond just being an online bank. You can shop, pay taxes, and even get married through the platform. Kaspi.kz's CEO, Mikhail Lomtadze, has an inspiring story. Originally from Georgia, he went from humble beginnings to becoming one of the most successful business figures in Kazakhstan. A pivotal moment in his career was when he was rejected by Harvard Business School and decided to challenge the decision in person… and got accepted later on. Today, under his leadership, Kaspi.kz serves 15 million customers, about 75% of Kazakhstan’s population, and is a publicly traded company with a market cap of $24 billion.

Podcast Series: The Missing Cryptoqueen (11 episodes)

The Missing Cryptoqueen podcast from BBC Sounds takes listeners on a captivating journey into the mysterious world of OneCoin, a cryptocurrency company that promised to revolutionize global finance but turned out to be a massive scam. Hosted by technology journalist Jamie Bartlett, the series investigates the rise and fall of Dr. Ruja Ignatova, the charismatic Oxford-educated leader who disappeared in 2017. OneCoin never issued a real cryptocurrency, yet its phenomenal success stemmed from combining the faith-based assumptions of the genuine crypto community with the incentive model of MLM companies.

My Fintech Documentaries Recommendations

Dumb Money: The True Story of the GameStop Short Squeeze (1h45m)

The Netflix documentary Dumb Money brings the 2021 GameStop short squeeze to life, highlighting how Reddit's WallStreetBets subreddit turned a struggling video game retailer into a financial phenomenon. Led by Keith Gill, aka "DeepF***ingValue," who turned a $50,000 investment into $47 million, Redditors united to buy GameStop stock, driving its price sky-high and causing over $12.5 billion in losses for hedge funds that had shorted it. Key players included Robinhood, the fintech app where much of the trading occurred, which faced criticism after halting GameStop stock purchases, fueling accusations of siding with Wall Street.

Skandal! Bringing Down Wirecard (1h32m)

Netflix's Skandal: Bringing Down Wirecard recounts the shocking rise and fall of Wirecard, a German payment provider and prepaid card issuer. The documentary follows FT journalist Dan McCrum, whose investigation uncovered that Wirecard was built on fraud and money laundering. The fintech documentary captures high-stakes drama such as espionage tactics, harassment by hired goons, and even legal action from Germany’s financial regulator.

The Mega Brands That Built America: Easy Money (42m)

Episode 3 of The Mega-Brands That Built America Season 2, titled Easy Money, is about the birth of the credit card industry in the U.S. Starting with the story of Diners’ Club, the episode captures how a simple card, initially made of paper and later on of plastic, revolutionized payments. Initially designed as a charge card for New York businesspeople, Diners’ Club gained prestige as it was accepted at Manhattan restaurants, becoming a status symbol for salespeople and Wall Street bankers. The episode follows the intense competition that ensued, with Bank of America and American Express entering the fray, ultimately igniting a trillion-dollar industry that reshaped PayTech forever.

US: History Channel | CA: Stack TV | IMDB

This may be a dumb question, but how does Affirm "buy now, pay later" compete with the likes of Visa and Mastercard?