MoonPay CEO Calls The Acquisition of German Stablecoin Fintech Iron A "Braintree Moment" 🇺🇸

We're also covering Klarna's IPO filing 🇸🇪, Binance's $2B deal 🇦🇪, Mexico's new fintech unicorn 🇲🇽, Rapyd's $610M PayU deal 🇮🇱, Bench's legal trouble 🇺🇸 & a $4B bet against Remitly 🇺🇸

🇺🇸 MoonPay CEO Calls The Acquisition of German Stablecoin Fintech Iron A "Braintree Moment"

MoonPay, the crypto trading app valued at $3.4 billion, has acquired stablecoin infrastructure startup Iron in its push to dominate the enterprise stablecoin market. This acquisition will allow MoonPay, known for allowing retail investor to trade meme coins, to get into the online payment business.

MoonPay CEO Ivan Soto-Wright (pictured above) framed the deal as a pivotal moment for the company, telling CNBC, "This is our Braintree moment. Iron's technology positions MoonPay to become the definitive infrastructure provider for enterprise stablecoin solutions."

Moonpay's CEO "Braintree moment" quote refer to PayPal's $800M Braintree purchase in 2013, which allowed PayPal to compete more effectively with Stripe in the recurring payment space and, later on, with Square’s Cash App, as payment app Venmo was part of Braintree.

The acquisition will allow MoonPay to offer fintechs and other businesses the ability to accept and pay in stablecoins, enabling low-cost, borderless transactions at a time when stablecoins are handling $27 trillion in transfers annually. The move comes just one month after Stripe closed its own $1.1 billion acquisition of Iron’s competitor Bridge Network, signaling increasing competition in the stablecoin payments infrastructure space.

MoonPay, which boasts over 30 million accounts across 180 countries, has an impressive lineup of celebrity investors as previously featured in our celebrity fintech investor ranking, including Paris Hilton, Drake, Snoop Dogg, Ashton Kutcher, and Maria Sharapova. They might be onto something. Indeed, the Miami-based fintech reports being cash-flow positive, with net revenue increasing 112% in 2024 compared to the previous year.

Source: Global Fintech Insider & CNBC

🇸🇪 Klarna IPO Filing Reveals Stunning Turnaround From $244M Loss to $21M Profit

Swedish buy now, pay later pioneer Klarna has officially filed for an initial public offering on the New York Stock Exchange, where it will trade under the ticker "KLAR." The fintech company revealed in its filing that it has returned to profitability in 2024, reporting a net profit of $21 million, a significant turnaround from its $244 million loss the previous year. Revenues rose almost 24% to $2.81 billion. The IPO is expected to value Klarna at approximately $15 billion, positioning it for a major comeback after its valuation plummeted from $46 billion in 2021 to just $6.7 billion a year later. The Swedish fintech, founded in 2005 by current CEO Sebastian Siemiatkowski (pictured above), has selected Goldman Sachs, JPMorgan, and Morgan Stanley as joint book runners for the offering, which is expected to take place by April.

Source: Financial Times

🇦🇪 Binance Bags $2B From Abu Dhabi While CZ Denies Trump Family Deal

Binance, the world's largest cryptocurrency exchange by trading volume, has sold a minority stake to United Arab Emirates state-owned investment firm MGX for $2 billion. The deal, paid in an unnamed stablecoin, represents Binance's first-ever institutional investment and is reportedly the largest investment ever made in a crypto company. This major announcement comes as the Wall Street Journal reported that the Trump family was negotiating to invest in Binance US, a claim that founder Changpeng Zhao (CZ) firmly denied on X: "Sorry to disappoint. The WSJ article got the facts wrong... Fact: I have had no discussions of a Binance US deal with... well, anyone."

The investment comes during a favorable regulatory environment for crypto under President Trump, with Binance now led by Richard Teng (pictured above), a former Singapore Exchange regulator and ex-CEO of the Abu Dhabi Financial Services Authority. Teng took over after CZ stepped down in 2023 following a $4.3 billion settlement with U.S. authorities. After serving four months in prison for money laundering violations, CZ now takes an advisory role in Binance's venture capital arm, YZi Labs.

Source: Global Fintech Insider, Financial Times & Wall Street Journal

🇲🇽 Former Russian Bank Employee Leads Mexican Credit Cards Issuer Plata to $1.5B Valuation

Mexican digital bank Plata has reached unicorn status following a $160 million Series A equity round that values the company at $1.5 billion. Founded by Neri Tollardo, a former executive at Russian digital bank Tinkoff, in April 2023, the startup has already secured one million active credit card users and is responsible for approximately 10% of new issued cards in Mexico. The fintech, which received a banking license from Mexican regulators in December, has raised a total of $750 million in equity and debt since its inception, including a $200 million warehouse facility from London-based Fasanara Capital. "Mexico is experiencing a unique opportunity in financial innovation," Tollardo told Bloomberg News, noting that while 82% of Mexicans own smartphones, only 25% use digital banking services.

Source: Bloomberg

🇮🇱 Rapyd Acquires PayU for $610M to Form a Global Payment Giant with Over $1B in Revenue

Israeli fintech unicorn Rapyd has completed its acquisition of European payments provider PayU from Dutch investment firm Prosus for approximately $610 million. To finalize the deal, Rapyd raised $500 million, primarily in equity with a small debt component, at a $4.5 billion valuation down from the $10 billion valuation it achieved in 2021 but still representing one of the largest funding rounds in Israeli tech history. Founded in 2015 by CEO Arik Shtilman (left), Arkady Karpman (center) and Omer Priel (right), Rapyd's international payments platform can now execute transactions in over 100 countries using more than 1,200 payment methods following the acquisition. The deal, initially signed in August 2023, required approvals from seven different regulators worldwide and expands Rapyd's operations across Europe, the UK, South America, Asia, and the US, with planned operations in Israel coming in 2025. The combined entity now employs approximately 1,600 people and generates revenues exceeding $1 billion.

Source: CTECH

🇺🇸 Capital One Claims Due Diligence & Competing Offer From JPMorgan Saved Them From Fintech Con

Capital One's head of corporate development, Mason Young, testified in Charlie Javice's fraud trial that his bank withdrew its $125 million bid for student-finance startup Frank on the same day JPMorgan offered $175 million for the company. Young told the New York jury that Capital One initially pursued Frank to acquire "a large audience, primarily young adults" that they could eventually cross-sell banking services to. However, the bank abandoned the deal during due diligence, citing regulatory issues with Frank's marketing strategy, concerns about rebuilding Frank's technology, unproven cross-marketing value, and lower-than-projected revenue figures. The testimony supports prosecutors' claim that Javice had motive to inflate Frank's user numbers from fewer than 300,000 to over 4 million, as both banks were primarily interested in the startup's customer base.

Source: Bloomberg

🇦🇺 Australian Regulator Sues FIIG Securities After Russian Hackers Steal 18,000 Client Records

Australian financial regulator ASIC has filed a lawsuit against investment firm FIIG Securities over "systemic and prolonged" cyber security failures that led to a major data breach in 2023. The regulator alleges that from March 2019 to June 2023, the Australian bond dealer failed to implement adequate cyber risk management systems as required by its financial services license. This negligence reportedly allowed Russian ransomware gang ALPHV to breach FIIG's network and steal 385 gigabytes of sensitive data including scans of driver's licenses, passports, bank details, and tax file numbers. FIIG subsequently had to notify approximately 18,000 clients that their personal information may have been compromised. ASIC Chair Joe Longo (pictured above) emphasized that "cyber security isn't a set-and-forget matter" and that the case "should serve as a wake-up call to all companies on the dangers of neglecting your cyber security systems."

