Fintech CEOs Are Getting Frustrated About the Open Banking Push Back in Canada 🇨🇦

We're also covering Elon Musk's most recent fintech setback 🇺🇸, Nubank's telecom ambitions in Latin America, Moniepoint becoming a unicorn 🇳🇬, Slice buying an actual bank 🇮🇳 & more.

🇨🇦 Borrowell CEO Andrew Graham Is Getting Frustrated About the Open Banking Push Back in Canada

Borrowell CEO Andrew Graham recently wrote a strongly worded Linkedin post about open banking in Canada, reacting to an industry mouthpiece who wrote an op-ed in the Globe & Mail against open banking following the unveiling of the open banking rules in the US : “This week is Halloween. 🎃 Maybe that's why we have a Globe op-ed digging up a zombie idea: that somehow open banking may lead to bank failures. Scary!”

The Globe’s op-ed was penned by historian John Turley-Ewart, who is transparent about the fact that RBC, one of Canada’s largest banks, is a client. Strangely, the unique argument against open banking in his piece is that there have not been any bank failures in Canada since 1985.

Andrew Graham, who launched Canada’s first credit monitoring app Borrowell, has been a vocal advocate of open banking in Canada since launching a credit improvement product that relies on bank connections to report rent payments to credit bureaus. In a previous interview, he reported that the connection failure rate (using an account aggregation provider) was 75% and that open banking was necessary to ensure that Canadian fintechs remain competitive.

While Canadian politicians have announced multiple times the implementation of open banking in the country, the rules have yet to be published and Andrew Graham is far from the only fintech CEO in Canada getting impatient. Last April, open banking was renamed “consumer-driven banking” in the federal budget, and it was announced that the Financial Consumer Agency of Canada (FCAC) would oversee its implementation. Yet, no timeline for implementation nor rules were unveiled.

Sources: Global Fintech Insider

🇺🇸 X Withdrew Its Application for a New York Money Transmitter License Back In April

Elon Musk’s ambition of turning its social network into the vision he had for his neobank X.com before its 2000 merger with PayPal, appears to be facing significant setbacks. Despite earlier promises that X Payments would launch in 2024, delays persist, notably tied to regulatory challenges in New York. According to Ars Technica, X discreetly withdrew its application for a New York money transmitter license in April 2024. In theory, X Payments could launch in the 38 states where it obtained a money transmitter license, but it would mean that users would not be able to send money to residents of the 12 states in which X don’t have a license, including New York. Given that Venmo and PayPal don’t face such a restriction, it seems unlikely X payments will launch anytime soon. Or maybe it will launch at the same time as Tesla’s self driving taxis and the hyperloop :)

