Revolut To Return To Canada, Now Likely Seeking A Banking License 🇨🇦

We're also covering Ualá's expansion 🇦🇷, Trump's altcoins reserve 🇺🇸, Pornhub founders' 5th fintech deal 🇨🇦, African super app series B 🇹🇬, Shopify US move 🇨🇦 & BofA's stablecoin 🇺🇸

If you are a fintech executive, it would be really nice if you could take 2 minutes to fill this form to share at least one clever way you use chatbots like ChatGPT, Claude or Gemini at work. I'll feature your tips and tricks in a subsequent issue of the newsletter, with your names, titles and LinkedIn profiles link, so it's also a good way to shine professionally.

🇨🇦 Revolut To Return To Canada, Now Likely Seeking A Banking License

Revolut is currently recruiting for the position of CEO of Revolut Canada to lead its reentry into the Canadian market and potentially secure a banking license. According to a recruitment LinkedIn message received by multiple Canadian fintech executives and obtained by Global Fintech Insider, the London-based global neobank is looking for an executive interested in building something “from the ground up”. Half of the responsibilities listed in this message sent by a Revolut executive recruiter relate to regulations, a key indicator that Revolut is now likely seeking a bank charter in Canada.

Here are the main things the new Revolut Canada CEO will be tasked with, according to the message:

Scaling the business from 0 to 1, and beyond, within Canada

Ensure smooth acquisition of all required regulatory licenses in a timely manner

Work with internal and external stakeholders to manage expectations

Continue to build and nurture relationships with regulators

While the email could refer to other types of licenses, it’s likely that Revolut learned from its first attempt at cracking the Canadian market and now aims to control its offering through a banking license. Launched in beta in 2019, the Canadian Revolut card, a prepaid card issued by a partner bank, never got out of beta, and the product was shut down in 2021.

Back then, Revolut had explained on Twitter that its departure was due to not being able to offer Canadians its full range of services, and expressed the hope to come back to the country in the future.

From 2019 to 2021, Revolut did not operate in the country as Revolut Canada nor did it hire a CEO, as its Canadian boss, Saud Aziz, was the head of strategy and operations in North America for Revolut.

Interestingly, Saud Aziz, who had criticized Canada’s strict banking regulations while at Revolut, just raised 15M USD for his B2B neobank Venn, which operates in Canada without a banking license through a prepaid card issued by a banking partner.

Revolut’s potential interest in a Canadian banking license would align with recent comments from its CEO Nik Storonsky. Speaking to investors in Helsinki in November 2024, he said : "For a long time, I wanted to be as less regulated as possible, it was the completely wrong decision." He since then secured a banking license in the UK, reached 50 million active users and announced his goal of getting to "100 million daily active customers in 100 countries".

Obtaining a banking license in Canada won't be easy. Canada is dominated by 5 big banks controlling 86% of the market and, while 12 foreign banks have obtained a Schedule II bank charter including Amex and UBS, most of those foreign banks do not have a full service retail bank offering, with some notable exceptions like ICICI Bank Canada and HSBC Canada… until it was acquired by RBC. Furthermore, if Revolut wants to become part of this select club of foreign banks, it will have to get some political support, as the Canadian Bank Act requires a direct authorization from the Minister of Finance to be eligible for a Schedule II charter.

Source: Global Fintech Insider

🇦🇷 Ualá Seeks New Banking Licenses in Latin America, But Not In Brazil

Argentinian neobank Ualá, which raised $300 million in a Series E round last November, is actively seeking new banking licenses to expand beyond its current operations in Argentina, Mexico, and Colombia. CEO Pierpaolo Barbieri (pictured above) has indicated the company is looking at underserved markets with less financial innovation rather than Brazil, a highly competitive market in which neobank behemoths like Nubank and Revolut are already established. Ualá achieved profitability in Argentina in 2024 (seven years after launch) and projects reaching profitability in Mexico by 2026. The company serves 2 million customers in Mexico through its ABC Capital acquisition and aims to reach 10 million users in the coming years, while continuing to clean up the legacy real estate loan portfolio it inherited through the acquisition, which should be completed in 2025.

