European Central Bank Boss Says Europe Need To Move Away From Visa, Mastercard & PayPal 🇪🇺

We're also covering Coinbase's CEO global political ambitions 🇺🇸, Stripe's "vibe coding" play 🇮🇪, Robinhood & Revolut's rivalry 🇱🇹, a "fake AI" scandal 🇺🇸 & Monzo's new CFO IPO comment 🇬🇧.

Thanks to you guys, I’m now sending this humble newsletter to no less than 2,600 fintech pros! If you value this free newsletter, it would mean the world to me if you could help me reach my 10,000 subscribers target for 2025 by sharing this email with your friends & colleagues!

🇪🇺 European Central Bank Boss Says Europe Need To Move Away From Visa, Mastercard & PayPal

Donald Trump’s trade war is not only threatening the hegemony of the US dollar as a reserve currency. It could also marginalize US payment infrastructures abroad. Interviewed on the The Pat Kenny Show, European Central Bank President Christine Lagarde advocated for Europe to stop relying on US payment networks: "Whether you use a card or a phone, typically it goes through Visa, Mastercard, PayPal, Alipay. Where are all those coming from? Either the US or China. The whole infrastructure mechanism that allows for payments is not a European solution."

Wero is the continent's obvious answer to Christine Lagarde’s call for european payment independence. Created by the European Payments Initiative (EPI), it debuted in Germany in July 2024, followed by France and Belgium, with the Netherlands scheduled for 2025. Backed by 16 major banks and two acquirers, the system aims to create seamless person-to-person, online, and in-store payments across Europe by the decade's end. However, it has not achieved consensus, as many European countries including Spain and Poland withdrew from Wero before it even launched. Nevertheless, Trump's tariffs could catalyze European cooperation on payment infrastructure and increase Wero’s odds of success.

Wero offers two main approaches to challenge American payment networks. First, it enables rapid account-to-account transfers between European bank accounts like Zelle in the US or Interac in Canada. Second, it's developing a QR code payment system that will allow merchants to accept payments without card networks. The strategy mirrors China's successful model, where applications like AliPay and WeChatPay have made QR code payments the norm.

National payment systems across Europe provide additional models for payment sovereignty. Several countries maintain their own domestic card schemes. France's Cartes Bancaires serves 77 million cards, Germany's Girocard has 100 million issued cards, and Italy's Bancomat counts 30 million cards. While widely accepted in local stores and ATMs, these national solutions typically don't work online or across borders without being co-branded with Visa or Mastercard.

Poland took a different approach with BLIK, which launched in 2019 and now has 3.6 million users. Instead of physical cards, BLIK works through banking apps that generate authorization codes for online, in-store, and ATM transactions. Poland's BLIK CEO Dariusz Mazurkiewicz stated last week in a Linkedin post that such "local innovation, rooted in the banking sector and scaled successfully, can already serve as a blueprint for a pan-European infrastructure."

Another model comes from Brazil's Pix payment network, which enjoys a 56% adoption rate in its home market and launched in Portugal in January 2025. Pix works with QR codes and passkeys, allowing for in-store and online transactions, money transfers between users and, soon, even Buy Now Pay Later purchases.

Source: Global Fintech Insider

🇺🇸 Coinbase CEO Brian Armstrong Wants To Get Pro-Crypto Candidates Elected In UK, Canada & Australia

Coinbase CEO Brian Armstrong announced on X that the company's political action initiative, Stand With Crypto, has expanded beyond the US to include the United Kingdom, Australia, and Canada. "We're going to get pro-crypto candidates and legislation everywhere around the world because crypto holders are a massive voting block," Armstrong stated in a recent social media post. The advocacy group, which originally launched in the US in August 2023, aims to mobilize cryptocurrency supporters to influence legislation favorable to the industry. It reported impressive results in the 2024 US election, with over 280 pro-crypto candidates winning seats.

Brian Armstrong’s playbook to influence elections is not limited to mobilize crypto-enthousiasts. According to the New York Times, Coinbase, alongside Ripple and venture capital firm Andreessen Horowitz, funded super PACs that spent over $130 million in the 2024 US elections, helping pro-crypto candidates win 53 of the 58 targeted races. Coinbase’s involvement in the US election is already yielding results, with supported lawmakers advancing industry-friendly legislation like the GENIUS Act for stablecoins and repealing crypto tax reporting requirements.

Source: Global Fintech Insider

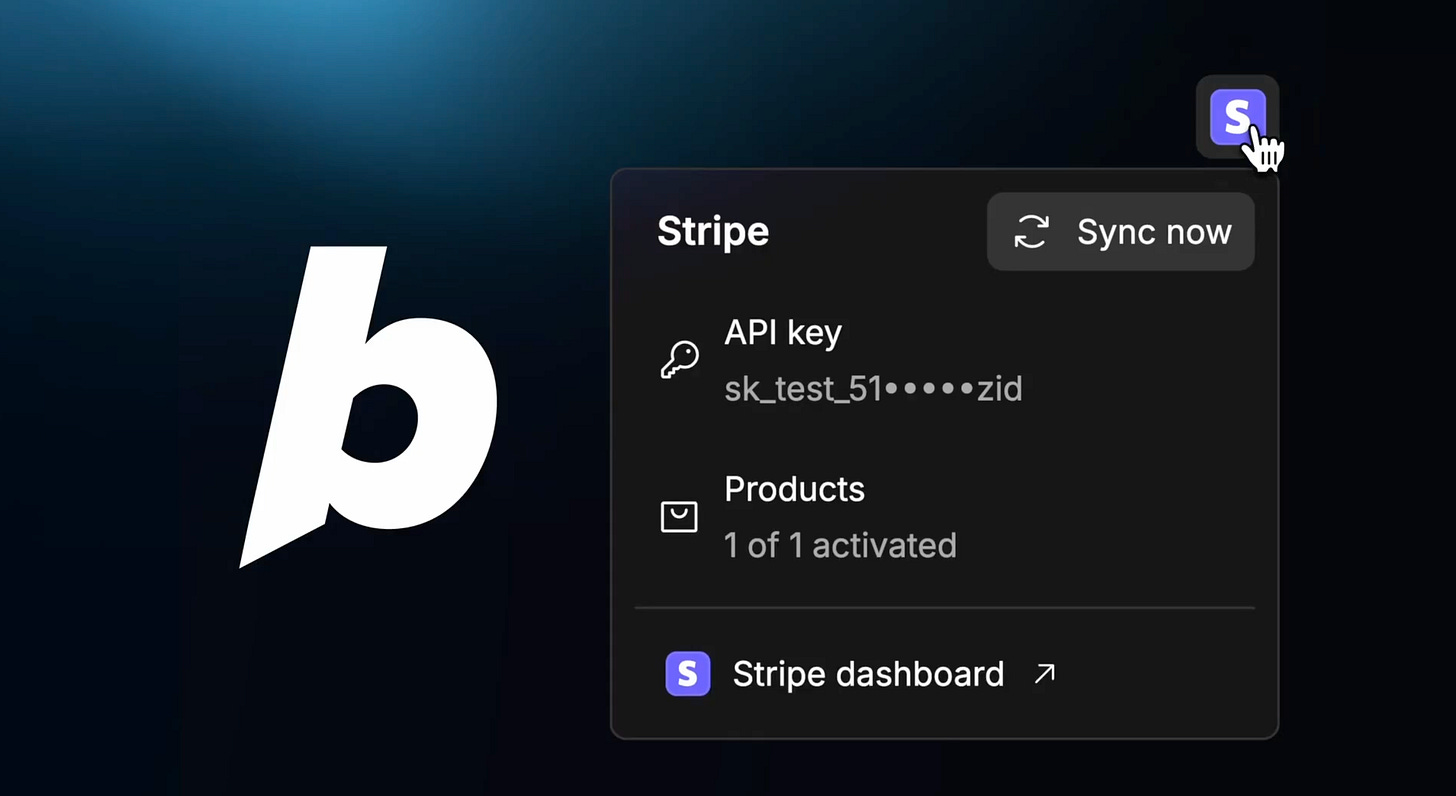

🇮🇪 Stripe Positions Itself As Default Payment Provider For "Vibe Coding" Platforms

Stripe is extending its developer-first approach to the emerging world of "vibe coding," the trend of building applications using AI. The payment processing giant, valued at $95 billion, has secured native integrations with multiple platforms enabling this new development approach. "Vibe coding brings app development to non-technical people, and this next generation of builders will likely be offering payments though Stripe," noted Alexander Schilling, Account Executive at Stripe, in a recent LinkedIn post. The strategy mirrors Stripe's original growth playbook: become the default payment option by being the easiest to implement. Recent integrations include Google's Firebase Studio, which offers Stripe as its default payment extension, Databutton with pre-built Stripe templates, Bolt's newly launched native Stripe integration for building subscription businesses, and Lovable's implementation of Stripe Payment Links. This positioning appears strategic as AI democratizes application development, with Stripe ensuring that just as it captured developers with its famous "seven lines of code" integration, it now aims to be the automatic choice for the growing community of non-technical builders.

Source: Global Fintech Insider

🇱🇹 Robinhood Enters European Market as Revolut Adds UK Stocks Trading

US fintech giant Robinhood has secured an A-category brokerage license from Lithuania's central bank, marking a critical step toward its continental European expansion. While the official launch date remains unknown, this license from an EU member state will allow Robinhood to offer stock trading throughout the European Union, following its UK launch in 2024. Meanwhile, British neobank Revolut, who has over 800,000 trading customers in the UK, is expanding its trading platform by adding UK stocks, building on its existing offerings of US and European equities. "We are including U.K. stocks in our offering as we've seen interest from our U.K. customers to get exposure to the local economy and diversify their portfolio further," said Yana Shkrebenkova, Revolut's CEO of wealth and trading UK. This intensifies the rivalry between the two fintechs in Europe, where more than half of Revolut's 50 million clients are located.

Source: Bloomberg & Baltic News

🇺🇸 Nate Founder Faces Fraud Charges For Calling Filipino Workers AI Technology

Albert Saniger, founder of Nate, a fintech that marketed itself as an AI-powered universal checkout solution for online shopping, has been charged with investor fraud by the U.S. Department of Justice. While Nate claimed its app used AI to enable one-click purchases across any e-commerce site without manual data entry for $1 per transaction, the DOJ alleges the service actually relied on hundreds of human contractors in the Philippines manually completing those purchases, with an automation rate of effectively 0%. Despite raising over $50 million from prominent investors like Coatue and Forerunner Ventures, this AI washing mirrors other prominent cases, including Amazon's Just Walk Out technology which employed over 1,000 contractors in India who manually watched video footage and logged items shoppers took from shelves.

Source: Global Fintech Insider & TechCrunch

🇹🇷 Nik Storonsky Backed Stripe Competitor Sipay Raises $78M At $875M Valuation

Turkish fintech powerhouse Sipay announced it raised $78 million in a Series B funding round led by Elephant VC, with participation from QuantumLight, the venture capital firm founded by Revolut CEO Nik Storonsky. This investment values Sipay at $875 million, bringing it closer to unicorn status. Unlike traditional payment processors, Sipay offers a comprehensive solution that combines online payment processing similar to Stripe with business banking accounts and point-of-sale capabilities, allowing merchants to manage their entire financial operations through a single platform. "We have achieved a 5x year-over-year revenue increase, ending the year with a $600 million revenue run-rate, making Sipay Turkey's most valuable and Europe's fastest growing fintech," said founder and CEO Nezih Sipahioglu in a LinkedIn post. Founded in 2019, the company has expanded to serve 6.3 million wallet users and 25,000 merchants, processing $7.4 billion in transaction volume. Sipay plans to use the funding to accelerate international expansion and advance its embedded finance technologies.

Source: Global Fintech Insider & Daily Sabah

🇺🇸 Ripple’s $1.25B Bet on Hidden Road Aims to Catapult Its Stablecoin Into Top 5

Ripple is buying Hidden Road, a prime brokerage dedicated to serving institutional investors, for $1.25 billion. Founded in 2018 by former Point72 executive Marc Asch, Hidden Road will integrate Ripple's RLUSD stablecoin as collateral across its services and migrate its post-trade operations to the XRP Ledger blockchain. The deal, expected to close in Q3 2025, represents a major strategic move to boost Ripple's stablecoin position, with CEO Brad Garlinghouse (pictured above) expecting the company’s stablecoin, RLUSD, to become one of the top-five stablecoins by year-end, up from its current ranking as the 12th largest with a market value just under $300 million.

Source : Bloomberg

🇬🇧 Revolut to Launch Rewards Credit Cards in Its Quest to Go Upmarket

Revolut is in the early stages of developing points-based credit cards that would leverage its RevPoints loyalty system launched in July last year. The new premium card will allow the British neobank to compete directly with established players like American Express and Barclaycard in the UK. This initiative aligns with Revolut's upmarket strategy, which includes the development of a private banking service for high-net-worth individuals featuring investment services and wealth management. Revolut already launched a premium subscription called Revolut Ultra in 2023, costing £45/month and offering perks they claim are worth €5,000 per year, including unlimited airport lounge access and monthly global data. So far, Revolut has only offered debit cards, meaning a shift to credit cards could unlock a new market in the upscale segment. Revolut's RevPoints system currently allows users to purchase gift cards from brands like Apple and Amazon, and offers 1:1 exchanges with popular airline miles programs.

Source: Sifted & Global Fintech Insider

🇮🇳 Super App CRED Eyes $4B Valuation In New Funding Round Despite Previous $6.4B Peak

Indian fintech unicorn CRED is looking to raise fresh capital at a significantly reduced valuation of 4 billion dollars. This round, in which the fintech is looking to raise between $100 and 200 million, represents a steep $2.4 billion haircut from its previous $6.4 billion valuation set during its $140 million Series F in 2022. CRED was founded by Kunal Shah (pictured above) in 2017 as a credit card bill payments platform, but has since then turned into a super app offering UPI payments, utility billing, vehicle management, travel experiences, and wealth management since it acquired Kuvera in 2024. The company is reportedly eyeing profitability and planning an IPO within the next two years, joining other Indian fintechs like Groww, PhonePe, and BharatPe in their public market ambitions. The fintech is in discussions with existing investors including Singapore's GIC, Peak XV Partners, Tiger Global, Ribbit Capital, and QED Innovation Labs.

Source: Inc42

🇫🇷 Pennylane Raises $85M At $2.3B Valuation To Meet Electronic Invoicing Deadline

French accounting fintech Pennylane has raised €75 million (85 million USD) from Meritech Capital Partners and CapitalG (Google's fund), alongside existing investors Sequoia Capital and DST. The startup, which provides both accounting production software for accountants and financial management tools for their clients, has doubled its valuation to €2 billion (2.3 billion USD) just one year after achieving unicorn status. CEO Arthur Waller (pictured above) emphasized that the founding team maintained control of the company's governance, noting that "we want to show accountants that we're here for the long term." Pennylane has grown significantly, now working with 4,000 accounting firms (up from 2,000 in early 2024) and 350,000 businesses (up from 140,000), with annual recurring revenue reaching €60 million (68 million USD) compared to €20 million (22.7 million USD) a year ago. The company is heavily investing in preparing for France's upcoming electronic invoicing reform, which will require all businesses to receive digital invoices by September 2026

Source: Les Échos

🇺🇸 Yellow Card CEO Says SWIFT Will Be Dead In Africa Within 10 Years

Yellow Card CEO Chris Maurice (pictured above) says SWIFT’s days are numbered in Africa. “As we look out five years, SWIFT is in trouble. In ten, no one will be making international wires again,” he told BeInCrypto. His view is backed by usage trends at Yellow Card, a crypto exchange based in Atlanta that operates in over 20 African countries, where stablecoins now account for more than 99% of transactions, with Tether (USDT) as the most popular asset. “When we first launched in 2019, people were exclusively buying Bitcoin. Now, the most popular asset is Tether,” Maurice said. In Africa, where remittance account for $48 billion annually, stablecoins are a practical tool, used for both remittances and inflation avoidance. Yellow Card has built infrastructure that connects with mobile money systems like M-Pesa and local currencies while managing compliance, FX, and settlement internally. Backed by $85 million in venture funding, the company is positioning itself to replace traditional rails and become the primary financial relationship for its users.

Sources: BeInCrypto

🇬🇧 Ex-Nubank Executive Turned Monzo CFO Says the Neobank Will Be A Great Public Company

Monzo's new chief financial officer is bringing IPO expertise to the UK challenger bank. Tom Oldham, who joined Monzo as CFO in February after leading financial planning at Brazilian neobank Nubank where he took part into its $52 billion IPO, has hinted at his new employer's public market ambitions. "We'll make a great public company one day but it's still far too early to talk about the specifics," Oldham told Sifted. The fintech, known for its coral pink cards and 10 million-strong customer base, raised over $600 million last year led by Google's CapitalG, bringing its valuation to $5.9 billion. While this significantly trails rivals like Revolut ($48 billion) and Klarna ($15 billion), Oldham sees growth opportunities as Monzo prepares to expand beyond the UK and US into Ireland as a gateway to wider EU operations. "Our platform can serve 100 million customers as brilliantly as we serve 1 million," he said, drawing parallels to his experience at Nubank where he witnessed growth from "single digit millions of customers" to over 80 million across three countries.

Source: Sifted

🇨🇦 Zūm Rails CEO Says Canada Is Not The Place To Build A Fintech Unicorn After Moving To Miami

Miles Schwartz, formerly Chief Sales Officer at Canadian open banking API provider Flinks, has relocated from Montreal to Miami to spearhead Zūm Rails' US expansion. The Canadian fintech he co-founded with Marc Milewski in 2020, allows US and Canadian businesses to process various payment methods through a single API. It has grown from a kitchen table startup in Montreal to a company with over 75 employees, after raising a 10.5 million CAD ($7.8 million USD) Series A from Arthur Ventures. "If you're trying to build a billion-dollar or 10-billion-dollar business, Canada's probably not the best place," Schwartz told Business Insider. “The fintech scene in Montreal wasn't as lively and none of our clients were based there”, he added. In a LinkedIn post, Schwartz revealed Zūm is evolving beyond payments processing to offer prepaid card issuance with direct deposit accounts, and banking integrations across North America.

Source: Business Insider & Global Fintech Insider

🇺🇸 Female Founders Raise $10.4M To Fuel The Growth of Their Investing App For Gen Z Women

Alinea Invest, a robo-advisor for Gen Z women, has secured $10.4 million in Series A funding. Co-founded by Anam Lakhani (left) and Eve Halimi (right), who previously worked at Goldman Sachs and Citi, Alinea has built a user base of over 1 million investors since launching in 2021, with 92% being women and 70% Gen Z. "We are the customer," explains Lakhani. "From day one, we were designing for ourselves and our friends." The company has achieved 6X year-over-year revenue growth in 2024, reaching a $6 million net revenue run rate with a team of just 10. Alinea’s dont charge a management fee, but an annual membership that costs $120 and provides access to automated investing, educational resources, and a community. The new funding will support the rollout of AI Allie, an AI-powered financial coach designed as a "money best friend". The round was led by Play Ventures, with participation from GFR Fund, Y Combinator, Gaingels, FoundersX, F7, and Visible Ventures.

Source: Forbes

🇺🇸 BaaS Provider Solid Files For Bankruptcy After Raising $81M And Suing Its Own Investors

Banking-as-a-Service (BaaS) provider Solid filed for Chapter 11 bankruptcy protection on April 7 in Delaware. Co-founded in 2018 by current CEO Arjun Thyagarajan (pictured above) under the name Wise, Solid had raised nearly $81 million and achieved a $330 million valuation after its $63 million Series B led by FTV Capital in August 2022. The company, which provided banking, payments, cards, and cryptocurrency products via APIs, is now down to just three employees. The bankruptcy follows a bitter legal battle with investor FTV Capital, which sued in 2023 to reclaim its $61 million investment, alleging the founders "lied to FTV concerning the company's revenues, customer churn, and business generally." Solid's co-founders filed a countersuit, accusing FTV of using "made-up claims of fraud, threats and strong-armed tactics to try to get its money back." A settlement reached by the parties in April 2024. Notably, Solid is the second BaaS platform using Evolve Bank & Trust to file for bankruptcy in a year, following Synapse's Chapter 11 filing and its aborted $9.7 million fire sale to TabaPay last year.

Sources: Jason Mikula & TechCrunch

🇨🇦 Wealthsimple Acqui-Hires San-Franciso Couples Finance Startup Plenty

Canadian robo-advisor Wealthsimple has acquihired Plenty, a San Francisco-based fintech specializing in financial management for couples. Co-founded by married couple Emily Luk and Channing Allen, Plenty raised approximately $7.75 million USD before getting acquired for an undisclosed amount. The three-year-old startup built tools that allowed couples to manage joint and private accounts side-by-side, with features designed to handle complex scenarios like breakups and new partnerships. All five Plenty team members will join Wealthsimple remotely from the US at the end of April, with Luk joining the product team while Allen and three software developers join the engineering team. In the farewell message posted on their website, Plenty's founders expressed conflicting emotions about shutting down their original vision: "As excited as we are, it's bittersweet. It means saying goodbye, for now, to the thousands of couples who are currently using Plenty." The platform will shut down on May 10, as Wealthsimple plans to leverage the team's expertise to enhance its family-focused offerings like joint accounts, spousal RRSP, and RESP accounts.

Source: BetaKit & Global Fintech Insider

Upcoming Fintech Events

🇹🇭 Money20/20 Asia will be held in Bangkok on April 22-24, 2025 (3,195 USD), with speakers such as Lucy Liu, co-founder & president of Airwallex & Martha Sazon, CEO of GCash.

🇬🇧 The Innovate Finance Global Summit will be held in London on April 29, 2025 (450 USD), with speakers such as Justin Basini, co-founder & CEO of ClearScore & Diana Avila, Global Head of Banking and Expansion at Wise.

🇨🇦 The AI Agent Montreal meetup will be held in Montreal on May 1, from 6:00 PM to 8:00 PM, with speakers such as Deck co-founder and president Frédérick Lavoie.

🇺🇸 FinovateSpring will be held in San Diego on May 7-9, 2025 (1,299 USD), with speakers such as Vishal Garg, founder & CEO at Better.com & Lauren McCollom, Head of Embedded Finance at Grasshopper Bank.

🇦🇪 Dubai FinTech Summit will take place in Dubai on May 12-13, 2025 (899 USD), with speakers such as Arik Shtilman, co-founder and CEO of Rapyd & John Caplan, CEO of Payoneer.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & co-founder of Zero Hash.

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, YouTube, TikTok, Instagram & X.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.