Source: Ars Technica & Global Fintech Insider

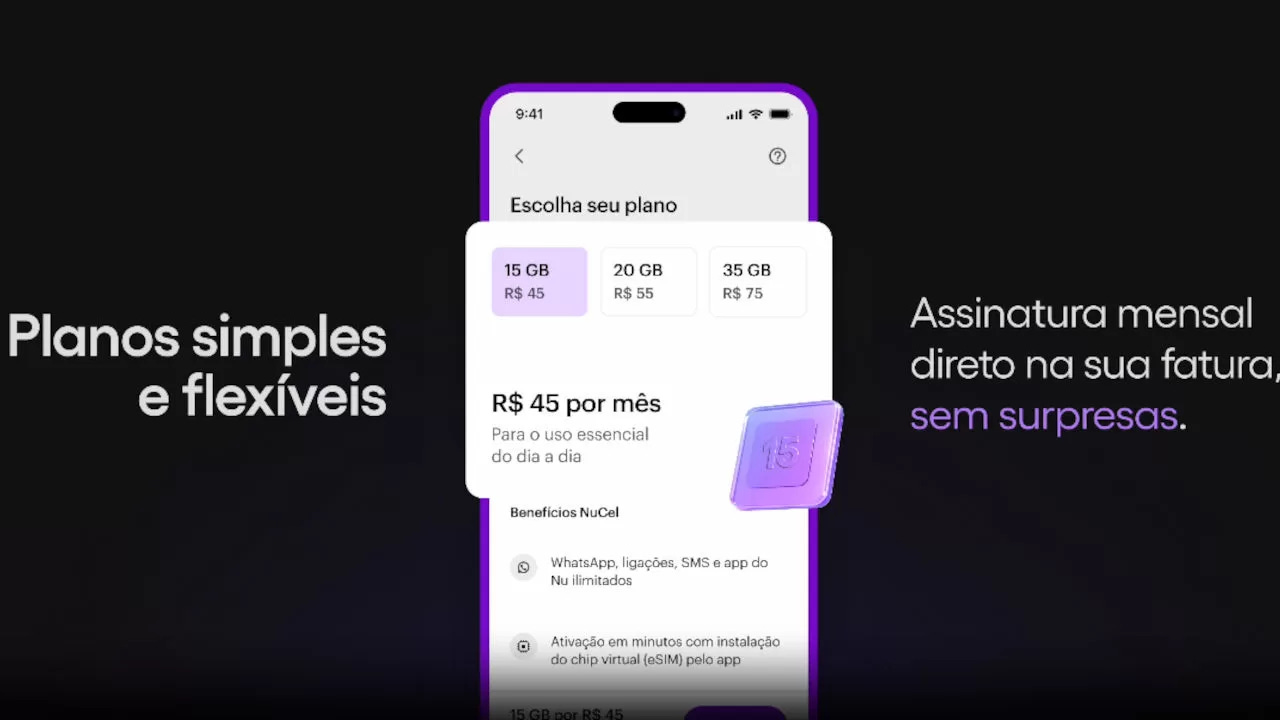

🇧🇷 Brazilian Neobank Nubank Launches NuCel to Disrupt Brazil’s Mobile Market

Brazilian fintech giant Nubank has launched its own mobile virtual network operator (MVNO) called NuCel, partnering with Claro to serve its 95 million clients in Brazil with mobile services. Nubank foray into mobile services is not unique and is part of a larger trend of neobank leveraging eSim technology, which allows consumers to switch operators (or simply use a different operator while abroad) without the need for an additional SIM card. Other neobanks such as London-based Revolut, Amsterdam-based bunq and Indian-American Zolve have launched an eSim product in 2024, but their offering is focused on mobile data abroad. Nubank’s MVNO, currently using eSIM technology, is more ambitious. NuCel's plans, starting at 45 Brazilian real ($7.80) per month, include mobile data at home and abroad, with unlimited access to WhatsApp and Nubank’s banking app. With plans for regional expansion, including Mexico and Argentina, Nubank’s foray into telecommunications could disrupt traditional telcos in Latin America.

Source: TeleSemana & Global Fintech Insider

🇳🇬 Moniepoint Joins the Exclusive Club of African Fintech Unicorns

Nigeria-based Moniepoint, a fintech company offering banking services, loans, and point-of-sale terminals for small merchants, has achieved unicorn status after securing $110 million in new funding, bringing its valuation to $1 billion, according to the Financial Times. Moniepoint’s CEO, Tosin Eniolorunda, plans to use this funding to expand beyond Nigeria into other African nations with similar needs for digital financial services. “The opportunities that exist in Nigeria also exist in multiple countries,” the fintech CEO told the Financial Times.

Source: Financial Times

🇮🇳 Indian Fintech Slice Finalizes Merger with North East Small Finance Bank

Slice, an Indian fintech known for its innovative credit card-like products, has successfully merged with North East Small Finance Bank. The merger, initially proposed last year and finalized after extensive regulatory review, allows Slice to become a bank. With this move, Slice plans to introduce traditional banking products, including savings and investment accounts. This merger is particularly notable given the difficulties startups face in obtaining banking licenses in India, as the central bank has been cautious due to past banking failures. Slice’s merger provides it with direct control over its lending operations and access to capital at lower costs.

Source: TechCrunch

🇺🇸 Sunbit Secures $355 Million to Scale Its BNPL Loans Designed For Mom-and-Pop Shops

Los Angeles-based BNPL lender Sunbit raised $355 million in debt financing. The company, which is expected to reach profitability this year, differentiates itself from the likes of Affirm and Klarna by targeting brick-and-mortar mom-and-pop shops such as car dealerships, dentist offices, and eyewear shops. Sunbit charges merchants an average fee of 8% to 9% for each loan, significantly higher than competitors like Affirm and Klarna, whose merchant fee typically varies between 2% and 8%, the lower range being typically only available to large retailers.

