Robinhood CEO Says He Applies Costco $1.50 Hot Dog Philosophy To Financial Services 🇺🇸

We're also covering super app Kaspi's Turkish expansion 🇹🇷, Mercury's $300M raise 🇺🇸, Sam Altman's Visa plans 🇺🇸 & eToro's crypto-reliant money-printing machine 🇮🇱

Before getting into the thick of this week's fintech news, I wanted to thank all the readers who took the time to share their AI tricks and tips! The special AI issue of the newsletter featuring those will be sent to you next Wednesday!

And since I always like to tackle something new, I've given myself a challenge: to develop a simple web app (using AI coding tools) that will provide value to my fintech audience. Before getting into it, however, I need to know which of my 5 web app ideas would be the most useful to you, so it would mean the world to me if you could take 1 minute and vote for an idea through my LinkedIn survey here: https://www.linkedin.com/posts/julienbrault_i-need-your-input-on-this-i-want-activity-7311355285325950976-AnPj

🇺🇸 Robinhood CEO Says He Applies Costco $1.50 Hot Dog Philosophy To Financial Services

Robinhood is transforming its Gold subscription with three major additions: robot-advisor-like managed investment accounts (Robinhood Strategies), private banking (Robinhood Banking) and an AI-powered stock market analyst (Robinhood Cortex). "Robinhood Gold itself grew from about 1.5 million paid subscribers one year ago to 3.2 millions today," CEO Vlad Tenev told CNBC on March 27. "It's a great deal at $5 per month, but it still generates significant revenue for us. It's a nine-figure business for us now."

The trading app is expanding beyond its self-directed investing roots with these new offerings. Tenev explicitly points to retail giants as his inspiration: "We took inspiration from Amazon, and we took inspiration from Costco, which has a great offering. And, you know, they have ludicrous offerings like the $1.50 hot dog. Even the gold bars have done very well for Costco. So yes, we take a lot of inspiration from those guys."

For Gold subscribers, Robinhood will charge just 0.25% on managed accounts up to $100,000, capping the maximum annual fee at $250 (significantly undercutting traditional wealth management fees). The upcoming Robinhood Banking service will offer premium perks typically reserved for high-net-worth clients, including discounted helicopter and private jet rides, access to exclusive events, estate planning, and on-demand cash delivery.

Rex Salisbury, general partner at fintech VC firm Cambrian, noted in a LinkedIn post the competitive advantage Robinhood now has over traditional banks: "Robinhood Gold is a pretty remarkable bundle: 4% checking, 3% cash back credit card, free trading, all in a very slick mobile app. Compare this to a typical banking app: 0% interest, 1% cash back card, $7 trades... and you have to leave your banking app and go to their affiliated brokerage app to do it!" The fintech's strategy is already showing signs of attracting more affluent customers, positioning the company to compete for the mass affluent customers traditionally served by established banks.

Source : Global Fintech Insider, CNBC & Wall Street Journal

🇹🇷 Kaspi.kz, The Nubank of Kazakhstan, Acquires Rabobank Turkey

Kazakh super app Kaspi.kz is expanding its Turkish footprint with the acquisition of Rabobank's Turkey operations. The fintech powerhouse, led by CEO Mikhail Lomtadze (pictured above), signed an agreement to purchase Rabobank’s Turkish subsidiary, which holds a full banking license in Turkey despite having no borrowing or depositing clients or branch network.

This marks Kaspi's second strategic move in Turkey within months, following its October acquisition of e-commerce platform Hepsiburada for $1.13 billion. The transaction details weren't disclosed and remain subject to regulatory approval.

What makes Kaspi a fintech phenomenon worth watching is its remarkable market penetration and multi-service platform. With 14 million users out of Kazakhstan's 20 million population (70% penetration), Kaspi.kz has become Kazakhstan's most valuable public company by seamlessly integrating payments, banking, e-commerce, and travel services into a single super app. This level of market dominance mirrors Nubank's achievement in Brazil, where the Latin American neobank has captured 57% of Brazil's adult population.