Source: Bloomberg Linea

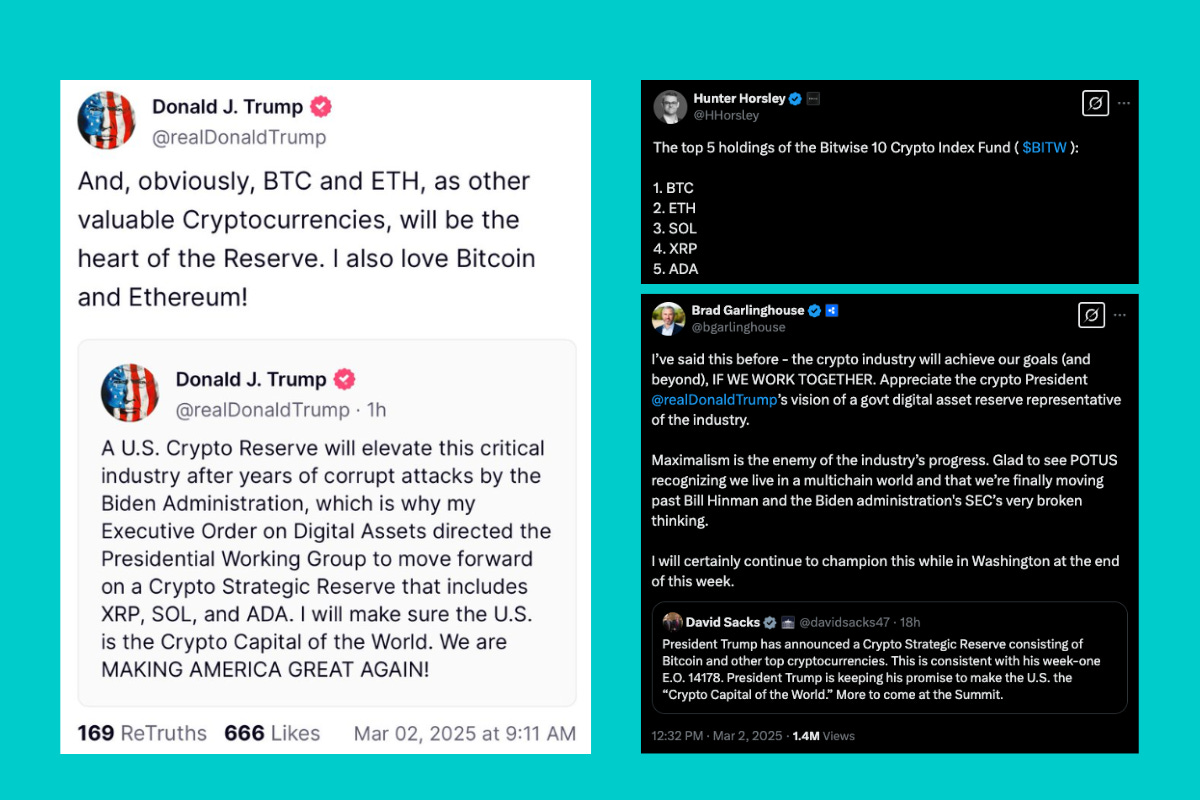

🇺🇸 Crypto Oligarchs Rejoice After Trump Said His Crypto Reserve Will Include Altcoins

US President Donald Trump ignited a crypto market surge over the weekend, after announcing on Truth Social that the previously announced US strategic crypto reserve will include not just Bitcoin, but also Ethereum, XRP, Solana, and Cardano. The news sparked a $300 billion rally, with Cardano up 31%, Solana 11%, and XRP 13%. The news triggered enthousiastic posts from the crypto entrepreneurs set to benefit, like Ripple CEO Brad Garlinghouse, whose company is behind the XRP cryptocurrency: "Glad to see POTUS recognizing we live in a multichain world", he wrote on X. Hunter Horsley, CEO of crypto index fund Bitwise (which happened to be in the porfolio of Trump’s crypto czar’ VC fund), rejoiced on X when he realized the 5 cryptocurrencies favoured by Trump happened to correspond Bitwise’s top 5 holdings. Binance founder and crypto billionaire CZ added in an another X post: "No need to overanalyze. More 'valuable crypto' are likely to be added over time. More countries will follow."

