Sam Altman Applauds Robinhood’s Solid Gold Credit Card Design 🇺🇸

We’re also covering Walmart's $2.5 billion fintech bet 🇺🇸, NAB ditching passwords 🇦🇺, a credit card for the elite backed by an ex-Google CEO 🇺🇸 & a fintech cashing in on its newsletter 🇨🇦.

Before we get started with the fintech news that caught my attention this week, I wanted to let you know that, as the news cycle slows down for the holidays (at least in the West), I’ll stop sending you my weekly fintech news recap until January 20, 2025. However, this is not the last email I will be sending you in 2024, as I’m working on a holiday gift for all of you. Next week, I’ll send you a holiday special of Global Fintech Insider, with my fintech content recommendations covering podcast episodes, books, and streaming shows. I know some of you want to disconnect, but I also assume some of you are workaholics who want to use your free time to explore in-depth (but entertaining) fintech content :)

🇺🇸 OpenAI CEO Sam Altman Applauds Robinhood’s Solid Gold Credit Card Design

OpenAI CEO Sam Altman recently praised Robinhood's gold credit card, a product the American fintech launched back in March. In a post on X, the Billionaire shared: "A few months ago Robinhood sent me a gold credit card with extremely high-quality details. I thought it was a ridiculous marketing stunt at the time but now it's an example I give when talking about great design."

While standard Robinhood Gold cardholders receive a gold-coloured stainless steel card weighing 17 grams, Altman got the 10K solid gold version weighing 36 grams, as we can see the "Au 79" marking on the bottom right corner of the picture of the card he posted on X. The marking refers to the chemical symbol of Gold (Au), which is the 79th element in the periodic table. This premium version of the card is available to users who refer 10 friends to the waitlist and to VIPs like Altman.

The Robinhood gold card comes in a luxurious packaging and a Robinhood branded wallet. Some users reporting even reported on Reddit receiving a Louis Vuitton wallet alongside their cards. This attention to detail has contributed to the card's appeal, helping Robinhood attract over one million waitlist sign-ups within its first month.

Credit cards have been a status symbol since Diners Club introduced the first charge card in 1950. American Express elevated this concept further with cards like the Centurion Card, which became the ultimate status symbol for high-net-worth individuals.

Robinhood's gold card seems to be attracting attention, but with between 50% and 80% of in-person payments now done through tap-to-pay technologies, the era of black, gold or metallic credit cards could be on its way out. What is not on its way out, however, is fintech using status signalling and high-end design to go up market. Robinhood, which originally gained popularity among small investors with its commission-free trading platform, is now following this well-trodden path. Like many fintechs, the company is strategically pivoting to target more affluent customer segments that promise higher profitability.

