Donald Trump Threatens BRICS Countries With 100% Tariff Increases If They Dare To De-Dollarize 🇺🇸

We're also covering Stripe’s record breaking Black Friday 🇮🇪, Abu Dhabi buying one of Canada's largest FI 🇦🇪, BaaS platform Solaris facing liquidation 🇩🇪, MUFG buying a robo-advisor 🇯🇵 & more.

🇺🇸 Donald Trump Threatens BRICS Countries With 100% Tariff Increases If They Dare To De-Dollarize

President-elect Donald Trump, in a post on X dated November 30, issued a stern warning to BRICS nations regarding any efforts to undermine the dominance of the US dollar. He wrote : “We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs”.

While Trump’s might have access to classified information, it’s unclear what he is referring to when talking about a “new BRICS currency”. There were discussions at the last BRICS summit about developing an alternative to the US-dominated SWIFT payment system that would facilitate trade in national currencies, so he could be referring to that. He could also be referring to India’s ongoing experiment with a central bank digital currency (CBDC) that was designed to speed up international transactions.

While Trump might be wrong about fearing a BRICS currency, he is not wrong that BRICs countries are interested in the de-dollarization of international trade. While the threat to be cut off from the US market might deter some nations to invest in de-dollarization effort, it might also have the opposite effect.

Mohammed Alkhereiji, SVP in charge of treasury at The Saudi National Bank (Saudi Arabia’s largest commercial bank), wrote on Linkedin that Trump’s agressive approach could backfire : “Honestly, I wasn’t sure how serious or motivated BRICS countries were about moving away from the dollar, but this might be the push they need to accelerate their plans. While 100% tariffs are a serious threat, I’d argue many expected heightened tariffs with Trump’s win anyway.”

Andrey Kostyuk, CEO of Cyprus-based AAlchemy Ventures, also thinks that black-mailing sovereign nations into using a specific currency is probably not a winning strategy: “You do not introduce reserve currency by force, you do it by making it an obvious and attractive choice, he wrote on Linkedin. US Dollar is moving in an opposite direction, ceding some space even to #stablecoins. Trying to reverse the trend by threats and tariffs is very XVII century”

While Trump publicly embraced the cryptocurrency industry, he might actually be against stablecoins and CBDCs if he perceives them as a threat to the dominance of the US dollar in international trade.