Source: Forbes & Global Fintech Insider

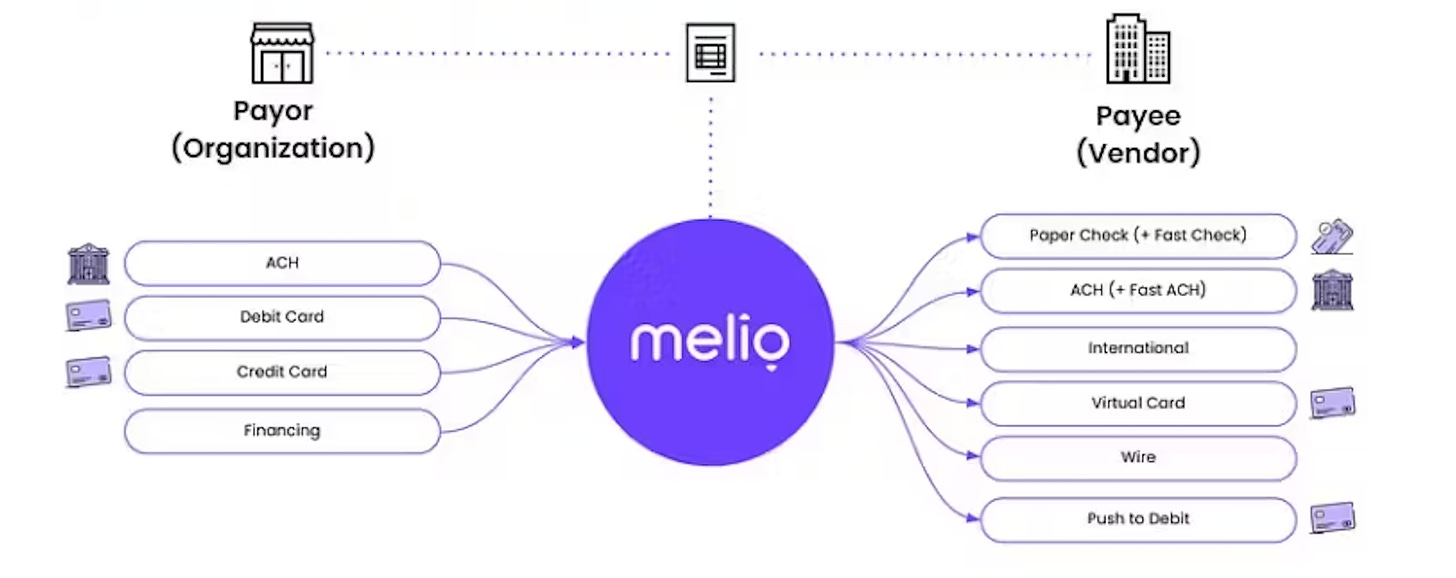

🇮🇱 Israeli Fintech Melio Achieves $2B Valuation By Helping SMBs Accept Various Payment Methods

Israeli fintech Melio, a B2B payments provider for small and medium-sized businesses (SMBs), has secured $150 million in new funding, bringing its valuation to $2 billion. Melio’s platform allows SMBs to handle accounts payable and receivable seamlessly, offering payment flexibility with options like ACH bank transfers and credit card payments. Integrated with popular accounting softwares such as QuickBooks, Melio enables businesses to keep their finances in sync. In partnership with payments giant Fiserv, which led the funding round, Melio's capabilities are now integrated into Clover point-of-sale systems.