The deal comes after Rabobank's previous failed attempts to exit Turkey, first through negotiations with cryptocurrency exchange BtcTurk and then with construction conglomerate Ronesans Holding, which had announced an agreement last July but never completed the transaction.

Source: Global Fintech Insider, Daily Sabah & Bloomberg

🇺🇸 Mercury Reports 10 Straight Profitable Quarters As It Lands $300M Investment

B2B neobank Mercury has secured $300 million in Series C funding, doubling its valuation to $3.5 billion. Led by Sequoia Capital with participation from new investors Spark Capital and Marathon, alongside returning backers Coatue, CRV, and Andreessen Horowitz, the round build on the valuation rebound experienced by B2B neobanks, with Ramp recently reaching a $13B valuation. Founded in 2018 by CEO Immad Akhund (pictured above), the fintech now serves 200,000 business customers including tech startups and e-commerce businesses. Unlike competitors Ramp and Brex, Mercury has expanded beyond pure business banking to offer personal banking services through Choice Financial Group. The company provides corporate credit cards and financial software to help businesses pay bills, send invoices, automate accounting and manage employee expenses. Mercury has maintained ten consecutive quarters of profitability, generated $500 million in revenue last year, and grew its customer base 40% in 2024.

Source: American Banker

🇺🇸 Sam Altman's Side Hustle World Network In Talks To Issue Visa Cards

Sam Altman's World Network is in discussions with Visa to integrate card functionality into its self-custody crypto wallet. Tools for Humanity, the for-profit company overseeing Worldcoin and World Network, has sent product request forms to card issuers, positioning World Wallet to become a "mini bank account" for users worldwide. Founded in 2019 by OpenAI CEO Sam Altman, Max Novendstern, and Alex Blania, Altman’s side hustle Tools for Humanity has raised $194 million from prominent investors including Blockchain Capital, a16z crypto, Bain Capital Crypto, and Distributed Global, potentially valuing the company at $3 billion. The Visa partnership would enable wallet holders to make stablecoin-based payments to thousands of merchants globally. It will be interesting to see if OpenAI, in which Altman claims he owns no stake, will partner with Tools for Humanity, as integrating payments & ID verification with AI agents could unlock a lot of possibilities. Furthermore, the recent merge of Elon Musk-backed X (which announced a Visa partnership of its own) and xAI could be a setting the table for such a move.

Source: Coindesk & Global Fintech Insider

🇺🇸 Jack Dorsey Lays Off 8% Of Block Staff Via Email

Payment giant Block, the fintech company behind the Square point-of-sale systems and the Cash App, has laid off 931 employees, approximately 8% of its total staff. The layoffs were executed the cuts through impersonal emails. In an internal email leaked to TechCrunch, Dorsey (pictured above) explained the restructuring also transitioned nearly 200 managers into non-managerial roles and closed almost 800 open positions. The cuts span three categories: 391 people for "strategy" reasons, 460 for "performance" reasons, and 80 managers to flatten hierarchy. Former Square Software Engineer Colten Derr described the cold execution on LinkedIn: "I found out when I got a message from my manager along the lines of 'Sorry, today is your last day. I just found out.' I barely finished reading the email when I lost access to everything, I didn't have time to say goodbye to anyone." Dorsey denied that the layoffs were financially motivated, despite reported declines in Cash App revenue and continued losses at Afterpay (acquired for $29 billion in 2021). This marks Block's second major workforce reduction in 15 months after cutting around 1,000 roles in January 2024.