Source: Global Fintech Insider

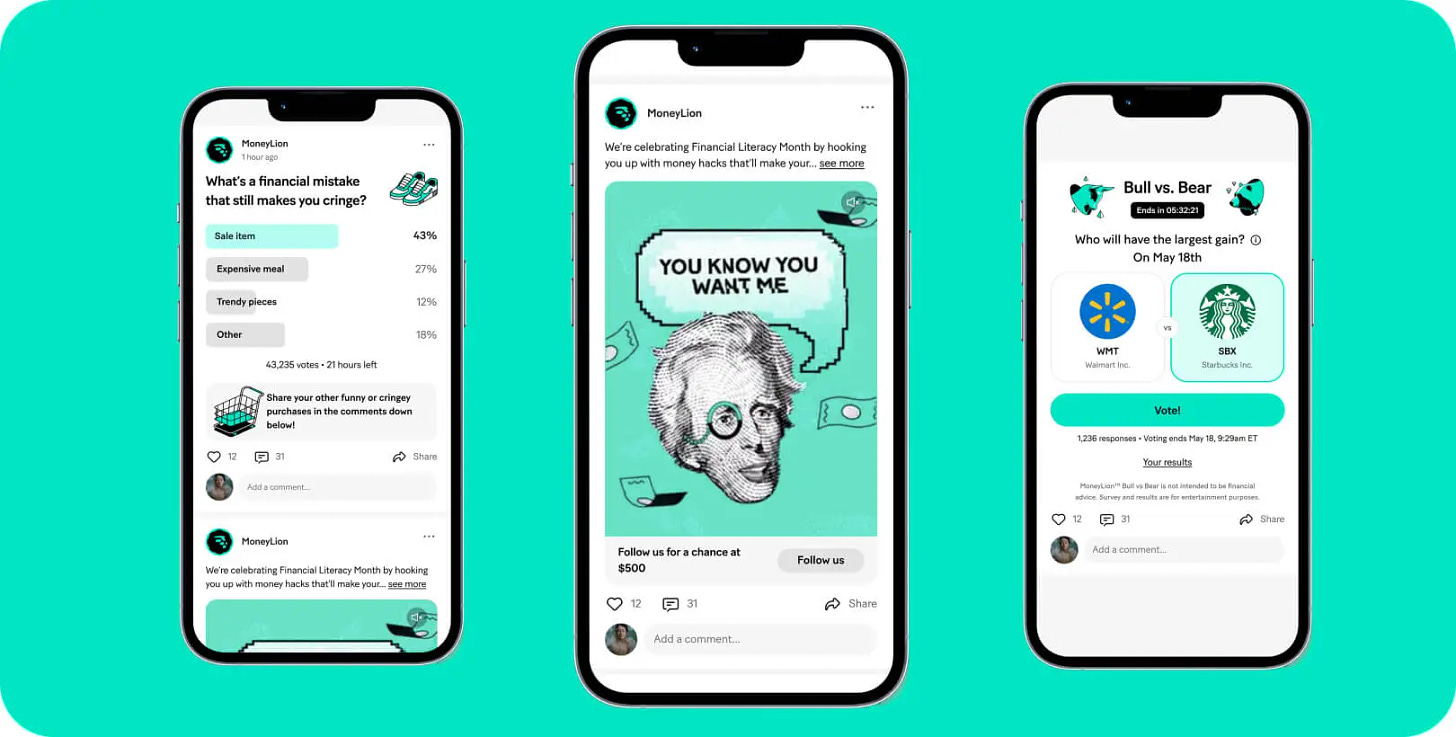

🇺🇸 Antivirus Giant Gen Digital To Swallow MoneyLion For $1B

Gen Digital, an antivirus software company formerly known as NortonLifeLock, has agreed to acquire MoneyLion, a personal finance website and app helping Americans pick financial products, for $1 billion. While this might seem like an unusual pairing, the companies see significant synergy through combining cybersecurity and financial services. Gen Digital, which owns brands like Norton and Avast, plans to offer MoneyLion's 18 million customers enhanced identity and cybersecurity protection. The acquisition is expected to double Gen Digital's addressable market to over $50 billion, with the potential to cross-sell financial and security products to Gen's 500 million existing subscribers. MoneyLion's CEO, Dee Choubey, highlighted the strategic value of joining Gen's "global reach, trusted brands, and powerful ecosystem".

Source: Banking Dive

🇦🇺 NAB, One of Australia’s Big Four Banks, Plans to Eliminate Passwords by 2030

National Australia Bank (NAB) plans to eliminate passwords for internet banking by 2030, replacing them with passkeys and biometric technologies like facial recognition and fingerprints. Sandro Bucchianeri, NAB's chief security officer, called passwords "terrible" and highlighted their vulnerability as identity theft and phishing attacks rise. NAB’s digital subsidiary, ubank, has already implemented passkeys, allowing customers to log in using phone-based methods. NAB faces over 50 million cyberattacks monthly and collaborates with other major Australian banks, including CBA, ANZ, and Westpac, through the BioCatch Trust network, that allows it combat fraud in real time.

Source: Yahoo News

🇺🇸 Walmart’s $2.5 Billion Fintech Venture Gets Boost from Backer of Revolut and Robinhood

Walmart’s fintech venture, One, has reached a $2.5 billion valuation, signalling the retail giant’s growing ambitions in financial services. Backed by a new $300 million funding round led by Walmart and Ribbit Capital (an investor behind fintech leaders like Coinbase, Revolut, and Robinhood), One offers products like installment loans, debit cards, and early wage access, serving both Walmart’s 1.6 million U.S. employees and its vast customer base. With over 3 million monthly active users and annualized revenue exceeding $200 million, One is poised for further growth, including launching Walmart’s reissued credit card next year. Led by ex-Goldman Sachs executive Omer Ismail, the fintech now wants to challenge traditional banks.

