TikTok Bidder Jesse Tinsley Claims Bench Accounting Is Now Profitable 🇺🇸

We're also covering Klarna's crypto plans 🇸🇪, Pix challenging Visa 🇧🇷, NFL star backing Ramp 🇺🇸, Deel's IPO plans 🇺🇸, Paysafe & Lightspeed's future 🇬🇧🇨🇦 & CFPB's complete shutdown 🇺🇸

🇺🇸 TikTok Bidder Jesse Tinsley Claims Bench Accounting Is Now Profitable

For a company that went bankrupt last month, Bench Accounting is doing surprisingly well. According to Jesse Tinsley, CEO of Employer.com, which snapped up Bench's assets in January, the accounting software firm managed to retain 95% of its customers… despite a swarm of competitors trying to poach its clients on LinkedIn. More importantly, the accounting platform is now back in the green. "Revenue MoM actually went up" and the company is generating "~15% Free cash flow," Tinsley revealed in a LinkedIn post last week. It’s his first post about the fintech since a while, since the entrepreneur allocate most of his social media posts to his strange bid to acquire the US assets of TikTok in partnership with YouTuber Jimmy Donaldson, aka Mr Beast.

The Bench turnaround comes after years of drama at the fintech founded in Vancouver, which started when its co-founder and former CEO Ian Crosby was pushed out in late 2021. "I went out for what I thought would be a regular lunch with one of my board members," Crosby shared in LinkedIn post published in the wake of the very public shutdown of Bench. Despite having just raised a Series C round and turned down a buyout offer, he was told they'd be bringing in a "professional CEO." The reason? Crosby wouldn't play ball with the board's plans to accelerate growth. "They wanted me to take the company in a new direction that I thought was a very bad idea. I wanted to continue with what was working," he wrote.

What followed was a spending spree that saw Bench burn through $135 million and rack up $50 million in venture debt from the National Bank of Canada. Since all it took to turn around the fintech was to get rid of the debt and let go of some people, it is safe to say that, had the company not contracted venture debt, it would have avoided bankruptcy.

Now that Bench is profitable again under new ownership, it seems Crosby's slower-growth approach wasn't so crazy after all: "I hope the story of Bench goes on to become a warning for VCs that think they can 'upgrade' a company by replacing the founder," he wrote. "It never works." The irony? After getting forced out of the company he built, Crosby went on to sell his next fintech to Mercury, while Bench ended up bankrupt and sold for pennies on the dollar.

Source: Global Fintech Insider

🇸🇪 Klarna CEO Teases Crypto Plans For Its 85M Users Just Before April IPO

Sebastian Siemiatkowski announced in a X post on Saturday that Klarna would finally embrace cryptocurrency, acknowledging his company as "the last large fintech in the world to embrace it." While he did not explain how Klarna would embrace crypto, he asked for suggestions. When a user suggested offering "Buy Crypto Pay Later," Siemiatkowski quickly shot down the idea with a "Haha probably not," though he highlighted Klarna's massive scale, noting that with 85 million users, 500 000 merchants & more than 1 million card issued, there were “tons of opportunities”.

Nikhil Chandhok, Chief Product & Technology Officer at Circle (the fintech behind the USDC stablecoin) jumped on the thread, suggesting on X that Klarna could "settle with merchants in stablecoin" and let users pay back their loans using their crypto wallets. The announcement comes as Klarna prepares for an April IPO in the US with a valuation of up to 15 billion USD. However, with Siemiatkowski recently claiming AI would allow Klarna to cut its headcount in half (while the company is still actively hiring), yours truly wonder if this crypto pivot is merely pre-IPO hype.

Source: Global Fintech Insider

🇧🇷 Brazil's Pix Takes On Visa & Mastercard With New Recurring Payment Feature

Brazilian payment network Pix, which already processes 338 billion USD in transactions monthly, will launch Pix Automático in June to handle recurring payments for utilities, streaming services, and other subscriptions, a market traditionally dominated by credit cards. Brazilian payment provider Ebanx expects it to draw 30 billion USD in eCommerce payments alone over two years. "According to Beyond Borders, Pix as a whole is expected to grow by 35% over the next two years. A large portion of this growth is related to Pix Automático," wrote Eduardo de Abreu, VP of Product at Ebanx, in a Linkedin post.

Sources: Global Fintech Insider & PYMNTS

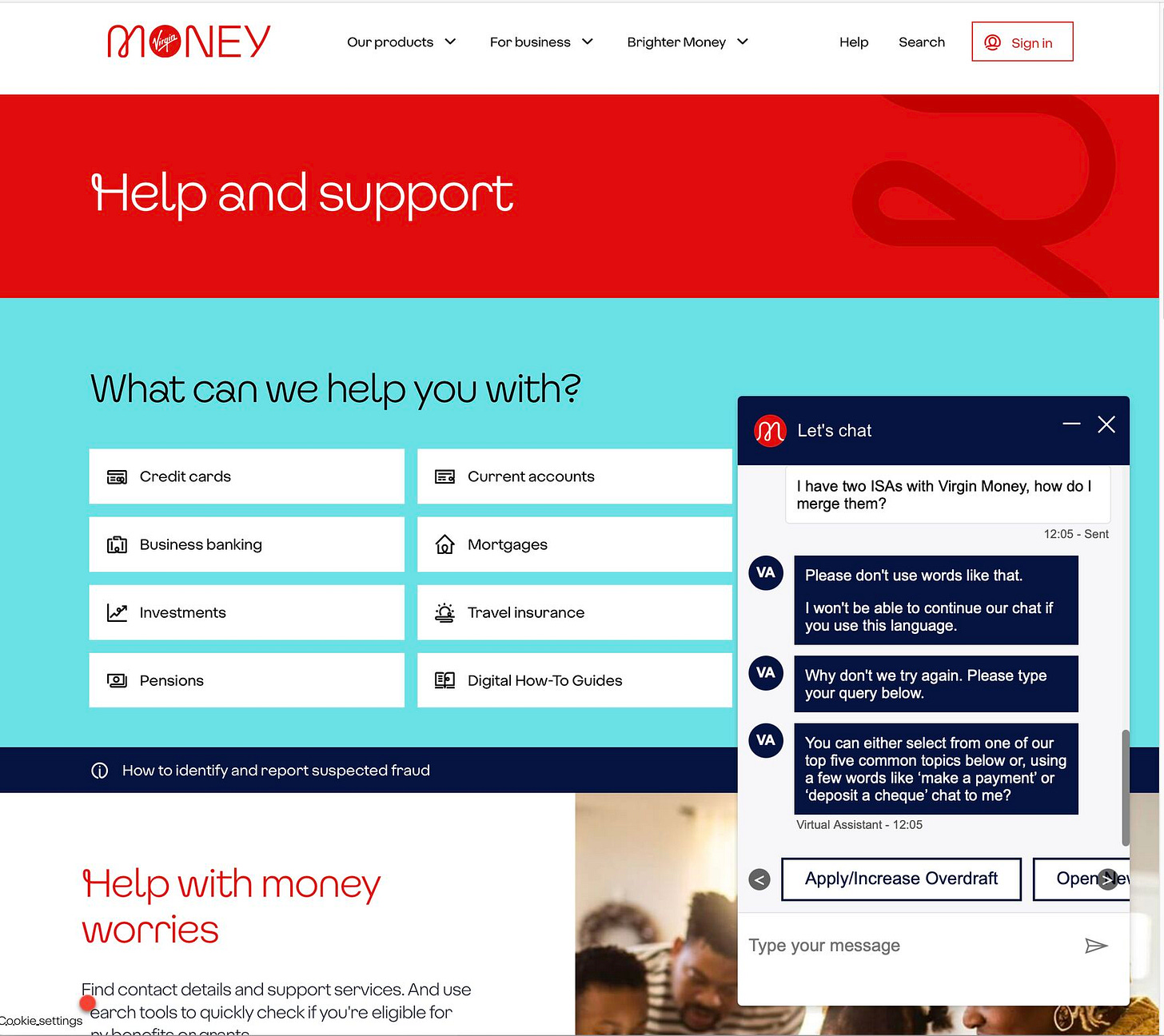

🇬🇧 Virgin Money’s AI Flags Its Own Brand As Inappropriate

AI went prude at Virgin Money. Fintech commentator David Birch was trying to merge two ISAs when the bank's chatbot warned him about using inappropriate language, specifically, the word "virgin." In a Linkedin post about the incident, Birch wrote: “Seriously Virgin Money? Can you be more specific about which words are now banned?” According to the Financial Times, Virgin Money quickly apologized, explaining that the incident occurred on one of its oldest chatbots running on basic natural language processing, not its latest AI models. The bank, which ranked 15th out of 16th in overall service quality in 2023, says improvements to this specific chatbot were already scheduled.

Source: Global Fintech Insider & Financial Times

🇺🇸 NFL Star Backs Spend Management App Ramp Then Stars In Its Super Bowl Ad

NFL star Saquon Barkley drowned in expense reports on Super Bowl Sunday. The Philadelphia Eagles' running back starred in Ramp's first-ever Super Bowl commercial yesterday, just days after being revealed as an investor in the corporate spend management platform. In an unusual twist, Barkley initiated the investment after reading Peter Thiel's "Zero to One" and receiving strong recommendations from mutual investor friends. "True partnership requires skin in the game. That's why I invested in Ramp," Barkley was quoted in a Ramp blog post. The 15-second ad, featuring the NFL star buried in expense reports, was shot in just seven days. Founded in 2019 and valued at 7.65 billion USD, Ramp marks Barkley's largest private tech investment to date, adding to his portfolio that includes crypto startup Monad Labs and Y Combinator alum Sequin.

Source: TechCrunch

🇪🇬 Egyptian Payroll Lender Khazna Eyes Saudi Expansion After 16M Raise

Egyptian fintech Khazna hit profitability through payroll lending. The company just raised 16 million USD in pre-Series B funding to fuel its expansion into Saudi Arabia and secure a digital banking license in Egypt. "What we did over the last two and half years was to focus on our core product, which is credit offering to payroll and pension recipients and also unsecured loans to gig workers," CEO Omar Saleh (on the picture above) told TechCrunch. Founded in 2019, Khazna serves 500,000 users, including 100,000 receiving payroll through its platform. The startup aims to capture 40-50% of its business from Saudi Arabia in the next four years, eyeing an eventual IPO on the Saudi Tadawul exchange. The round included global investors Quona and Speedinvest, alongside regional players like Aljazira Capital and anb Seed Fund.

Source: TechCrunch

🇺🇸 HR Unicorn Deel Plans 2026 IPO After 300M Secondary Sale

A five-year-old HR unicorn plans to defy startup aging trends. Deel, a YC-backed fintech providing global payroll and HR software, just completed a 300 million USD secondary sale to new investors including General Catalyst and Mudabala, while maintaining its 12 billion USD valuation from 2022. CEO Alex Bouaziz revealed plans for a U.S. IPO as early as 2026, which would make Deel unusually young compared to the 17-year median age for tech IPOs in 2024. "We are in a pretty good place and looking at maybe some point next year to take the company public," Bouaziz told Axios. The company has grown its annual recurring revenue to 800 million USD, up 70% year-over-year, and is profitable on both EBITDA and cash-flow basis.

Source: Axios

🇺🇸 British Serial Entrepreneurs Brothers Raise 12M To Make Junior Analysts Obsolete

Serial founders are coming for junior analysts' jobs. Model ML, founded by british brothers Chaz and Arnie Englander, emerged from stealth with 12 million USD in funding led by Y Combinator and LocalGlobe. The platform lets finance professionals instantly create financial models, reports, and analysis through voice commands, eliminating the manual data gathering and processing that typically consumes junior analysts' time. Already used by 20 customers including major financial institutions, Model ML builds custom AI agents for each organization that integrate with existing workflows. The company, headquartered in New York with offices in London and Hong Kong, marks the Englander brothers' third Y Combinator-backed venture, after successfully selling their previous startups.

Source: Tech.eu

🇬🇧 🇨🇦 Paysafe Seeks Buyer As Lightspeed Backtracks On Sale

London-based payment processor Paysafe, whose stock has dropped 80% since its 9 billion USD SPAC deal in 2020, is exploring a sale after receiving takeover interest. The company, backed by Blackstone and CVC Capital Partners, is also considering selling non-core assets from its portfolio of payment processing, prepaid cards and digital wallet services. Its shares jumped 22% on the news to a 1.4 billion USD market value. Meanwhile, Montreal's point-of-sale software provider Lightspeed Commerce, whose market cap stands at 2 billion USD, has gone the other way after months of shopping itself around and will instead buy back 400 million USD of its shares. The decision got backing from its largest shareholder, Quebec's pension fund CDPQ, which owns 16% of the company.

Sources: Bloomberg and The Globe & Mail

🇺🇸 23 Year Old Founder Raises 17M For Copy Trading App Dub

Dub, a fully licensed broker-dealer founded by 23-year-old Harvard dropout Steven Wang, has raised 17 million USD in seed funding to build what he calls "TikTok meets Wall Street", a trading app where users can copy entire portfolios of other traders. The app, which has been downloaded 800,000 times, charges a 10 USD monthly subscription, with additional premium subscriptions available for access to top traders' portfolios, from which Dub takes a 25% cut.

Source: TechCrunch

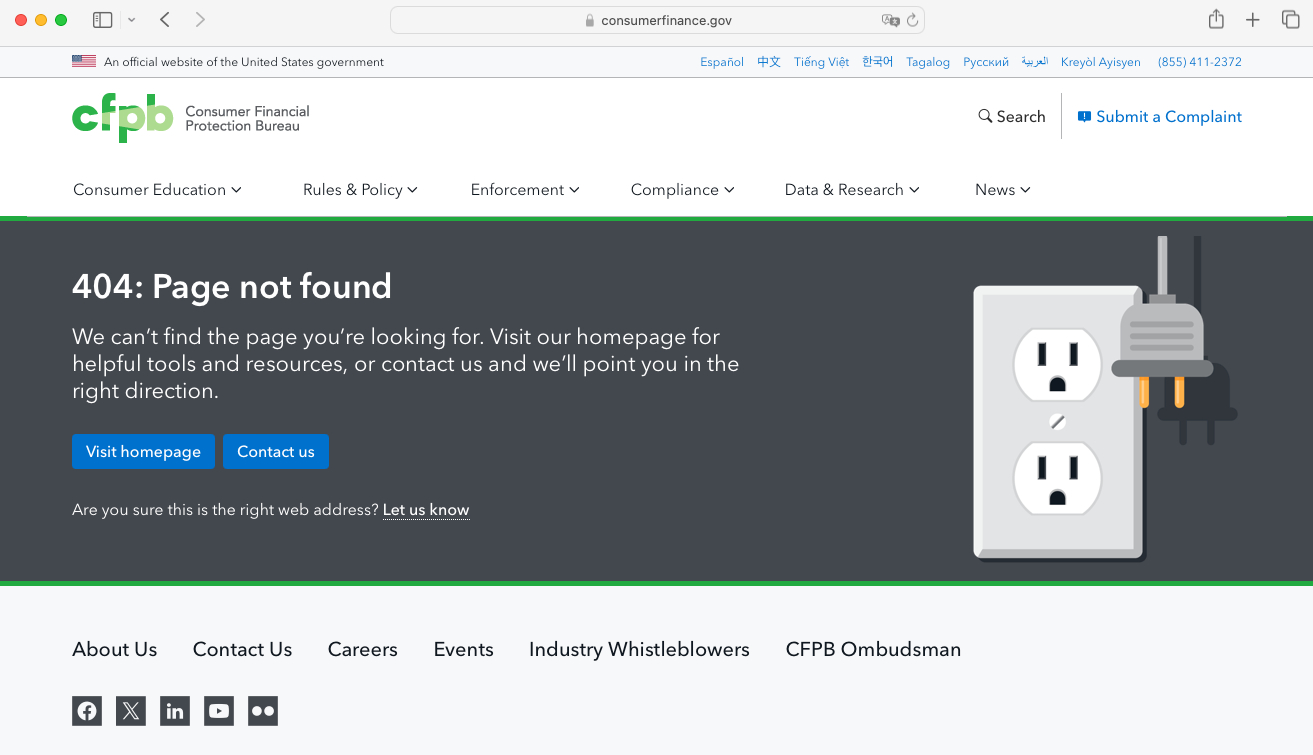

🇺🇸 US Financial Watchdog CFPB Goes Dark As Yet Another Director Is Nominated

The CFPB's website homepage shows a 404 error, its X account has vanished and its employees received an email on Sunday telling them not to show up to work this morning, following the nomination of Russell Vought as the agency’s third director in a week. According to CNN, officials from Elon Musk's Department of Government Efficiency (DOGE) deleted the agency's social media presence just after Treasury Secretary Scott Bessent ordered a freeze on virtually all CFPB operations. The shutdown creates uncertainty around recent CFPB initiatives, including its January selection of the Financial Data Exchange (FDX) as the national open banking standard. In a LinkedIn post, OpenFinity CEO Laurent Van Huffel argued that, as the US seems to be moving away from its own open banking regulations, 69 countries have already implemented such regulations. Van Huffel believes that, with or without regulations in place, open banking is there to stay, with 96 million US consumer already accessing their banking data through FDX APIs without any mandate.

Source: Global Fintech Insider, CNN & Reuters

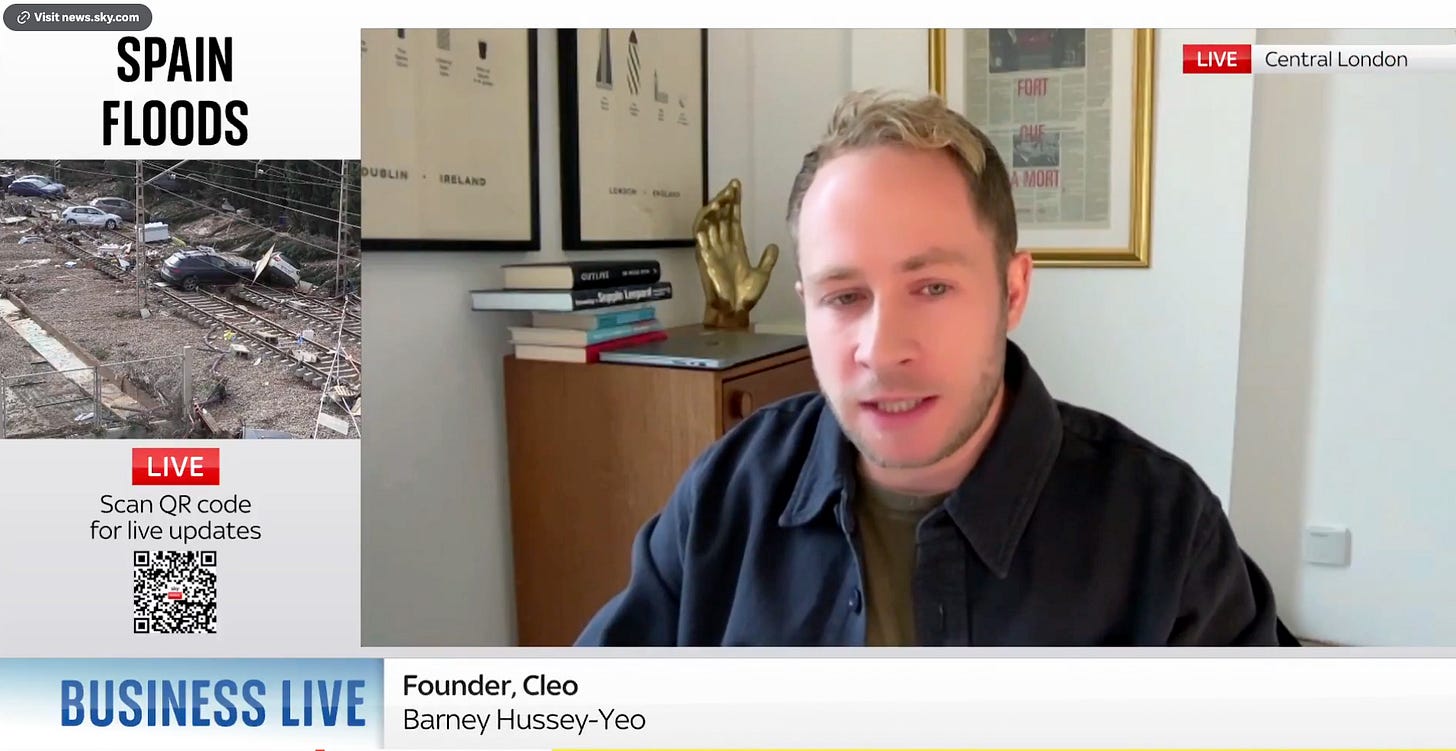

🇬🇧 Cleo CEO Warns UK Risks Becoming Mere Tech Incubator

Barney Hussey-Yeo, founder of AI-powered financial assistant Cleo that helps Gen Z manage their money, wrote on Linkedin that Britain risks becoming a mere "incubator economy" without urgent changes to help tech companies scale. In a LinkedIn post responding to a new House of Lords report, the fintech CEO pointed out that while the UK can build 100 billion USD companies like ARM, DeepMind, and Revolut, it captures almost none of their value. The issues range from US-dominated venture capital at early stages to a lack of local growth funding, forcing the most promising scale-up to raise money from the US. "Without radical, urgent change, the UK will continue to stagnate and miss out on the value generated by London's next tech giants," Hussey-Yeo said, noting that founders are increasingly fleeing to tax havens or the US from day one.

Source: Global Fintech Insider

Upcoming Fintech Events

🇳🇱 Banking Renaissance will take place in Amsterdam on February 19-20, 2025 (1,263 USD), with speakers such as Giorgi Shagidze, CEO of maib & Ivar Lammers, Global Head of Financial Crime at ING Bank.

🇬🇧 Finovate Europe will be held in London on February 25-25, 2025 (2,399 USD), with speakers such as Joris Hensen, co-lead of co-lead Deutsche Bank API Program & Joanne Phillips, managing director for Aviva Direct Wealth.

🇺🇸 The Bank Automation Summit will be held in Austin on March 3-4, 2025 (632.50 USD), with speakers such as Michael Lehmbeck, CTO at BankUnited and Koren Picariello, head of generative AI strategy for Morgan Stanley Wealth Management.

🇺🇸 Fintech Meetup will take place in Las Vegas on March 10-14, 2025 (2,800 USD), with speakers such as Leif Abraham, co-CEO of Public.com & Misha Esipov, CEO of Nova Credit.

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & Co-Founder of Zero Hash.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

I’m now product manager for Beeye, an AccountingTech SaaS.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin.