Klarna, eToro & Chime Freeze IPO Plans as US Tariffs Cause Fintech Stocks to Collapse 🇸🇪🇮🇱🇺🇸

We're also covering Super.com's billion-dollar pivot 🇺🇸, Airwallex eyeing UK & US banking licenses 🇸🇬, Revolut's French conquest 🇫🇷, Shopify's new stance on AI 🇨🇦 & Deel's spy confession 🇮🇪

Thanks to you guys, I’m now sending this humble newsletter to no less than 2,500 fintech pros! It’s about 25% of my 10,000 target for 2025, but I feel more confident than ever I can do this!

While my main focus is to send you fintech content so good you have to share it (like last week’s 32 AI Tips & Hacks From Top Fintech CEOs & Execs), I’m also trying to diversify my social media audience away from my Linkedin account, which generate the bulk of my new subscribers.

Given how much time my wife spends watching vertical videos on her phone, I decided to get into the vertical videos game. My first video take a look at the similarities between Costco & Robinhood.

Feel free to watch it (and to follow me) on TikTok & Instagram!

🇸🇪🇮🇱🇺🇸 Klarna, eToro & Chime Freeze IPO Plans as US Tariffs Cause Fintech Stocks to Collapse

Fintech giants Klarna, eToro, and Chime have paused their plans to go public as financial markets reel from President Trump's global tariff announcement on April 2. The "buy now, pay later" giant Klarna had been preparing for a $15 billion IPO roadshow that was supposed to start this week, while trading platform eToro had filed paperwork last month for its U.S. public offering. Digital banking platform Chime had also been quietly preparing for its market debut.

The postponements come as fintech stocks experience a particularly severe impact from the market-wide selloff, with publicly traded fintechs like Affirm plunging 23%, Shopify sliding 22%, Robinhood loosing 21%, and PayPal falling 14% since April 2. The financial bloodbath has wiped out nearly $2 trillion in value from the S&P 500, with analysts pointing to fintech companies' vulnerability to both reduced consumer spending and global supply chain disruptions.

While tech CEOs seems to be cautious to criticize Trump’s administration this time around, the market turmoil caused by the massive tarriffs announced by Trump triggered public reactions from some fintech leaders. Klarna CEO Sebastian Siemiatkowski shared a clip of comedian Dave Chappelle mocking Trump's tariff policy. In the clip, Chappelle imitates Trump saying "I'm gonna get those jobs from China and bring them back here to America," before responding, "For what n*gger, so iPhone can be $9,000? Leave that job to China where it belongs. None of us want to work that hard!"

Meanwhile, Rippling CEO Parker Conrad took to X to question venture capitalist Marc Andreessen's prediction about an "economic coiled spring" under a Trump presidency. In the same X post, Conrad reshared former Treasury Secretary Larry Summers' stark assessment claiming the recent tariff announcement had cost markets approximately $30 trillion, or about $300,000 per family of four.

Source: Global Fintech Insider, Wall Street Journal & Axios

🇺🇸 Henry Shi, Co-Founder of Super.com, Says the Secret to Becoming a Fintech Unicorn Is Telling an Exciting Story

Henry Shi, co-founder of the savings app Super.com, found himself questioning fintech valuations in 2020 when Lemonade, an AI-powered insurance company, IPO'ed at a $1.6B valuation while his travel deals platform was valued at just $100M. In a recent Linkedin post, Shi wrote: "To add salt to the injury, Lemonade had raised $480M and lost $100M a year, while we raised just $16M and were close to breakeven. This kept me up at night, given our retention was 30% HIGHER than the industry average, while theirs was 25% LOWER."

After approaching dozens of investors seeking answers, Shi finally realized that their numbers looked great on paper, but as "outsiders in an unsexy market," their story simply didn't excite anyone. Shi writes that, instead of impressing investors, their ability to build with minimal resources made their achievements seem less remarkable. This revelation became their turning point.

Around the same time, COVID-19 devastated the travel industry and Super.com, then called SnapTravel, faced bankruptcy, with just four months of runway, according to a Linkedin post penned by Pablo Srugo, partner at seed stage VC Mistral. The SnapTravel team pivoted dramatically, rebranding as Super.com and launching SuperCash, a cashback card helping users save across multiple categories. "Hussein (Shi’s co-founder) went so deep on his customers, he understood his customers weren't looking to make travel easier or faster—just cheaper. Their number one problem was they needed to save."

The strategic pivot has propelled Super.com to over $1B in annual Gross Merchandise Value (GMV) and $150M in revenue while achieving profitability. Today, over 80% of Super's transactions are non-travel related. While Super.com's current valuation isn't public, Shi notes they've "closed that ridiculous 10x gap" with Lemonade, which currently maintains a market cap of around $2 billion, down from its peak of $10 billion in 2021.

Source : Global Fintech Insider

🇸🇬 Airwallex Sets Sights on UK and US Banking Licenses

Singaporean payment and spend management startup Airwallex plans to challenge global banks by obtaining banking licenses in the UK and US. Founded in Melbourne in 2015, but now headquartered in Singapore, the fintech valued at $5.6 billion will first apply for a UK banking license, citing the country's fintech-friendly regulatory environment, before later seeking US approval through a bank acquisition. Airwallex aims to expand beyond payment and spend management services into lending, with a credit card (as opposed to a charge card) already being trialed in Australia. Despite its UK regulatory push, Airwallex remains committed to a future US listing rather than London, with CEO Jack Zhang believing American capital markets offer superior access and liquidity for fintech companies of Airwallex's size.

Source: Financial Times

🇨🇦 Shopify CEO Tobias Lütke Makes AI Usage Mandatory for All Staff

In an internal memo, Shopify CEO Tobias Lütke required all his employees to embrace AI and to investigate if AI could do a task before hiring anyone to perform it. Claiming the memo was being leaked, Lütke decided to share the entire document himself on X Monday morning. The memo establishes that using AI is now non-negotiable at the Canadian fintech. "Using AI effectively is now a fundamental expectation of everyone at Shopify. It's a tool of all trades today, and will only grow in importance. Frankly, I don't think it's feasible to opt out," wrote Lütke, positioning AI as essential for maintaining competitiveness. The fintech leader is requiring AI integration across all aspects of work, including for prototypes and performance reviews.

Source: Global Fintech Insider

🇫🇷 Revolut Becomes France's Number Two Neobank With 5M Users

British neobank Revolut has reached 5 million customers in the French market, adding a million new accounts in just the last five months as it closes the gap with market leader Boursobank's 7.2 million users. "France is our second market after the United Kingdom, but it's our first in terms of growth," said Antoine Le Nel, Vice President of Growth at Revolut. "With 200,000 new customers per month, we're on track to reach 10 million by 2026 and 20 million by 2030."

France's top neobank, Boursobank, isn't slowing down either, having gained 1.5 million new customers in the past year while achieving profitability for the second consecutive year. Meanwhile, traditional bank BNP Paribas launched an aggressive Hello bank promotion last week offering new customers up to 180 euros for signing-up. Unsurprisingly, Revolut plans to move into traditional banks' turf by launching a mortgage product in France during the second half of 2025.

Source: Global Fintech Insider & Les Échos

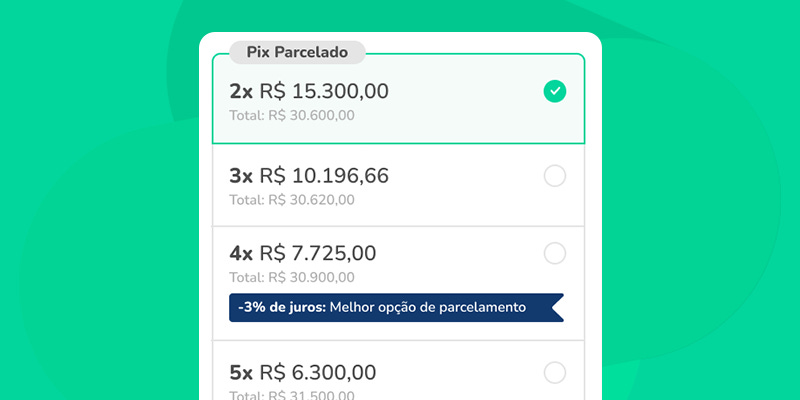

🇧🇷 Brazilian Payment Giant Pix Adds Buy Now Pay Later Functionality

The Central Bank of Brazil announced that Pix Parcelado, a new feature allowing users to pay in installments, will launch in September 2025. This development directly challenges credit cards in a market where paying in installments is deeply ingrained in consumer behavior. While shoppers will be able to spread payments over time, merchants will receive the full amount instantly, making it an attractive option for businesses. The central bank also revealed plans for a 2026 feature enabling future Pix receivables to be used as collateral for credit operations, potentially lowering borrowing costs for businesses that rely heavily on Pix. Since its 2020 launch, Pix has rapidly become Brazil's most popular payment method, and these credit-focused expansions seem poised to accelerate its growth further.

Source: Reuters

🇺🇸 Visa Offers 100M To Snatch Apple Card Away From Mastercard And Amex

Visa has offered Apple approximately $100 million to take over the network role from current provider Mastercard as Goldman Sachs exits its money-losing position as the Apple Card issuer. This aggressive move shows just how valuable the Apple relationship is to payment networks, with American Express also competing to become both issuer and network for the card. Apple is expected to select a network partner before choosing which bank will replace Goldman as the card issuer. With roughly $20 billion in balances, the Apple Card represents one of the largest co-branded portfolios to change hands, and the winning network hopes to secure a strategic position in Apple's expanding financial ecosystem. Mastercard has reportedly explored using its Finicity fintech subsidiary to enable Apple users to view their bank account balances within Apple's ecosystem.

Sources: Wall Street Journal

🇮🇪 Deel Spy Confesses Being Paid $5,458 Per Month In Crypto To Steal Rippling Secrets

Court documents published by Rippling CEO Parker Conrad on X reveal how Keith O'Brien, a Rippling employee in Dublin, allegedly spied for Deel, a competitor in the global payroll software market. The affidavit, made public in an Irish court on Wednesday, shows O'Brien was recruited directly by Deel CEO Alex Bouaziz, who suggested he become a spy. O'Brien allegedly received €5,000 ($5,458) monthly: initially via Revolut and, then, through the Ethereum cryptocurrency to eliminate trace. Deel's CFO Philippe Bouaziz reportedly established coded communication, with O'Brien sending watch pictures as payment requests through an encrypted Telegram channel. The spying scheme unraveled after leaked documents obtained through Deel’s spy were accidentally forwarded to a journalist, who then informed Rippling.

Source: Global Fintech Insider & New York Post

🇺🇸 Plaid Raises $575M In Major Down Round At $6.1B Valuation

Plaid has sold $575 million worth of common stock at a $6.1 billion valuation, less than half of the $13.4 billion the San Francisco-based fintech was worth when it raised its Series D in April 2021 during the peak of fintech valuations. Franklin Templeton led the oversubscribed down round, with participation from new investors Fidelity Management and Research, BlackRock, and existing backers NEA and Ribbit Capital, with proceeds providing some liquidity to current team members. CEO and co-founder Zach Perret (pictured above) reported revenue grew over 25% in 2024 with new products now representing more than 20% of Plaid's revenue, while confirming the company will not go public in 2025 despite appointing former Expedia exec Eric Hart as CFO in October 2023. The fintech has expanded beyond its core bank account connectivity service to include lending, identity verification, credit reporting, anti-fraud, and payments services.

Source: TechCrunch

🇨🇦 Shopify Payments Expands to Mexico, Poland and 13 Other Countries

Shopify's payment solution has launched in 15 additional markets across Europe and Latin America. COO Kaz Nejatian (pictured above, right) announced the expansion on X, revealing that Shopify Payments is now live in Mexico, Poland, Norway, Lithuania, Hungary, Estonia, Croatia, Slovenia, Latvia, Malta, Greece, Cyprus, Bulgaria, Liechtenstein, Luxembourg, and Gibraltar. This global rollout strengthens Shopify's payment ecosystem, which utilizes Stripe as a major processing partner (with Shopify having invested over $350 million USD in the company), while also working with PayPal as an additional processor. The expansion aligns with Shopify's broader strategy to capture more value from its ecosystem

Source: Global Fintech Insider

🇬🇧 Remittance Giant Zepz Bags $165M Months After Firing 20% Of Its Employees

Digital remittance provider Zepz has secured $165 million in debt, led by HSBC Innovation Banking and HSBC Private Credit. Led by CEO Mark Lenhard, the company comes off a challenging period, having cut 20% of its workforce (200 employees) back in February. The London-based company, which operates WorldRemit and Sendwave brands, currently serves over 9 million users across 4,600 payment corridors and processes over 85% of transactions within minutes. As part of its long-term strategy, Lenhard plans to launch a digital wallet in 2025, integrating savings, insurance, and microloans to become a core financial hub for migrants.

Source: Global Fintech Insider & The PayPers

🇮🇳 Scapia Secures $40M To Fuel Its Travel Credit Card For Indian Millennials

Scapia, an Indian fintech providing travel credit cards, has secured $40 million in Series B funding led by Peak XV Partners, with Elevation Capital, Z47, and 3STATE Capital participating. Founded by Anil Goteti (pictured above), the company offers a travel-focused co-branded credit card with Federal Bank featuring zero joining and annual fees, no forex markup, and complimentary airport privileges based on monthly spending. Scapia's app allows users to book and redeem rewards across global airlines, 500,000+ hotel properties, and visas for 45 countries. According to investors, Gen Z and millennials now account for 50% of India's credit card issuance, representing an $80-100 billion annual revenue opportunity by 2030. The company has also expanded into India's domestic payments ecosystem by launching a RuPay card (India's national payment network) with Federal Bank to leverage India’s UPI payment network.

Source: Entrepreneur

🇺🇸 WhatsApp-Based Remittance Platform Félix Secures $75M For LatAm Expansion

Miami-based remittance startup Félix has raised $75 million in Series B funding led by QED Investors to expand its Latin American operations. The company uniquely operates its entire money transfer service through WhatsApp, leveraging the messaging app's widespread adoption in Latin America to facilitate over $1 billion in transactions during 2024. Founded in 2020 by Manuel Godoy (left) and Bernardo Garcia (right), Félix is already serving Mexico, El Salvador, Guatemala, Honduras, and the Dominican Republic. The fintech plans to enter Colombia, Ecuador, and Peru while evolving beyond simple WhatsApp-based remittances to offer credit products and savings accounts. The fintech, which processes transfers using stablecoins like USDC with an average transaction value of $290, is approaching unicorn status despite increased US regulatory scrutiny around cross-border transfers.

Source: Bloomberg

🇫🇷 French Insurtech GRACE Raises $6.4M to Shield Your Rolex Collection From Theft

Paris-based insurtech GRACE has secured €5.9 million ($6.4 million) in Seed funding to protect luxury items. Since luxury theft has surged by 236% year-over-year, automatic theft and loss protection for high-end goods might be increasingly in-demand. Co-founded by CEO Quentin Roy (left), President Lou Dana (center), and CTO Martin Lenweiter (right), the insurtech partners with global insurer Chubb to provide coverage that activates immediately upon purchase and stays with items even when gifted, allowing claims filing in minutes with resolution typically within days. GRACE aims to cover over 200,000 luxury items by end-2025 through partnerships with luxury brands. The fintech also plans to help those brands capture valuable customer data from traditionally inaccessible distribution channels.

Upcoming Fintech Events

🇨🇦 The Canadian Fintech Summit will be held in Toronto on April 8th, 2025 (221 USD), with speakers such as Darcy Tuer, CEO of ZayZoon and David Nault, GP at Luge Capital.

🇩🇪 FIBE Fintech Berlin will be held in Berlin on April 9-10, 2025 (1,204 USD), with speakers such as Dan Schulman, former CEO of PayPal & Hélène Falchier, partner at Portage Ventures.

🇹🇭 Money20/20 Asia will be held in Bangkok on April 22-24, 2025 (3,195 USD), with speakers such as Lucy Liu, co-founder & president of Airwallex & Martha Sazon, CEO of GCash.

🇬🇧 The Innovate Finance Global Summit will be held in London on April 29, 2025 (450 USD), with speakers such as Justin Basini, co-founder & CEO of ClearScore & Diana Avila, Global Head of Banking and Expansion at Wise.

🇺🇸 FinovateSpring will be held in San Diego on May 7-9, 2025 (1,299 USD), with speakers such as Vishal Garg, founder & CEO at Better.com & Lauren McCollom, Head of Embedded Finance at Grasshopper Bank.

🇦🇪 Dubai FinTech Summit will take place in Dubai on May 12-13, 2025 (899 USD), with speakers such as Arik Shtilman, co-founder and CEO of Rapyd & John Caplan, CEO of Payoneer.

🇺🇸 Stablecon will take place in New York on May 29, 2025 (1,295 USD), with speakers such as Cuy Sheffield, Head of Crypto at Visa and Edward Woodford, CEO & co-founder of Zero Hash.

🇳🇱 Money20/20 Europe will be held in Amsterdam on June 3-5, 2025 (3,395 USD), with speakers such as Steven van Rijswijk, CEO of ING & Yoni Assia, CEO of eToro.

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s faith and I started this newsletter to keep myself busy in the aftermath.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on Linkedin, Instagram, TikTok & X.

P.-S. : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.