Source: CyberDaily.au

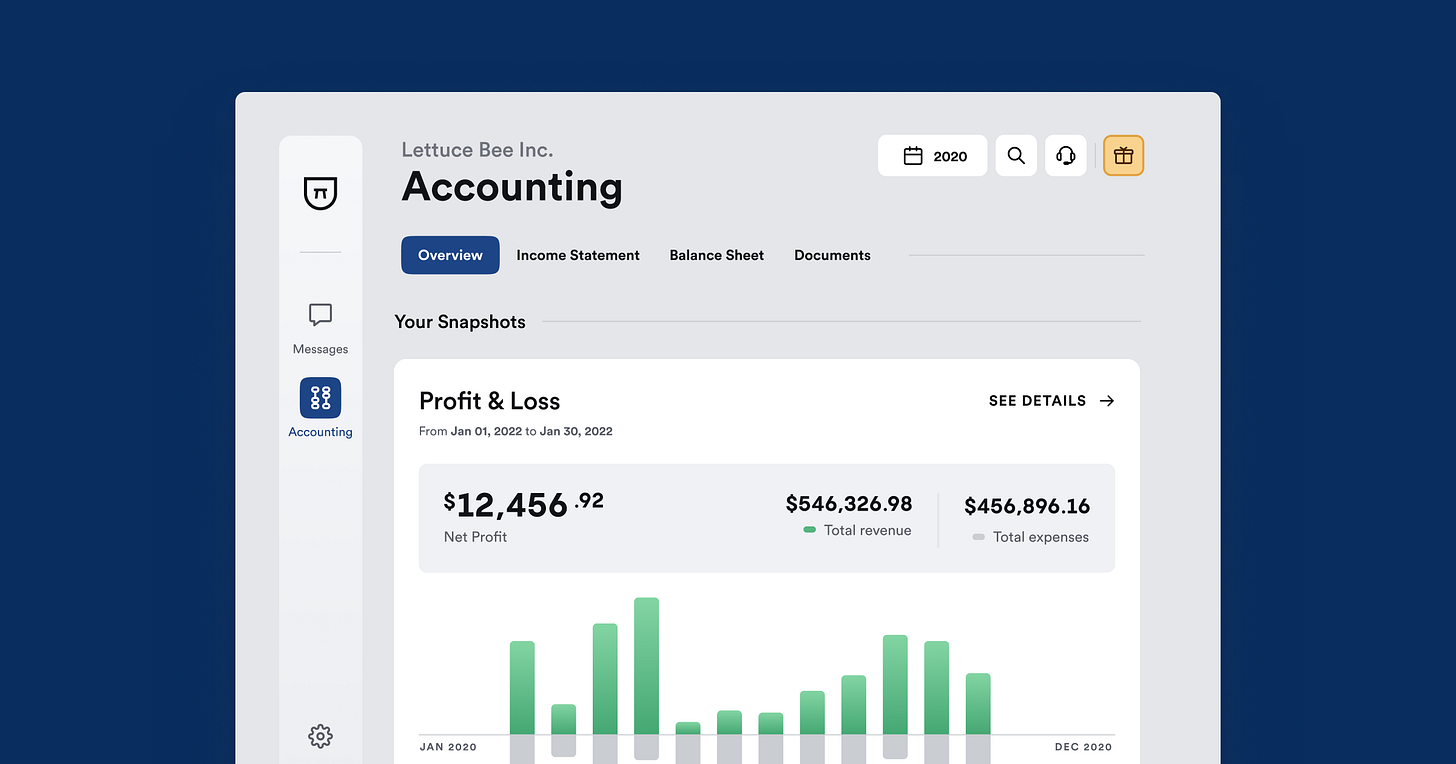

🇺🇸 Fintech CEO Sues After Being Forced to Pay Twice for Same Bench Services

Fintech entrepreneur Andrew Pietra, CEO of Outpay and Qorum, is alleging in a lawsuit that accounting platform Bench’s new owner, US-based Employer.com, is not honouring services he’s already purchased. The lawsuit filed last week alleges that Qorum was required pay again to receive its 2023 tax return despite public promises made by Employer.com CEO Jesse Tinsley to honour all services previously sold by the Canadian founded fintech. Interestingly, Jesse Tinsley announced last month that Bench was now profitable, which Tinsley told me on X was necessary given the structure of the deal : “We didn't take any loans, debt or working lines of credit to buy Bench so there was only one option for us and that is profitability.” Other customers reported similar experiences to TechCrunch, with one being told "Bench 2.0" has no affiliation with prior obligations. Employer.com's CMO Matt Charney denies these allegations. The controversy follows Employer.com's $9 million fire sale of Bench’s assets after the Canadian fintech abruptly shut down in December 2024.