Source: Global Fintech Insider

🇹🇬 African Super App Gozem Secures $30M to Expand Its Vehicle Financing & Digital Banking Offering

Togo-based super app Gozem has secured $30 million in Series B funding ($15M equity, $15M debt) led by SAS Shipping Agencies Services and Al Mada Ventures to bolster its vehicle financing service and enter new markets. The company offers ride-hailing, commerce, vehicle financing, and digital banking through Gozem Money, which processes millions in daily transactions. With 10,000 registered drivers and operations across Togo, Benin, Gabon, and Cameroon, Gozem has grown from financing 1,500 vehicles in 2021 to approximately 7,000 today. "Our main client is the professional driver," co-founder Gregory Costamagna told TechCrunch, as the company addresses both vehicle financing and banking needs of drivers across its markets.

Source: TechCrunch

🇺🇸 Alkami Swallows Mantl, The Shopify Of Account Opening For $400M

US-based digital banking software provider Alkami has agreed to acquire Mantl, often described as the Shopify of account opening, for $400 million. The fintech's core-agnostic platform enables ultra-fast account opening under five minutes for retail and under 10 minutes for business accounts, compared to industry averages of 15 minutes and 3.5 hours respectively. Mantl co-founder and CEO Nathaniel Harley shared on LinkedIn that he would stay on: "Post-closing, MANTL will remain business as usual, operating as a stand-alone brand and a distinct, separate business unit that I will continue to lead as President." The acquisition, following what Harley called the company's strongest sales quarter in Mantl's history, is expected to close by March 31.

Source: American Banker & Global Fintech Insider

🇦🇺 Hello Clever Launches AI Payment Platform That Forecasts Sales And Offers Business Advice

Australian fintech Hello Clever, co-founded in 2022 by Gavin Nguyen and Caroline Tran (on the picture above), has officially launched Clever AI, an AI-powered payment solution that goes beyond processing transactions by providing merchants with sales forecasting and business intelligence through two unique components: "Clever Forecaster," which uses deep learning to predict future sales, and "Clever Actionable Insights," which combines data analysis with generative AI to deliver real-time business recommendations. CEO Caroline Tran announced on LinkedIn that the company has achieved profitability while generating millions in revenue as it expanded from Australia to serve merchants across Japan, Singapore, and Southeast Asia.

Source: Global Fintech Insider

🇨🇦 TD Securities Managing Director Warns Shopify Could Be Moving To The US

Canada's largest tech company Shopify has taken steps that could facilitate a move to the US, according to TD Securities managing director Peter Haynes. In its latest SEC filings, Shopify listed its New York City office alongside its Ottawa headquarters and filed a 10-K form typically used by domestic US issuers rather than the 40-F form for foreign companies. The e-commerce and payment giant also added a US Employer Identification Number and changed how it reports segmented assets, flipping its geographic breakdown from approximately 86 percent Canadian to 78 percent US-based. When questioned, Shopify spokesperson Alex Lyons stated the company chose to voluntarily file the 10-K form "in order to align our disclosures more closely with other software peers we believe our investors are familiar with," but did not address whether this signals plans to redomicile.

Source: BetaKit

🇺🇸 Bank of America CEO Reveals Plans For Dollar Backed Stablecoin

Bank of America chairman and CEO Brian Moynihan revealed plans to launch a bank-issued stablecoin once regulations permit during a recent Economic Club of Washington, D.C. breakfast. "If they make that legal, we will go into that business. We will have a BAC – a Bank of America coin U.S. dollar deposit – and it'll be able to move back and forth because now it's legal for us to do it," Moynihan stated, adding that such a stablecoin would be "fully dollar-backed". The CEO's comments come as the Trump administration signals a more crypto-friendly approach, though Moynihan questioned what practical applications might emerge, saying "The question of what it's going to be useful for is going to be interesting."

Source: American Banker

🇮🇪 New Cybersecurity Ranking Shows Claude 3.5 Sonnet As Most Secure AI Model

Irish AI security startup CalypsoAI has launched a new security leaderboard that ranks the cybersecurity of popular large language models, revealing significant security differences between top performers and the rest of the field. The ranking is generated using the company's "Red-Team" technology, which deploys over 10,000 malicious prompts and an AI agent that simulates tailored cyberattacks against each model. Anthropic's Claude 3.5 Sonnet topped the security rankings with a score of 96.25 on CalypsoAI's CASI metric, followed closely by Microsoft's open-source Phi4-14B (94.25) and Anthropic's Claude 3.5 Haiku (93.45). The Ireland-based company, which has raised over $38 million, noted a significant security drop after the top three, with OpenAI's GPT-4o scoring just 75.06. According to CEO Donnchadh Casey, many organizations are adopting AI without understanding the risks

Source: SiliconAngle

🇨🇦 Pornhub Co-Founders Turned Cigar Butt Chasers Add Yet Another Fintech To Portfolio

Montreal-based Valsoft, founded by Pornhub co-founders Sam Youssef and Stéphane Manos, acquired Digital Currency Systems (DCS), a US-based provider of check cashing point-of-sale systems. This marks Valsoft's fifth fintech acquisition and second check-cashing software company in their portfolio. Valsoft has modeled its acquisition strategy after Constellation Software, focusing on niche vertical software businesses that generate consistent cash flow but attract little attention from larger buyers. This "cigar butt" investment approach, inspired by value investing pioneer Benjamin Graham, has proven successful for the former Concordia University engineering students, who pivoted away from the adult content industry in 2010. Valsoft, now valued at over US$2 billion, recently secured a US$150 million equity investment co-led by Portage, a known fintech investor.

Source: Global Fintech Insider

🇺🇸 Brex Pivots From Startups To Enterprise Clients As It Prepares For IPO

Corporate spend management platform Brex is the latest fintech to shift its focus from startups to enterprise clients as it prepares for a potential IPO. After hitting challenges when its startup-heavy customer base reduced spending amid rising interest rates, Brex has aggressively pursued larger clients like Anthropic, Robinhood, and Sonos, resulting in 80% revenue growth in its enterprise segment during 2024. This strategic pivot has helped Brex reduce its cash burn by 82% year-over-year as it targets $500 million in annual net revenue for 2025 and aims to be cash-flow positive by mid-year. CEO Pedro Franceschi (pictured on the left) emphasized the company's restructuring to better serve these larger clients: "We brought leaders closer to the model, closer to the customer, and we narrowed down our scope to do fewer things." Brex has also streamlined operations by cutting its workforce by 21% to approximately 1,100 employees since the end of 2023.

Source: Bloomberg

Upcoming Fintech Events

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 (633 USD), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

🇯🇵 The GFTN Forum Japan will take poace in Tokyo from March 3-7, 2025 (350 USD), with speakers such as Doug Feagin, President of Ant International & Kenneth Gay, Chief Fintech Officer of the Monetary Authority of Singapore.

🇺🇸 Fintech Meetup will take place in Las Vegas on March 10-14, 2025 (2,800 USD), with speakers such as Leif Abraham, co-CEO of Public.com & Misha Esipov, CEO of Nova Credit.

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

🇩🇪 FIBE Fintech Berlin will be held in Berlin on April 9-10, 2025 (1,204 USD), with speakers such as Dan Schulman, former CEO of PayPal & Hélène Falchier, partner at Portage Ventures.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & Co-Founder of Zero Hash.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

I’m now product manager for Beeye, an AccountingTech SaaS.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.

Revolut is learning the hard way in fintech, the house (aka regulators) always wins. You can build the best product, but if you don’t have the right licenses, you're just playing in someone else’s sandbox.