Source: Global Fintech Insider

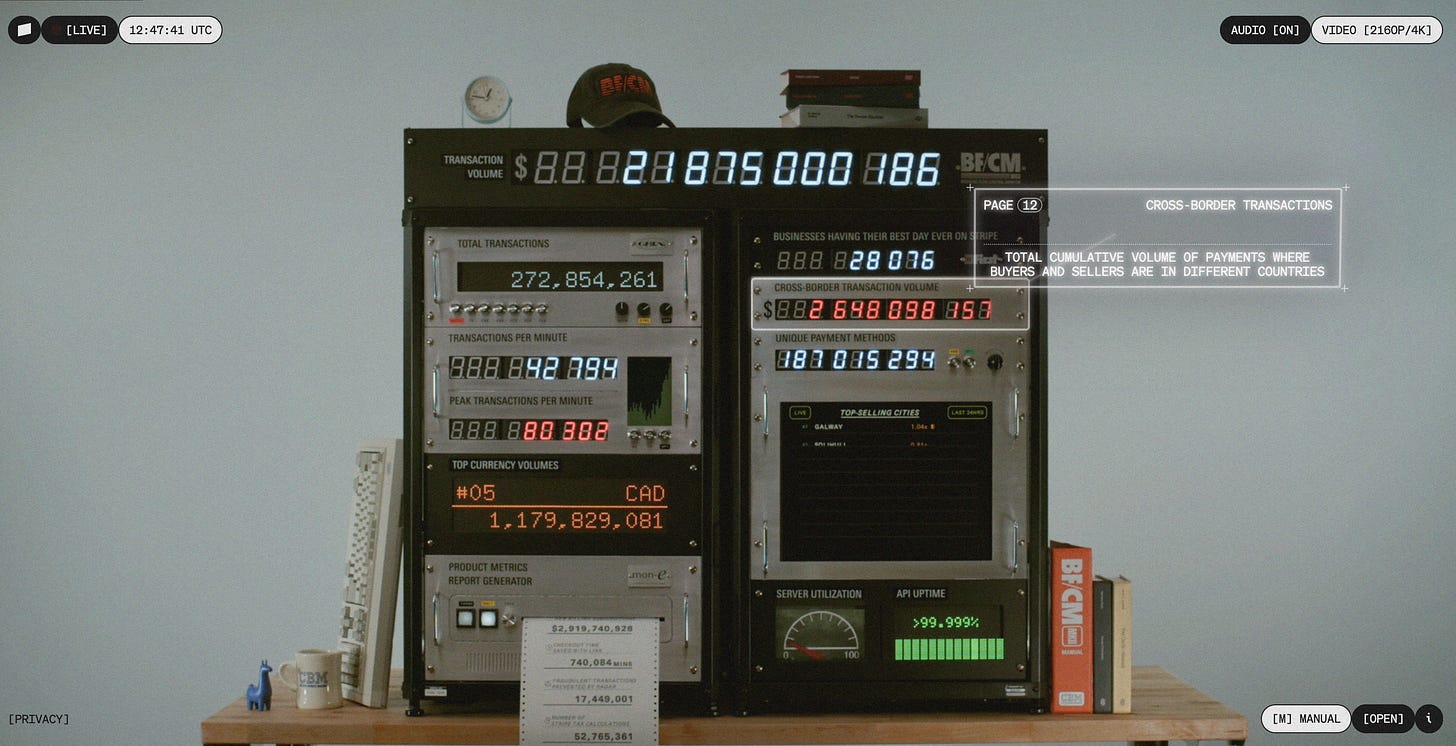

🇮🇪 Stripe’s Black Friday Microsite Shows Cross-Border Transactions Reached New Records This Weekend

As of this Cyber Monday morning, Stripe has already processed over 273 million transactions since Black Friday, totalling more than $22 billion in payment volume. This figure has already surpassed last year’s record of $18.6 billion, which included all of Cyber Monday. Stripe’s microsite is tracking these and other Black Friday-Cyber Monday (BFCM) metrics live. Once a U.S.-centric shopping event, BFCM has gone global, with cross-border transactions reaching $2.6 billion over the weekend. This staggering amount of cross-border transactions is interesting to see play out two months after Stripe’s 1.1 billion acquisition of a stablecoin startup, especially given that John Egan, head of crypto at Stripe, believes stablecoins are “the future of global commerce. Shopify also launched a micro site tracking Black-Friday purchases which, as of this writing, report more than 66 million shoppers have made purchases on a Shopify-powered online store. Given Shop Pay reliance on Stripe, it safe to assume that the bulk of those purchases were also tracked on Stripe’s microsite.

Source: Global Fintech Insider

🇦🇪 Abu Dhabi’s Sovereign Fund Is Buying CI Financial, a Canadian Wealth Management Firm Growing Rapidly in the US

Mubadala Capital, the sovereign wealth fund of Abu Dhabi, is acquiring Canadian wealth manager CI Financial in a C$12.1 billion ($8.66 billion) all-cash deal. The offer price of C$32 per share represents a 33% premium, boosting CI’s shares by 30% after the announcement. While CI Financial has recently focused on acquiring traditional advisory firms in the U.S., it has a history of fintech investments in Canada. It acquired Virtual Brokers, a Canadian online brokerage, in 2017, and WealthBar, the country's second-largest robo-advisor, in 2020. These were integrated into CI Direct Investing, blending a digital-first approach with its advisor-led services in Canada. It also issued co-branded credit cards for its Canadian wealth clients with Canadian fintech Neo in October 2024. Once privatized, CI Financial will be able to tap into Mubadala Capital’s oil money to accelerate its growth in the U.S. However, it remains unclear if its growth plans in the U.S. will include fintech acquisitions and partnerships.

Source: Global Fintech Insider

🇩🇪 German BaaS Platform Solaris Faces Liquidation After Intense Weekend of Fundraising

Berlin-based Solaris, Europe’s leading Banking-as-a-Service (BaaS) platform, urgently needs between 100 and 150 million euros (105 million to 158 million USD) in fresh capital to avoid liquidation. According to Manager Magazin, the company is currently pursuing a funding round and is aiming to secure the necessary funds by Christmas 2024. The company has called for an extraordinary general meeting on Monday (December 2, 2024) to put pressure on investors. If the required funds aren’t committed by that date, liquidation is on the table. Solaris could sell itself to a major bank or a private equity. Manager Magazin reports that initial investor commitments were made over the weekend. Solaris’s financial difficulties stem from rising customer deposits, regulatory pressures, and costly fixes required by the German financial regulatory body, BaFin, that uncovered deficiencies in its risk management.

Source: Gruenderszene

🇯🇵 Mitsubishi UFJ Financial Group Snags Japanese Robo-Advisor For $664 million

Mitsubishi UFJ Financial Group (MUFG), Japan’s largest bank, has acquired WealthNavi, a leading Japanese robo-advisory platform, for $664 million. WealthNavi offers automated asset management services, including portfolio rebalancing, tax optimization, and tailored investment strategies, with over $8.7 billion in assets under management. The move highlights a growing trend among traditional banks to adopt digital innovations like robo-advisors to stay competitive in the wealth management space.

Source: FStech

🇲🇽 Google-Backed R2 Raises $59M to Expand Its Invisible Bank Services Across Latin America

R2, a Mexican embedded finance startup co-founded by Roger Larach & Roger Teran, just raised $59 million. Backed by heavyweights like Y Combinator and Google’s Gradient Ventures, R2 provides revenue-based loans and lending infrastructure that let other tech companies seamlessly embed merchant loans under their own brands. With $59 million in fresh funding—$9 million in equity led by Hi Ventures and Cometa, and $50 million in credit from Community Investment Management— the company plans to grow in Chile, boost its AI-powered underwriting, and explore applying for a bank license in Mexico. Operating in Mexico, Chile, Colombia, and Peru, R2 has lent $85 million since 2021. The Mexican fintech aims to break even by 2025, all while staying behind the scenes as an "invisible bank."

Source: Bloomberg

🇬🇧 Former Revolut Employees Raise $2.3M To Launch A Stablecoins Mastercard

Former Revolut employees Joao Alves and Guilherme Gomes have raised $2.3 million in pre-seed funding to launch Bleap, a London-based self-custodial stablecoin app designed to integrate blockchain technology with traditional banking. Bleap allows users to spend stablecoins via a Mastercard-linked debit card without conversion fees and offers high-interest multi-currency accounts. The platform ensures user control over assets with its self-custodial wallet and supports fee-free crypto transactions. Currently in beta, Bleap is registered as a Virtual Asset Service Provider (VASP) in the EU and plans a public launch in early 2025. Bleap is backed by investors like Ethereal Ventures, Maven11, and angel investors from companies like Revolut and OKX.

Source: CoinTrust

🇸🇬 Pi-xcels Raises $2.7M To Introduce Eco-Friendly Digital Receipts

Pi-xcels, a Singapore-based fintech co-founded by Daniel Lim & Yi Hao Tan, has raised $2.7 million in seed funding to revolutionize digital receipts by sending them directly to consumers' phones without requiring personal information. This technology could gain traction as many countries phase out paper receipts for environmental reasons. Pi-xcels' platform enables consumers to either download receipts instantly or create an account to save them, while providing payment providers with valuable transaction data. The startup plans to sell its service to payment providers and expand into Asia, Europe, and the U.S. in 2025.

Source: Axios

🇲🇽 Revolut Gets Regulatory Approval To Launch in Mexico in Early 2025

Revolut, the UK-based neobank, is set to enter the Mexican market in Q1 2025 after receiving approval from the Comisión Nacional Bancaria y de Valores (CNBV). With over 50 million customers worldwide, Revolut plans to compete with established digital platforms like Nu and Stori by offering innovative features such as unlimited deposit debit accounts and free international transfers. With over 100,000 people already pre-registered, Revolut is poised to be a strong contender in Mexico’s rapidly evolving fintech space.

Source: Vanguardia

🇮🇷 Iran Pushes Back Sanctions With Digital Rial Launch

The Central Bank of Iran (CBI) has announced plans to launch a central bank digital currency (CBDC), the digital rial, to modernize the country’s banking system and circumvent international sanctions. The digital rial, under development since 2018, has entered a pilot phase with Iranian banks and is focused on retail use. This initiative comes as part of Iran's broader strategy to integrate its financial systems with Russia, including the MIR payment system, to replace SWIFT and strengthen ties with BRICS nations. These efforts are seen as a way to mitigate the impact of sanctions, with Iran also exploring cryptocurrency for international trade.

Source: Coin Telegraph

Upcoming Fintech Events

🇬🇧 Fintech Connect will be held in London on December 4-5 ($325), with speakers such as Zahra Gill, Financial Crime Strategy Lead at Starling Bank (!!!) and Anirudh Narla, Head of Product - Global Payments, Anti-Fraud & Wallet at Hopper.

🇦🇪 The Global Blockchain Show will be held in Dubai on December 12-13 ($299), with speakers such as John Lilic, CEO of Telos and Eowyn Chen, CEO of Trust Wallet.

🇳🇱 Banking Renaissance will take place in Amsterdam on February 19-20, 2025 (€1000), with speakers such as Giorgi Shagidze, CEO of maib & Ivar Lammers, Global Head of Financial Crime at ING Bank.

🇬🇧 Finovate Europe will be held in London on February 25-25, 2025 (£1,899), with speakers such as Joris Hensen, co-lead of co-lead Deutsche Bank API Program & Joanne Phillips, managing director for Aviva Direct Wealth.

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 ($632.50), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

Have some fintech news you think I should include in the Global Fintech Insider newsletter or heard some rumours you’d like me to look into? Drop me an email at: jrbrault@icloud.com