Shopify’s Balancing Act Between Fintech Partnerships and In-House Solutions 🇨🇦

On top of our coverage of Forum Fintech 🇨🇦, we are covering NerdWallet's drastic downfall 🇺🇸, X's new TV app 🇺🇸, Dutch neobank Bunq's global expansion 🇳🇱 & Revolut's new investor 🇦🇪.

🇨🇦 Forum Fintech Canada Exclusive Coverage

Earlier this week, I had the opportunity to cover my first fintech conference for Global Fintech Insider in my hometown Montreal. While there was a bunch of panels, he are the two most noteworthy news I gathered during the event:

🇨🇦 Shopify’s Balancing Act Between Fintech Partnerships and In-House Solutions

Shopify’s President Harley Finkelstein (on the right) prefers partnering with other fintechs when the e-commerce giant doesn’t have an unfair advantage. Speaking at Forum Fintech in Montreal on September 11, Finkelstein explained that Shop Pay is powered by Stripe and Shop Pay Installments by Affirm, two multibillion-dollar fintechs in which Shopify holds sizable stakes.

However, Shopify chose to build its own revenue-based financing arm, Shopify Capital, in-house. While other fintechs offer revenue-based financing, Finkelstein noted that Shopify’s access to detailed merchant data enables them to take on more risk compared to relying solely on bank statements and credit scores. “We see their returns, we see how often they log in on the platform, we see their sales, we see the quality of their traffic. All of that gives us the ability to make loans [that could seem risky] and get repaid,” he said.

Source: Global Fintech Insider

🇨🇦 Wealthsimple Announces Plans to Launch Its Own Visa Card

Canadian fintech Wealthsimple, known for its robo-advisor and stock trading app, is set to issue its own Visa credit card. Currently, the company offers a prepaid Mastercard issued by KOHO, which allows users to earn cash back on purchases that can be reinvested automatically.

However, Wealthsimple’s Vice President of Payments Strategy, Hanna Zaidi (on the right), explained that relying on a partner has limitations. “In a traditional partnership with a bank issuer, the customer relationship is owned by the issuer, and we felt we needed to own the whole relationship to control the customer experience,” Zaidi stated at the Forum Fintech in Montreal, on September 10th.

This shift towards direct control aligns with a trend among large fintech companies. While traditional credit card networks largely rely on banks for issuing cards, fintechs like Revolut and Wealthsimple are increasingly taking matters into their own hands. As these companies grow, they aim to own the entire customer experience. “We want to be the primary financial relationship of our customers,” Zaidi added. “We were creating an experience on top of duct tape, integrating various services we did not control end to end. That’s why we worked to have direct access to [Canada’s upcoming] payment rails and are now in the process of issuing our own Visa.”

Source: Global Fintech Insider

🇺🇸 X TV Debuts as Elon Musk Aims to Transform X into a Super App

X (formerly Twitter) has officially launched the beta version of its new TV app, X TV, designed for internet-connected televisions. This allows users to watch video content from X directly on their big screens, similar to how YouTube or Netflix work on smart TVs. The app highlights trending videos using X’s AI and will soon offer ad options. While X has signed content deals with personalities like Tucker Carlson and the WWE, its lineup isn’t mainstream yet, and its subscription business doesn't seem to have reached the success of its adult-content competitor, OnlyFans, which boasted $6.6 billion in gross subscription sales in 2023. However, this move could be part of Elon Musk’s larger plan to turn X into a super app that includes financial services like payments and stock investing. X has already secured money transfer licenses in 28 U.S. states as part of this broader strategy.

Source: Social Media Today

🇨🇳 Ant Group Unveils AI Assistant Amid WeChat Pay Expansion

Ant Group, the fintech giant behind Alipay, has launched Zhixiaobao, a new AI-powered personal assistant app designed to handle daily tasks like ordering food and hailing taxis through text or voice prompts. The launch also follows a recent shakeup in the Chinese payments landscape, with Alibaba's Tmall and Taobao now accepting WeChat Pay, ending Alipay's payment exclusivity on China’s largest e-commerce platforms. In light of this, Ant's push to place its AI assistant on consumers' phones seems like a strategic effort to compete with super app WeChat.

Source: South China Morning Post

🇳🇱 Dutch Neobank Bunq Eyes UK and US Growth After Profit Surge

Dutch neobank Bunq plans to expand its workforce by 70% by the end of the year as it targets re-entry into the UK and entry into the US markets. The Amsterdam-based bank, which has 12.5 million users across Europe and employs 680 people, reported a net profit of €53.1 million for 2023. Bunq aims to re-enter the UK after withdrawing in 2020 due to Brexit-related issues, focusing on the “digital nomad” niche with features like local international bank account numbers (IBANs). For the US market, Bunq is working to secure a banking license following its withdrawal from a previous application.

Source: Sifted

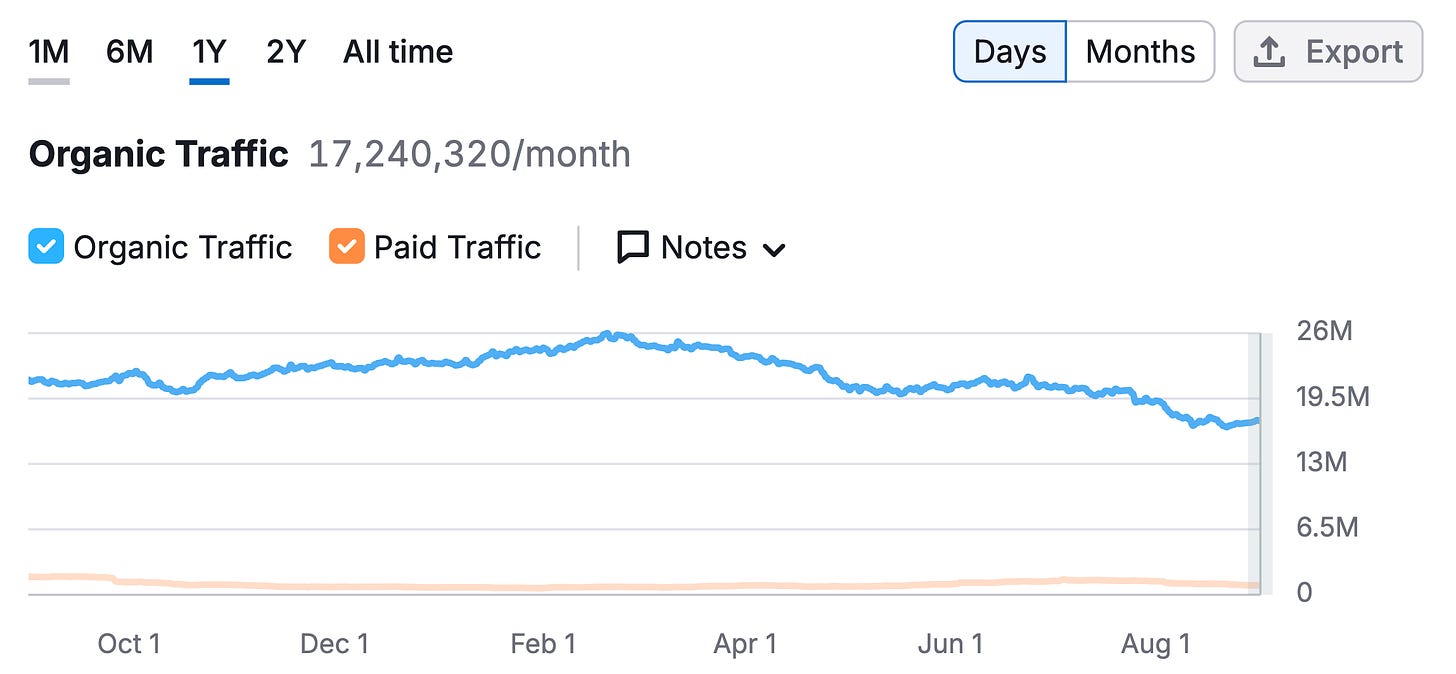

🇺🇸 NerdWallet Cuts Workforce by 15% After Losing 34% of its Organic Traffic

NerdWallet, a publicly held rate comparison site operating in the US, UK, and Canada, is cutting 15% of its 730-strong workforce due to a decline in organic search traffic. While NerdWallet did not disclose its traffic numbers during its last earnings call, SEO analytics software SEMrush estimates that traffic dropped from 25,956,432 visitors in March to 17,240,320 as of this writing, a total decline of 34%. Google’s new practice of showing credit cards directly in search results for terms like "best credit cards” in the US could have contributed to NerdWallet’s financial challenges. Despite a 5% revenue increase to $151 million in Q2, NerdWallet reported a $9.6 million operating loss. CEO Tim Chen stated, "We fell short of our guidance for non-GAAP operating income due to unexpected headwinds in organic search traffic."

Source: Seeking Alpha

🇰🇿 Global Crypto Exchanges Binance and Bybit Secure Full Licensing in Kazakhstan

Binance and Bybit have secured formal approval from Kazakhstan’s Astana Financial Services Authority (AFSA) to become the first fully licensed Digital Asset Trading Facilities (DATF) in the country. This approval allows the exchanges to offer advanced trading, investment services, and custody solutions in the Astana International Financial Centre (AIFC). Both exchanges had been operating under provisional authorization and completed extensive audits to meet the regulatory requirements. Kazakhstan, a major crypto-mining hub, has been tightening its digital asset regulations following the passage of its Digital Assets Law in 2023.

Source: COINTELEGRAPH

🇫🇷 French Entrepreneurs Score $55 Million to Protect Your Gadgets and Getaways

Neat, a Paris-based insurtech startup, has secured €50 million (around $55 million) to scale its offering of embedded insurance products (like smartphone and travel insurance) sold through retailers. Neat designs its own insurance products, which come with a small commission for the company. Retailers also earn commissions. With a broad portfolio covering various insurance types, Neat has already partnered with 1,500 distributors, selling over 1 million insurance products.

Source: TechCrunch

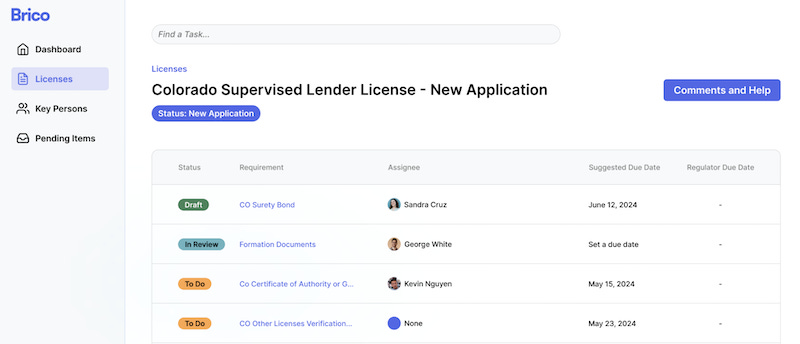

🇺🇸 Brico Raises $8 Million to Simplify Fintech Licensing in the U.S.

Brico, a SaaS platform that simplifies the process of obtaining and managing fintech and financial institution licenses, has raised $8 million in seed funding. Brico automates applying for, maintaining, and meeting ongoing regulatory requirements for licenses such as money transmission licenses, using AI to streamline the application process. CEO Snigdha Kumar, who previously worked at automated savings startup Digit (acquired by Oportun in 2021), founded Brico after recognizing the high costs and manual processes fintechs face when managing licenses across all 50 U.S. states.

Source: Axios

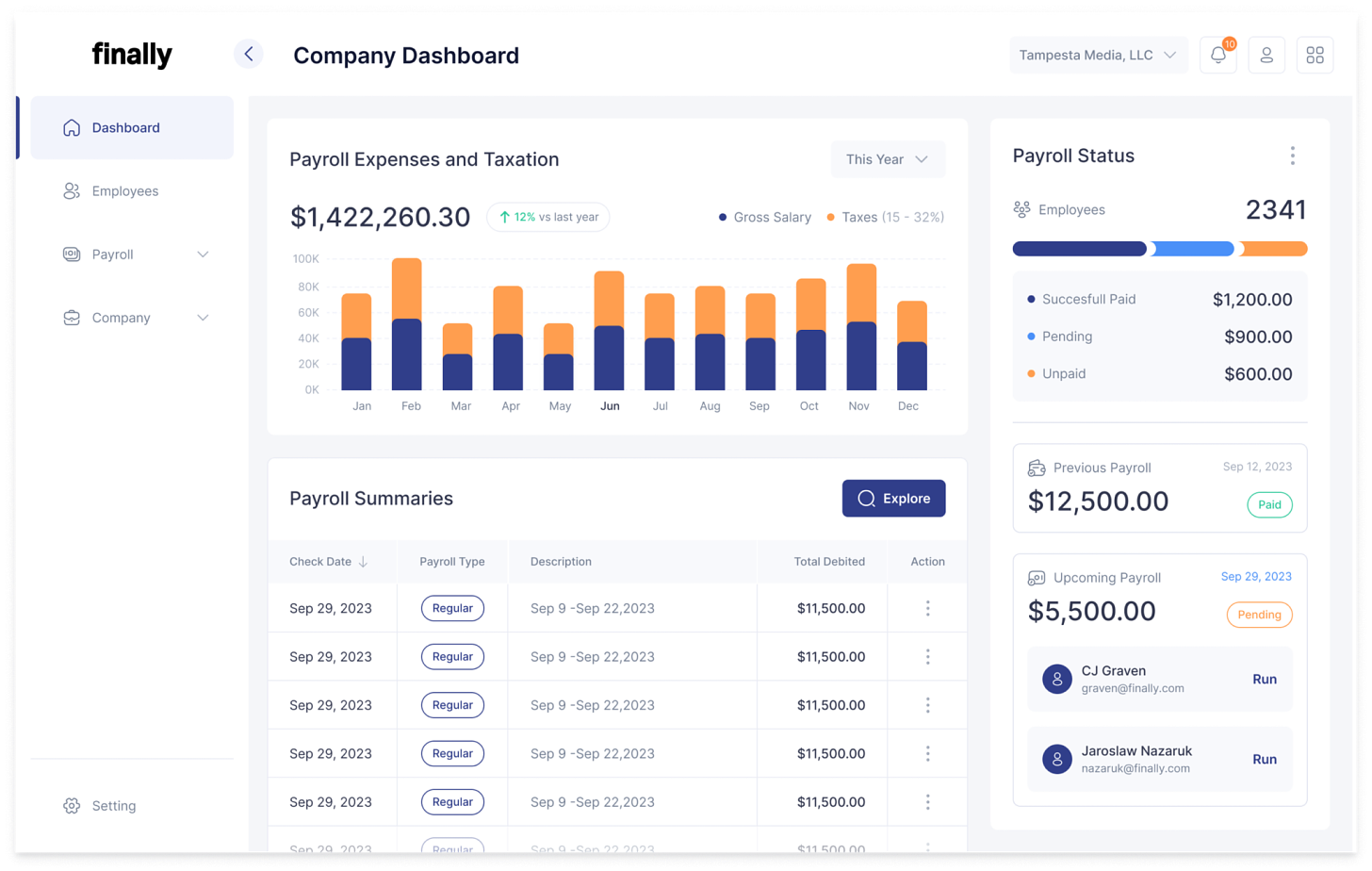

🇺🇸 Finally Nabs $200 Million to Simplify SMB Finances with AI Magic

A Miami-based startup, Finally, has raised $50 million in Series B funding and secured a $150 million credit line to expand its all-in-one financial management platform for small and mid-sized businesses (SMBs). Founded by Felix Rodriguez and his wife Glennys, Finally combines AI-driven bookkeeping with a corporate card and other financial services, aiming to streamline accounting tasks for SMBs. Finally’s model reflects broader fintech trends of bundling accounting softwares with other financial services, similar to startups like AccountsIQ and Pennylane, which are also enhancing financial operations with AI.

Source: TechCrunch

🇦🇪 Abu Dhabi’s Sovereign Wealth Fund Bets on Revolut’s Global Expansion

Revolut's latest $500mn share sale is making waves, with Abu Dhabi's sovereign fund Mubadala joining the fintech game for the first time. Mubadala is part of a star-studded lineup of investors, including Coatue and Tiger Global, boosting Revolut's valuation to a jaw-dropping $45bn. CEO Nik Storonsky cashed in big, netting at least $200mn to fuel his new venture, QuantumLight, which is betting on the future of tech with AI-driven investing.

Source: Financial Times

Upcoming Fintech Events

🇸🇬 Token2049 Singapore will be held on Sept. 18 & 19 ($999 to $4,999) with speakers such as Solana co-founder Anatoly Yakovenko & Binance CEO Richard Teng.

🇪🇸 The European Blockchain Convention will be held in Barcelona on Sept. 25th & 26th (€719 to €1899) with speakers such as Polygon co-founder Jordi Baylina and Kraken COO Gilles BianRosa.

🇬🇧 The Fintech Without Borders Forum will be held in London on Sept. 25th (£109 to £326), with speakers such as Adam Gagen, head of government affairs at Revolut and Elizabeth Rossiello, CEO of AZA Finance.

🇺🇸 Boston Fintech Week will be held in Boston Oct. 14th to 18th ($395), with speakers such as Chris Behling, Head of Risk Product Sales & Underwriting at Northwestern Mutual and Matt Harris, partner at Bain Capital Ventures.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@protonmail.com