Source: Silicon Angle

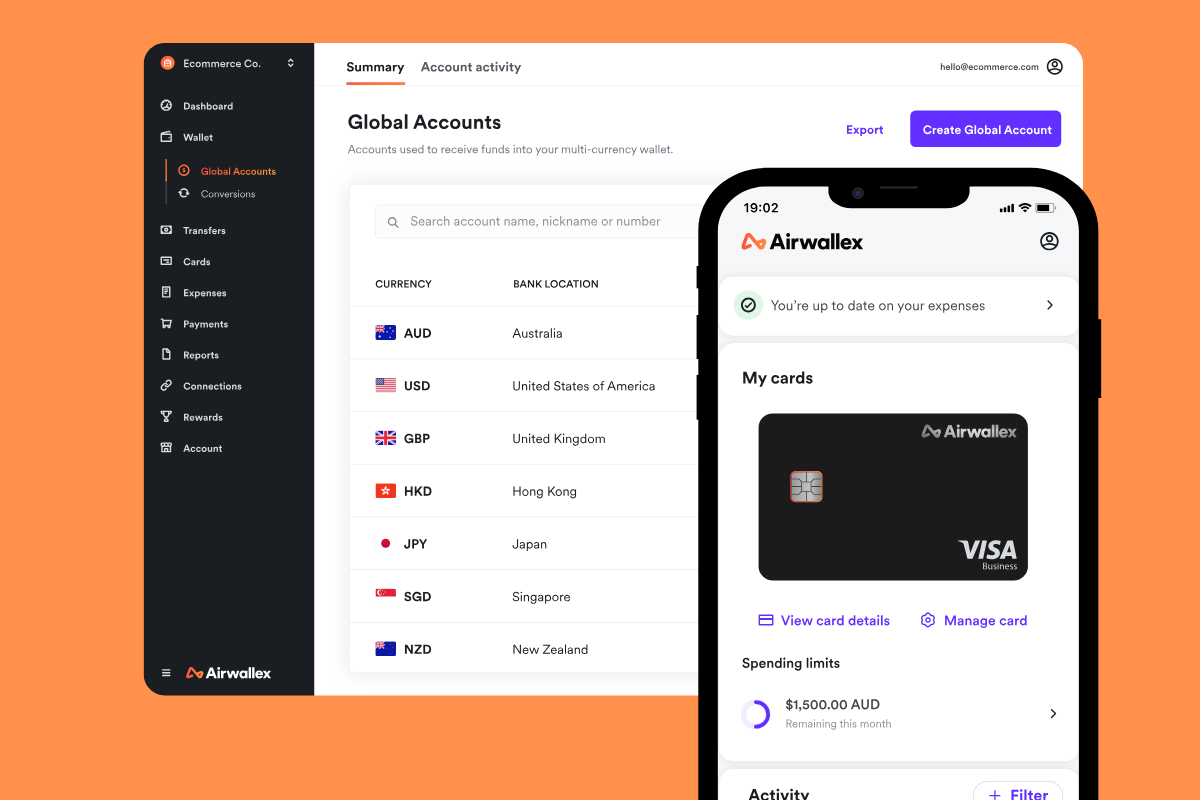

🇸🇬 Global Neobank for Startups Airwallex Eyes $6B Valuation After Reaching $500M Revenue

Tencent-backed fintech Airwallex is in discussions to raise approximately $200 million at a $6 billion valuation, according to Bloomberg. The Singapore-based firm, originally founded in Australia in 2015, surpassed $500 million in annual revenue as of August and supports over 100,000 businesses with its multi-currency accounts associated with Visa debit cards. With recent investments in AI to enhance customer onboarding and support, Airwallex has expanded into North America, Europe, and Asia, operating with a team of over 1,600 employees across 23 offices. The company, which previously raised $100 million in 2022, is positioning itself for a potential IPO by 2026.

Source: Bloomberg

Upcoming Fintech Events

🇸🇬 The Singapore Fintech Festival will take place Nov. 6th to 8th, with speakers such as Kfir Godrich, Chief Innovation Officer at BlackRock and Richard Teng, CEO of Binance.

🇿🇦 The Africa Tech Festival will be held in Cape Town November 12-14 ($1,749), with speakers such as Kagiso Mothibi, CEO of MTN Fintech and Christian Kajeneri, director, payment systems at the National Bank of Rwanda.

🌐 The OpenFinity 2024 Expo will take place online on November 20-21 (free), with speakers such as Jane Barratt, Chief Advocacy Officer at MX and Roy Kao, board member at Open Finance Network Canada.

🇬🇧 Fintech Connect will be held in London on December 4-5 ($325), with speakers such as Zahra Gill, Financial Crime Strategy Lead at Starling Bank (!!!) and Anirudh Narla, Head of Product - Global Payments, Anti-Fraud & Wallet at Hopper.

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 ($632.50), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@protonmail.com