Sources: Global Fintech Insider, Crowdfunding Insider & TechCrunch

🇮🇱 eToro IPO Filings Reveal That 96% of The Company's Revenue Comes From Crypto

Trading platform eToro has filed for an initial public offering, revealing that crypto assets make up a staggering 96% of its revenue. Founded in 2006 by current CEO Yoni Assia (pictured above), the Israel-based fintech reported that crypto assets generated $12.1 billion of its $12.6 billion total reported revenue in 2024, while also accounting for 38% of commission from trading activity last year (up from 17% the year before). Overall financial performance showed impressive growth, with commission revenue reaching $931 million in 2024, a 46% increase from $639 million the previous year, and net income surging to $192 million from just $15.3 million in 2023. As a direct competitor to Robinhood, EToro distinguishes itself with a much broader international footprint, operating across 74 countries including the US, the UK, EU countries, Australia, Singapore and Brazil, while Robinhood is limited to just the US and the UK. Goldman Sachs, Jefferies, UBS, and Citigroup are leading the NASDAQ listing under the ticker ETOR.

Source: Bloomberg & Global Fintech Insider

🇺🇸 Dun & Bradstreet, A Fintech That Once Employed Abraham Lincoln, To Be Taken Private For $4.1B

Wall Street's 184-year-old corporate credit rating provider Dun & Bradstreet is going private again. Private equity firm Clearlake Capital has agreed to acquire Dun & Bradstreet in a deal valued at $4.1 billion, or $7.7 billion including debt, representing a 4.8% premium to its last closing price. The acquisition ends D&B's second stint as a public company after its 2020 IPO, which had valued it at about $9 billion, with shares having fallen nearly 30% this year and about 60% since going public. Despite its storied history and having once employed four future U.S. presidents including Abraham Lincoln, the data and credit rating provider has struggled in public markets, though analysts note its healthy cash flow and growth potential made it an attractive target. The deal includes a "go shop" period allowing D&B to seek alternative proposals.

Source: Reuters

🇮🇳 Cashfree Payments Secures $53M for MENA Expansion Led by Korean Gaming Giant Krafton

Bengaluru-based Cashfree Payments has raised $53 million in Series C funding led by Korean gaming giant Krafton, with support from existing backer Apis Growth Fund, valuing the company at $700 million according to sources familiar with the deal. Founded in 2015, Cashfree serves over 800,000 businesses, processes $80 billion in transactions annually for major Indian clients including BigBasket, Cred, and Zoomcar, and plans to use the funding to accelerate its expansion into MENA markets. "This investment will help us accelerate our key efforts," says Cashfree CEO and co-founder Akash Sinha (pictured above), highlighting the company's focus on enhancing cross-border and security features while targeting "six big marketplaces like UAE, Saudi, Egypt and three smaller markets like Jordan and Kuwait" as part of its international growth strategy.

Source: Fintech Futures

🇺🇾 Strike Raises $13.5M for AI Powered Real Time Pen Testing Platform

Cybersecurity is getting an AI upgrade from South America. Uruguay-based Strike has secured $13.5 million in Series A funding led by FinTech Collective, with participation from Galicia Ventures and existing investors Greyhound Capital, FJ Labs, Canary Ventures, and Carao Ventures to scale its continuous penetration testing platform in the U.S. and Brazil. Founded in 2021, the company connects certified ethical hackers with over 100 companies to deliver AI-powered security testing at scale, while also announcing the launch of Strike360, an AI-driven platform that automates vulnerability detection, retesting, and compliance reporting. "Companies are spending millions on security, yet hackers still breach them before they are aware of their vulnerabilities and can react," said Santiago Rosenblatt, CEO and founder of Strike (pictured above), whose platform emphasizes real-time alerts with actionable remediation suggestions and allows clients to modify test scopes even after initiation.

Source: Silicon Angle

🇩🇪 N26 Emerges as Germany's Top Fintech Founder Factory With 34 Spinoffs

Berlin's neobank N26 is breeding Europe's next generation of startup founders. According to Sifted, at least 34 startups have emerged from N26, with seven founded by former employees in just the past year. These recent ventures include Alex Goddijn's Fern Labs (AI agent embedding platform), Alexander Weber's stealth healthtech startup, Alexander Walsh's Oraion (AI-powered customer insights), Evgeny Krapivin's Hiring Method (AI-powered recruiting system), John Arts' Emerge Data (customer behaviour tracking), Prokopis Gryllos' Emblematic AI (AI for accounting teams), and Omkar Pimple's stealth AI software quality management startup. Founded in 2013 by Valentin Stalf and Maximilian Tayenthal, the Berlin-based neobank has raised over $1.5 billion from investors like Dragoneer, Earlybird, and Coatue, and serves over 4 million customers across 24 European countries.

Source: Sifted

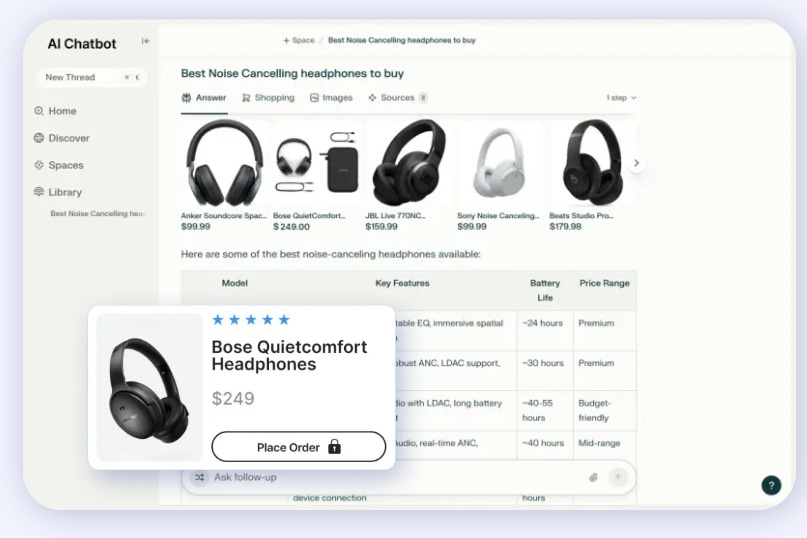

🇺🇸 Perplexity Teams Up With Firmly to Enable GenAI Shopping Without Leaving the Platform

GenAI will get its own native checkout experience on Perplexity.ai. The AI-powered search engine has announced a strategic partnership with Firmly to transform how consumers discover and purchase products through its "answer engine." The collaboration enables Perplexity's reported 15+ million users to browse and buy products without leaving the platform. Firmly's "agentic commerce platform" serves as the crucial connector, allowing merchants to integrate once through a single API and instantly make their products available across diverse digital channels while maintaining control over transactions and customer relationships. "It's almost impossible for an individual merchant to integrate with these types of platforms one by one," said Firmly co-founder and CEO Kumar Senthil in a conversation with PYMNTS. Perplexity's Head of Advertising Taz Patel explained that the platform is following user behaviour, noting that consumers are already using Perplexity for detailed shopping queries.

Source: PYMNTS

Upcoming Fintech Events

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

🇩🇪 FIBE Fintech Berlin will be held in Berlin on April 9-10, 2025 (1,204 USD), with speakers such as Dan Schulman, former CEO of PayPal & Hélène Falchier, partner at Portage Ventures.

🇹🇭 Money20/20 Asia will be held in Bangkok on April 22-24, 2025 (3,195 USD), with speakers such as Lucy Liu, co-founder & president of Airwallex & Martha Sazon, CEO of GCash.

🇬🇧 The Innovate Finance Global Summit will be held in London on April 29, 2025 (450 USD), with speakers such as Justin Basini, co-founder & CEO of ClearScore & Diana Avila, Global Head of Banking and Expansion at Wise.

🇺🇸 FinovateSpring will be held in San Diego on May 7-9, 2025 (1,299 USD), with speakers such as Vishal Garg, founder & CEO at Better.com & Lauren McCollom, Head of Embedded Finance at Grasshopper Bank.

🇦🇪 Dubai FinTech Summit will take place in Dubai on May 12-13, 2025 (899 USD), with speakers such as Arik Shtilman, co-founder and CEO of Rapyd & John Caplan, CEO of Payoneer.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & co-founder of Zero Hash.

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.