Source: Global Fintech Insider & TechCrunch

🇺🇸 Hedge Fund Makes a $4 Billion Bet Against Remitly Over Fake Customer Reviews Claim

Hedge fund Spruce Point Capital Management has taken a $4 billion short position against remittance provider Remitly, causing the stock to fall over 2% this week. In a scathing report, the activist short seller claims a reverse image search revealed that Remitly's customer testimonials featured stock photos rather than actual customers. Spruce Point also accused the fintech of manipulating review ratings on its website and raised concerns about high turnover in the company's legal, compliance, and risk functions, with eight executives in those areas reportedly departing since July 2024. The allegations come despite Remitly's strong financial performance, with revenues growing 34% to $1.26 billion last year, achieving profitability in Q3, and growing its active customer base to 7.8 million. The hedge fund also criticized Remitly for allowing co-founder Josh Hug (left, picture above), who recently announced his departure as Vice Chair, to pledge 2 million shares as collateral for a personal line of credit, calling it "poor governance."

Source: Fortune

🇦🇷 Brazilian Super App Inter Brings US Stocks and ETFs to Argentinian Investors

Brazilian digital bank Inter is continuing its international expansion by launching operations in Argentina through a strategic partnership with the BIND Group, allowing Inter to offer services without obtaining its own banking license in the country. Its initial offering will be a global investment account, enabling Argentinians to invest in stocks and ETFs traded on the NYSE and Nasdaq, with future plans to expand to payments, money transfers and cashback. This move follows Inter's first international expansion in 2021, when it acquired US fintech Usend. Founded in 1994 by Brazilian real estate billionaire Rubens Menin (left, picture above) as a traditional bank, Inter transformed into a digital bank by 2015 and, as of today, has grown to over 36 million clients under CEO Alexandre Riccio (right, pictured above) and Global CEO João Vitor Menin (second from the right, picture above). This Argentina expansion puts Inter in direct competition with other Brazilian digital banks making Latin American moves, including Nubank, which already operates in Mexico and Colombia, and Mercado Pago, which operates in seven Latin American countries.

Source: Finsiders Brasil

🇮🇳 Zolve Raises $251M to Provide Bank Accounts to Newcomers in US, Canada, UK and Australia

Bangalore-headquartered neobank Zolve has secured $251 million in a combined equity and debt funding round to accelerate its expansion across major English-speaking markets. The round includes $51 million in equity led by Creaegis, with participation from HSBC, DG Daiwa, Accel, Lightspeed Venture Partners and DST Global. The remaining $200 million comes as debt financing to acquire loan books from partner banks. Founded in 2021, Zolve helps newcomers to the U.S. access credit cards and banking services on day one by leveraging their home country credit data, addressing a significant pain point for high-skilled immigrants. "Financial institutions in one country don't talk to financial institutions in another country because sufficiently low-risk individuals end up being treated as high-risk. That's the problem we are trying to solve," said Raghunandan G (pictured above), CEO of Zolve. The fintech has already amassed 750,000 customers and processed over $1.2 billion in transactions, generating $25 million in net revenue last year. With the fresh capital, Zolve plans to expand its lending products and enter Canada by mid-2025, followed by the UK and Australia.

Source: TechCrunch & Global Fintech Insider

🇬🇧 Apple Pay Rival Curve Bags $48M In Fresh Capital After Halving Its Losses

London-based fintech Curve has raised £37 million (48M USD) in a new funding round led by Hanaco Ventures, along with participation from existing investors Fuel Ventures, IDC, Outward VC, and Lord Stanley Fink. The all-in-one payment platform, founded in 2015 by Israeli entrepreneur and current CEO Shachar Bialick (pictured above), also announced it had cut its pre-tax losses from £69.1 million (90 million USD) to £36 million (47 million USD) in 2023, a 48% improvement year-over-year, while growing revenue to £26.7 million (35 million USD). Curve, which allows customers to link multiple cards to one app and has amassed over 5.5 million users across 30+ markets. The company is developing Curve Pay as a rival to Apple Pay, which it claims could save banks "millions of euros" in transaction fees. Despite its progress, Curve has paused US operations in July 2024 to focus on reaching profitability.

Upcoming Fintech Events

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

🇩🇪 FIBE Fintech Berlin will be held in Berlin on April 9-10, 2025 (1,204 USD), with speakers such as Dan Schulman, former CEO of PayPal & Hélène Falchier, partner at Portage Ventures.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & Co-Founder of Zero Hash.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

I’m now product manager for Beeye, an AccountingTech SaaS.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.