Source: BNN Bloomberg

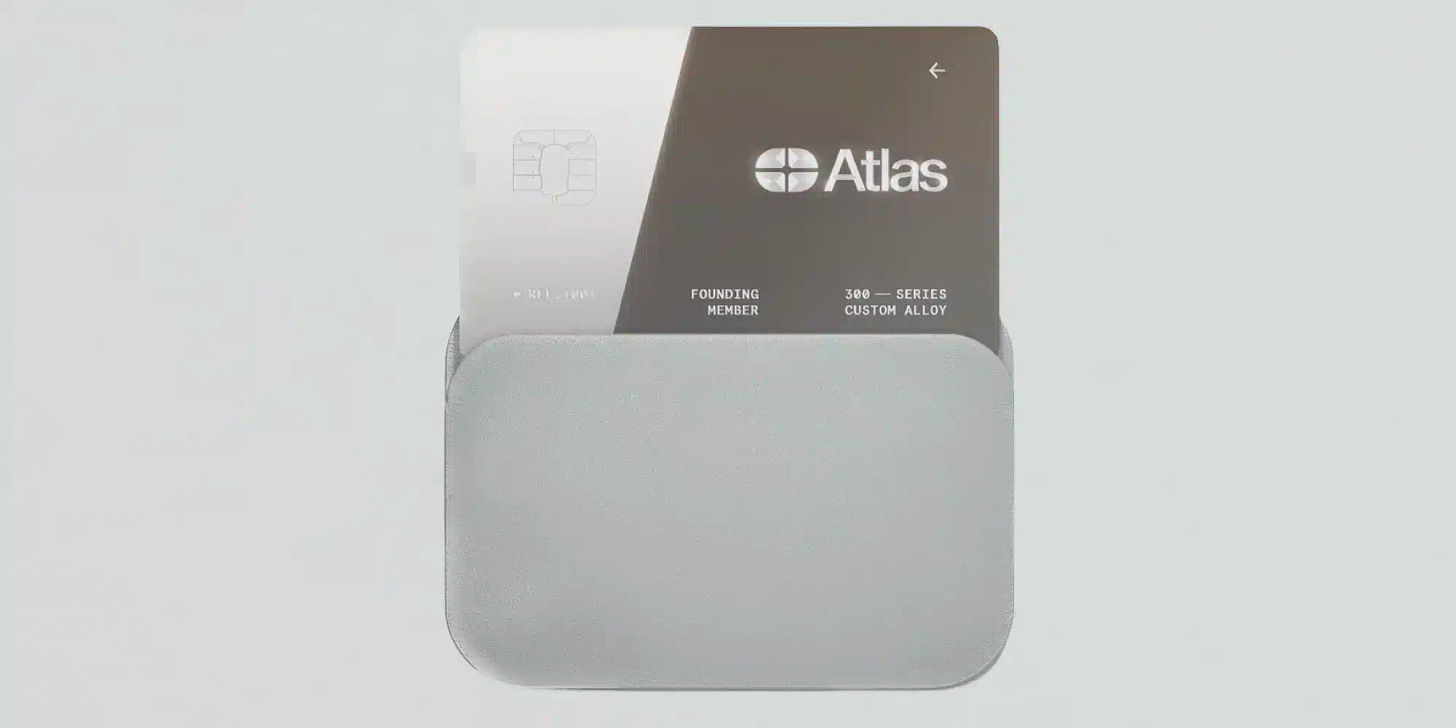

🇺🇸 Atlas Card Raises $27 Million with Backing from Former Google CEO Eric Schmidt

Atlas Card, the fintech offering a high-end concierge service and charge card, has raised $27 million in Series B funding. The round was led by Michael Gilroy and Gokul Rajaram’s fintech fund Marathon, with backing from other investors including former Google CEO Eric Schmidt, Olaf Carlson-Wee, and Anton Levy. It seems most investors, including Eric Schmidt and Gokul Rajaram, started as Atlas card holders before becoming investors. In a Linkedin post, Gokul Rajaram explained what he likes about the card: “My first experience with Atlas was a last minute prime time reservation at Dirt Candy in NYC, something I had struggled to secure for several months prior. Over the past few months, it has rapidly become my top-of-wallet card”. Founded in 2023 by current CEO Patrick Mrozowski, who previously launched a round-up app and a debit card, Atlas has surpassed $200 million in annualized spend volume by providing its wealthy members with access to luxury experiences such as exclusive reservations and sold-out events. With a waitlist of over 30,000, the company aims to surpass $1 billion in purchase volume in 2025.

Source: Global Fintech Insider

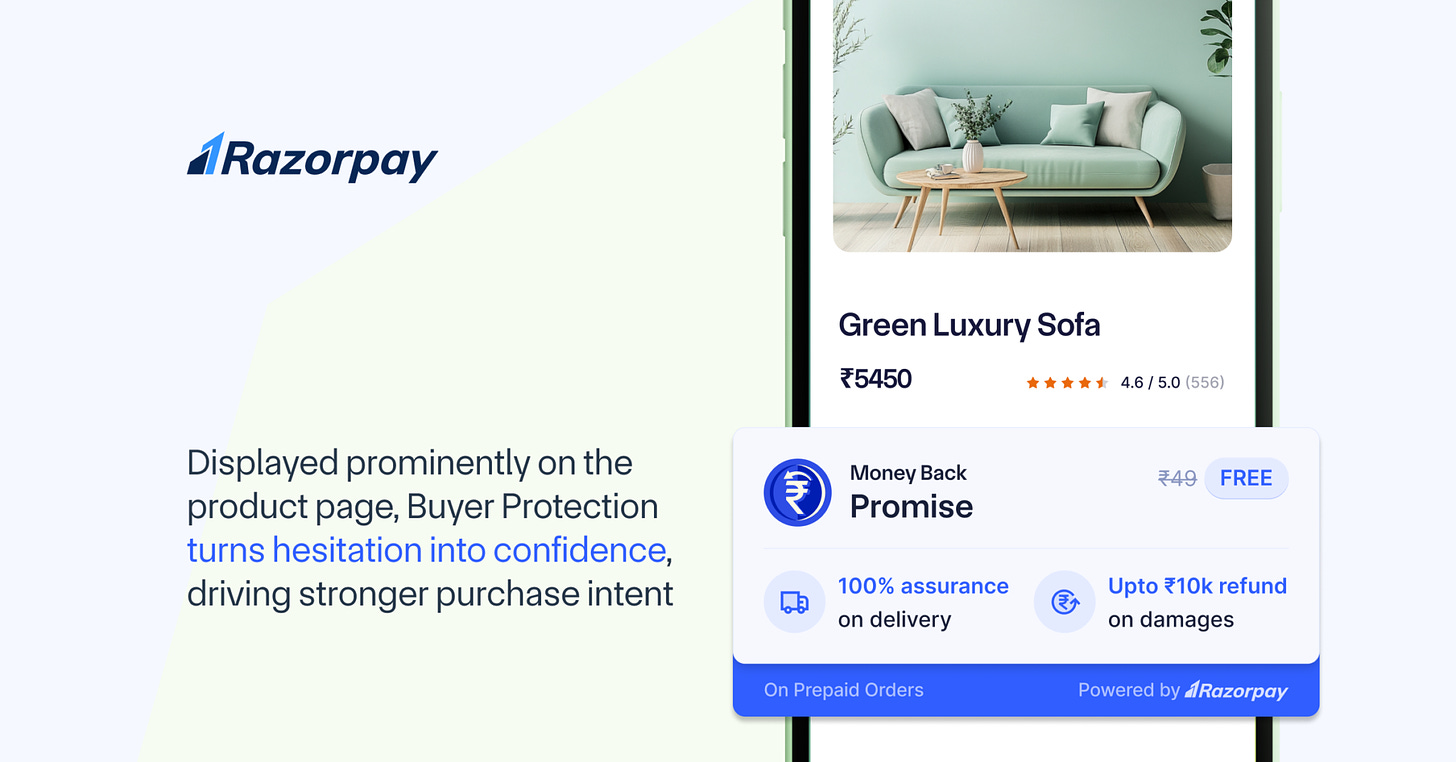

🇮🇳 Razorpay Launches Add-On to Help Indian Merchants Move Away from Cash on Delivery

Last week, Razorpay launched Razorpay Buyer Protection, which allow consumers to get a third party to guarantee on-time delivery, the option to return the item purchased. In India, where cash-on-delivery (COD) still makes up a large portion of transactions, Razorpay Buyer Protection is free for prepaid orders, incentivizing customers to move away from COD and complete transactions upfront. This reduces fraud, lowers operational risks, and helps merchants improve their cash flow. Co-founded in 2014 by Harshil Mathur and Shashank Kumar, Razorpay reached a 7.5 billion USD valuation in 2021. While Razorpay Buyer Protection is specific to the Indian market, I have a feeling this won’t be the last time we see payment providers adding insurance as an upsell embedded in the payment flow. As a result, I wouldn’t be surprised if global players like Stripe or Adyen start offering something similar soon.

Source: Global Fintech Insider

🇨🇦 Blossom’s Newsletter Hits 100K Subscribers and $200K in ARR

Blossom, the social trading app that lets users share their stock picks, has turned its weekly newsletter, The Weekly Buzz, into a revenue-generating asset. CEO Maxwell Nicholson shared on LinkedIn that the newsletter has reached over 100,000 subscribers, generating more than $200,000 in annual recurring revenue (ARR), with ad slots already sold out for the first quarter of 2025. While newsletters are typically used for growth, in Blossom's case, it has become a significant revenue stream. In a private message on Linkedin, Maxwell Nicholson told me that the newsletter generated about 10-15% of the company’s projected revenue for 2024.

Source: Global Fintech Insider

🇲🇽 Sofía Raises $13.5M to Bring Affordable Health Insurance & Telehealth to Mexico's SMBs

Mexican insurtech startup Sofía has raised $13.5 million in funding, bringing its total capital raised to $37.5 million. The round was led by European fund Kfund, marking its first investment in Mexico, along with support from Index Ventures, Kaszek, and BID Lab. Launched in 2020 by co-founders Arturo Sánchez Correa, Manuel Andere and Sebastián Jiménez, Sofía provides health insurance to individuals and small to medium-sized businesses (SMBs). With only 21% of Mexico's population covered by health insurance, Sofía aims to expand its reach and offer more affordable, tech-driven solutions. The company is also exploring the use of AI to improve medical care, while continuing to offer telemedicine and a network of over 1,800 doctors. In a Linkedin post in Spanish about the round, Sofia’s founder and CEO, Arturo Sánchez Correa wrote : “We are very excited at Sofía about all that remains to be done to improve how people take care of their health, in particular the possibilities that AI opens up”.

Source: Forbes Mexico

🇺🇸 YC-Backed Finny Raises $4.2M for Its AI-Driven Platform Matching Clients with Financial Advisors

YC-backed startup Finny is leveraging AI to streamline the client acquisition process for financial advisors. Co-founded in late 2023 by McGill-educated engineers Eden Ovadia and Theodore Janson, and former Uber product manager Victoria Toli, Finny uses AI to match advisors with high-potential prospects by analyzing a database of leads and scoring them based on conversion likelihood. Advisors receive tailored, "warm" leads, saving time on cold outreach and improving their conversion rates. The platform also suggests optimal outreach channels, handles follow-ups, and schedules meetings. After launching its MVP in May 2024, Finny raised $4.2 million in a seed round, experiencing rapid growth with 150% monthly revenue increases.

Source: TechCrunch

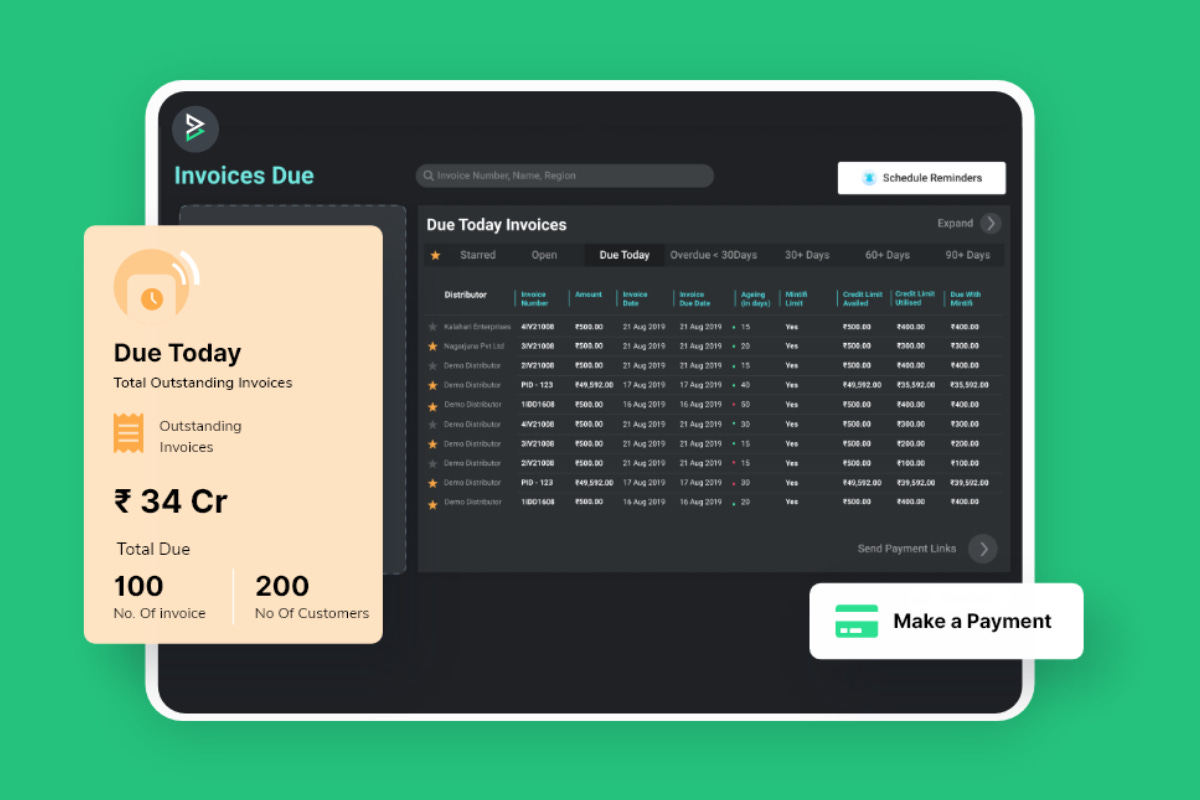

🇮🇳 Indian Digital Lender Mintifi Raised 180 million USD from Prosus & the Ontario Teachers Pension Plan

Mintifi secured 180 million USD in a funding round co-led by Prosus and Ontario Teachers’ Pension Plan (OTPP), bringing the fintech’s valuation to 825 million USD. The round included $100 million in primary capital and $80 million in secondary funding, enabling Lok Capital’s complete exit and providing liquidity to employees. Founded in 2017, Mintifi specializes in invoice-backed loans. In a Linkedin post about the round, CEO and co-founder Anup Agarwal wrote: “Mintifi is processing over USD 3 billion in invoices annually working with the largest brands in the country and helping thousands of distributors and SMEs unlock their true potential!”

Source: The Economic Times

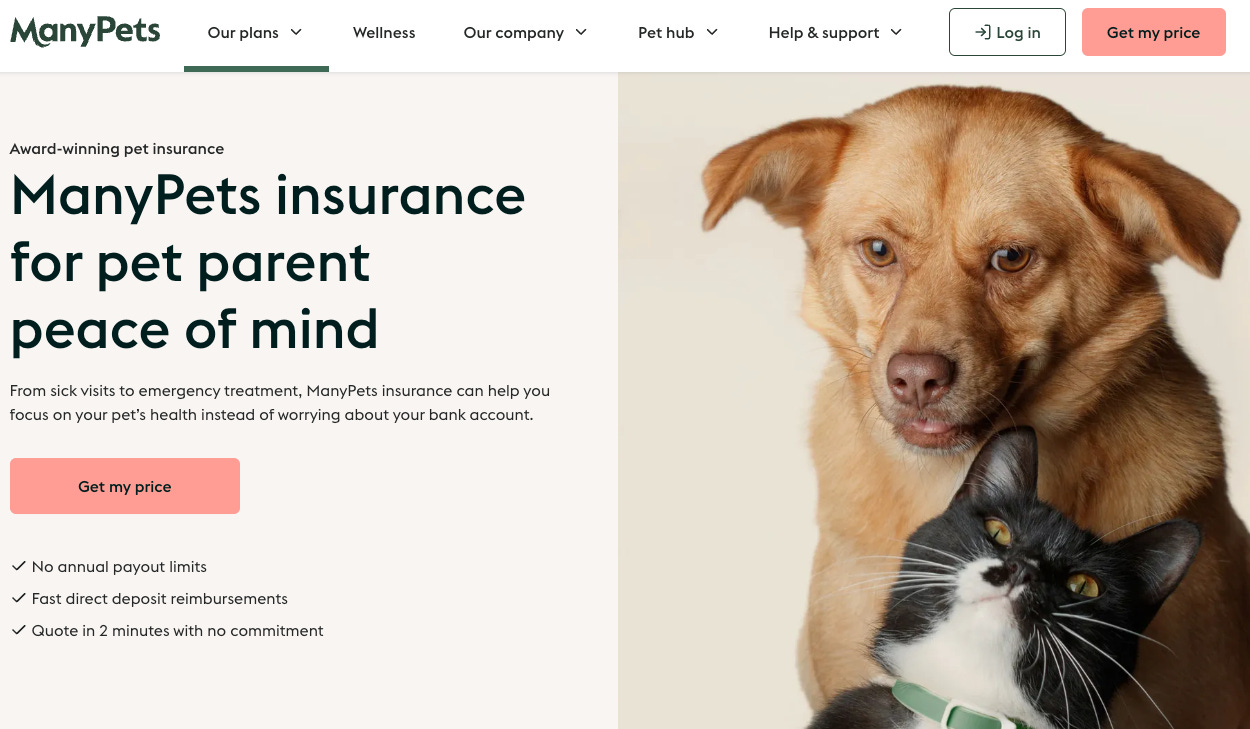

🇬🇧 Pet Insurance Unicorn ManyPets Cuts Losses in Half After Exiting the US and Sweden

Pet insurance provider ManyPets has reported a significant reduction in its losses for the year, cutting them from £67.5 million to £33 million (85 to 22 million USD). Despite a drop in revenue, the company has made strides in its path to profitability by restructuring its operations, including leadership changes, layoffs, and exiting its US and Swedish markets. The company, now under the leadership of CEO Luisa Barile, has been hit by rising inflation and increasing veterinary costs but has increased policy prices to counter these challenges. ManyPets, which holds 11-13% of the UK pet insurance market, plans to grow its market share to 15% within two years and aims to hit profitability by the end of 2025. With £88.7 million (112 USD) in cash reserves, the company is not seeking further external funding and is exploring potential acquisitions.

Source: Sifted

Upcoming Fintech Events

🇮🇳 The Bharat Fintech Summit will take place in Bombay on February 5-6, 2025 (94 USD), with speakers such as Balaji Rajagopalan, CTO of the State Bank of India & Anup Agarwal, CEO of Mintifi.

🇳🇱 Banking Renaissance will take place in Amsterdam on February 19-20, 2025 (1,263 USD), with speakers such as Giorgi Shagidze, CEO of maib & Ivar Lammers, Global Head of Financial Crime at ING Bank.

🇬🇧 Finovate Europe will be held in London on February 25-25, 2025 (2,399 USD), with speakers such as Joris Hensen, co-lead of co-lead Deutsche Bank API Program & Joanne Phillips, managing director for Aviva Direct Wealth.

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 (632.50 USD), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

🇺🇸 Fintech Meetup will take place in Las Vegas on March 10-14, 2025 (2 800 USD), with speakers such as Leif Abraham, co-CEO of Public.com & Misha Esipov, CEO of Nova Credit.

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

Fintech’s Musical Chair

🇺🇸 Spanish bank Banco Santander appoints a Silicon-Valley based executive and former PayPal SVP Nitin Prabhu as Global Head of Digital Consumer Bank, as it enters the U.S. market with its own digital bank.

🇺🇸 Occupi, a fintech app allowing tenants to pay their rent & utility with a credit card, appoints former Dentons Sirote partner Josh Hornady as Chief Legal Officer.

🇫🇷 Thibault Verbiest, a french lawyer specialized in fintech and part-time novelist, was appointed as Chairman of Paytend.com, a Lithuanian paytech.

🇬🇧 Stephanie Clarke, former SVP of Data & Analytics at investment & accounting software provider Broadridge, was appointed as Head of International Strategy and Corporate Development at the company.

🇲🇽 Andreas Waldmann, formerly Chief Product Officer at payment provider Clara, was named Chief Marketing Officer of Kueski, Mexico’s largest online lender.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

I’m now product manager for Beeye, an AccountingTech SaaS.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin.